Oil

-

Oil pulled back by the end of the month and is set to finish January rather flat. WTI trades around 1% month-to-date while Brent gains around 2%

-

EU embargo on Russian oil derivative products is set to go live at the beginning of February and it may lead to higher volatility in prices of those products as well as oil price

-

In spite of a rather flat performance of oil price in recent weeks, it is expected that OPEC+ will not decide to change its production goal at the coming meeting. Simultaneously, OPEC has a limited capacity to boost production, and Russia may be unwilling to increase its output due to sanctions

-

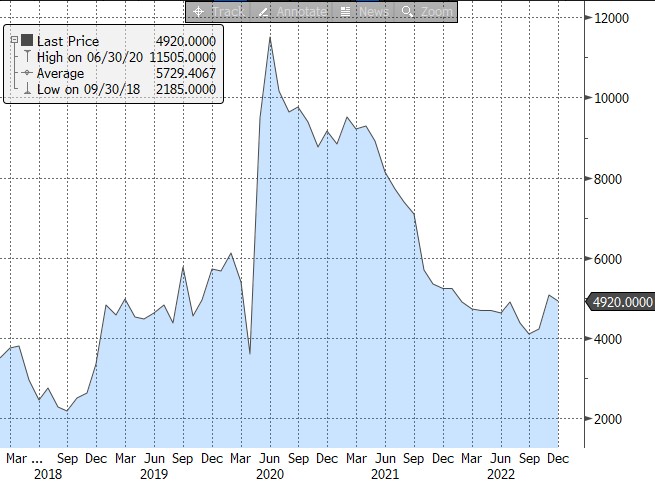

Seasonal patterns suggest that in spite of a mixed start to the year, oil price should resume climb

-

Some of the more important factors for oil prices are the US dollar and level of interest rates around the world. If Fed hints at a looming hike cycle pause tomorrow, oil may catch a bid. Simultaneously, EURUSD also support higher oil prices in the long-term

-

Limited supply around the world amid economic uncertainty may lead to a situation when prices start to trade sideways as it was the case in 2011-2014 period. However, current high interest rate environment should limit potential of the global economy and it should lead to price settling at lower levels than previously, possibly in $70-100 per barrel

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appSpare production capacity at OPEC is limited but a small rebound could be spotted following OPEC decision to limit production goal by 2 million barrels per day in autumn 2022. Source: Bloomberg

Brent is set to finish January around 2% higher while WTI trades around 1% lower month-to-date. Source: Bloomberg

Brent (OIL) continues to trade in a downtrend but bounces off the 38.2% retracement. A key support can be found near the 50% retracement. Source: xStation5

Brent (OIL) continues to trade in a downtrend but bounces off the 38.2% retracement. A key support can be found near the 50% retracement. Source: xStation5

Natural Gas

-

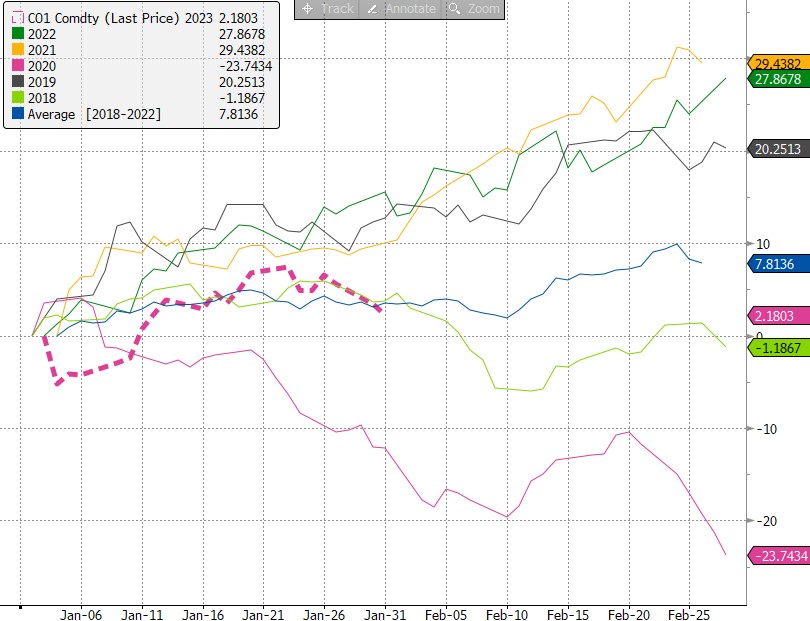

Natural gas prices have the worst start to the year since 2001, trading over 30% lower year-to-date

-

In spite of numerous bullish signals, like lower temperature forecasts or relatively high gas consumption (in some regional hubs prices grew to double-digit levels), futures price remained muted to those news

-

Gas is now showing more and more signs of being oversold, but the latest weather forecasts once again point to a higher temperature, what may lead to further deepening of declines

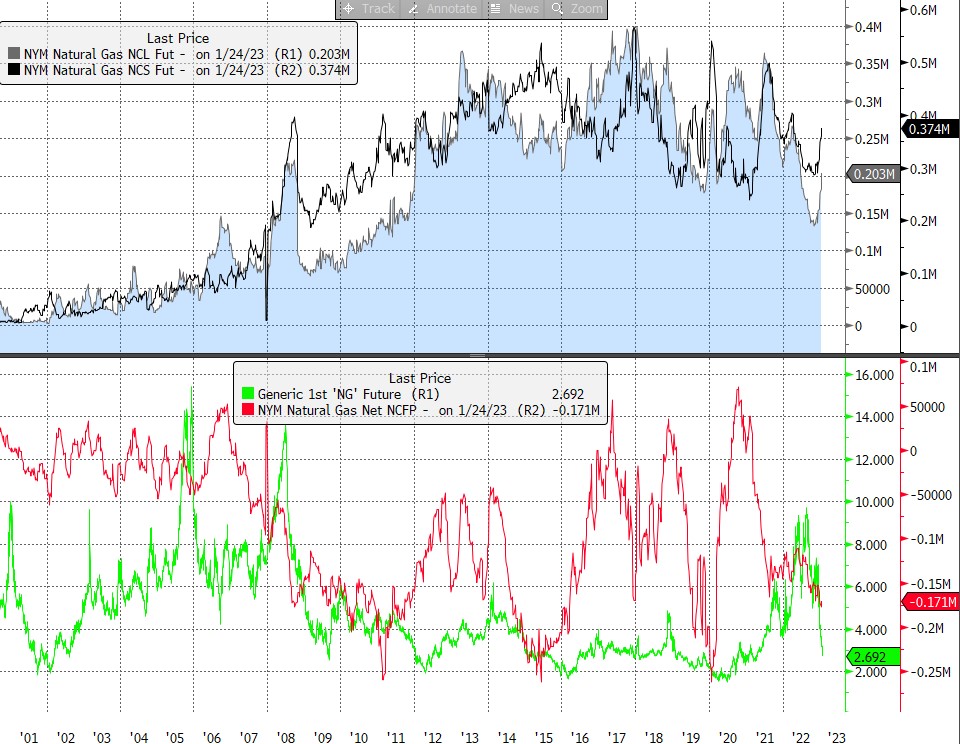

Taking a look at natural gas market positioning data, we can see that both buyers and sellers are becoming more and more active. Higher open interest should lead to a pick-up in near-term volatility. Source: Bloomberg

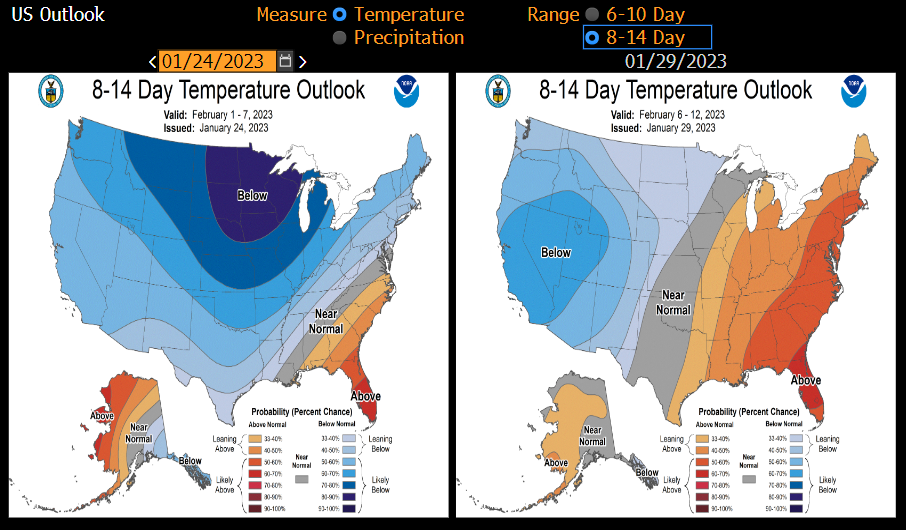

Weather forecasts for the Untied States point to a warmer temperatures in the coming days and weeks. Source: Bloomberg

Weather forecasts for the Untied States point to a warmer temperatures in the coming days and weeks. Source: Bloomberg

NATGAS dropped around 74% off its recent peak, what is a correction of similar magnitude as previous major sell-offs. On the other hand, it is also the quickest such a big correction, which have been in play for only 5 months so far. Source: xStation5

NATGAS dropped around 74% off its recent peak, what is a correction of similar magnitude as previous major sell-offs. On the other hand, it is also the quickest such a big correction, which have been in play for only 5 months so far. Source: xStation5

Copper

-

Copper is losing bullish momentum even in spite of an upbeat Chinese PMIs and return of Chinese investors to the market after a long New Year holiday

-

Copper stockpiles remain at extremely low levels

-

Due to a drop in stockpiles, Cochilco mine expects copper price to remain at elevated levels in this year. New target price was set at $8,470 per tonne which is still much lower than current market price

-

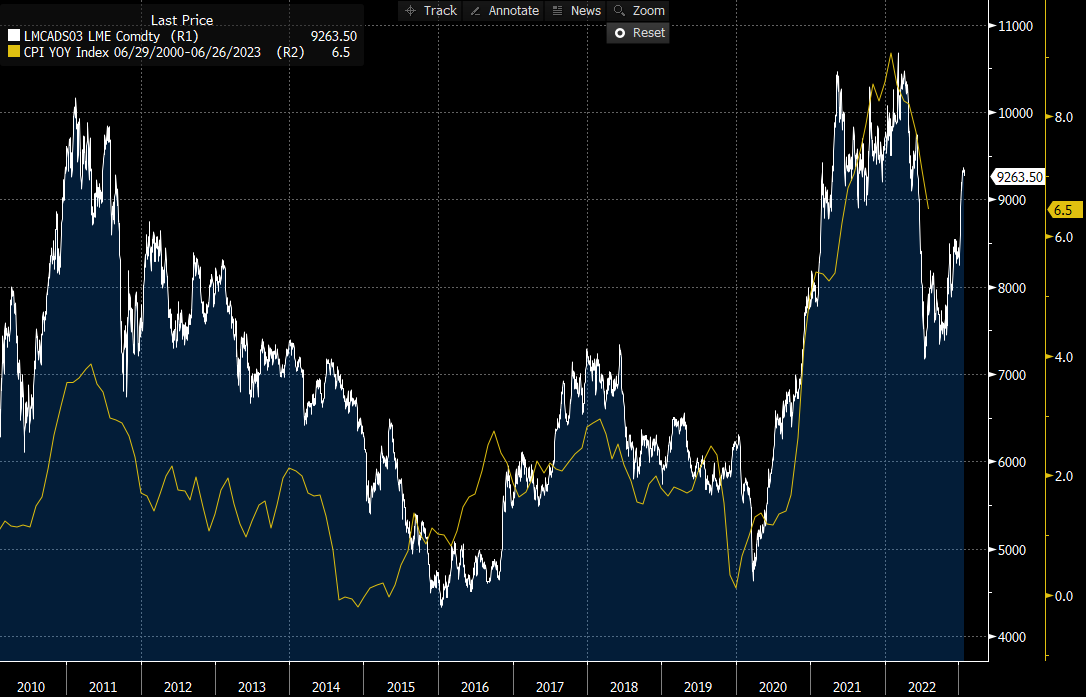

Copper is seen as a global barometer for the global economy. Should copper be a leading indicator for US inflation, it may be mean that we are set to see inflation spike after reaching a local low in a 1-2 month horizon

If copper is a barometer for the condition of the economy, we may expect inflation to spike in a few months. Source: Bloomberg

If copper is a barometer for the condition of the economy, we may expect inflation to spike in a few months. Source: Bloomberg

Copper price is pulling back from the area marked with 23.6% retracement and is testing $9,000 per tonne area. Chinese yuan pulled back slightly but increased uncertainty related to a looming Fed decision may lead to pick-up in copper market volatility. Source: xStation5

Copper price is pulling back from the area marked with 23.6% retracement and is testing $9,000 per tonne area. Chinese yuan pulled back slightly but increased uncertainty related to a looming Fed decision may lead to pick-up in copper market volatility. Source: xStation5

Wheat

-

Wheat is currently trading near a key support level in the 750 cents per bushel area

-

Current situation on wheat market starts to resemble the one from 2008 when after the second strong upward wave and trimming it later on, price broke below a key support and erased the whole upward impulse

-

Positioning on wheat is the lowest since the beginning of pandemic but not yet on extremely low levels in historical terms

-

RSI indicator dropped into oversold territory

-

Drop in wheat prices is driven by improving exports outlook around the world, including those related to Ukraine and Russia. Nevertheless, situation where one side withdraws from grain exports agreement cannot be ruled out and it may lead to another spike in prices

-

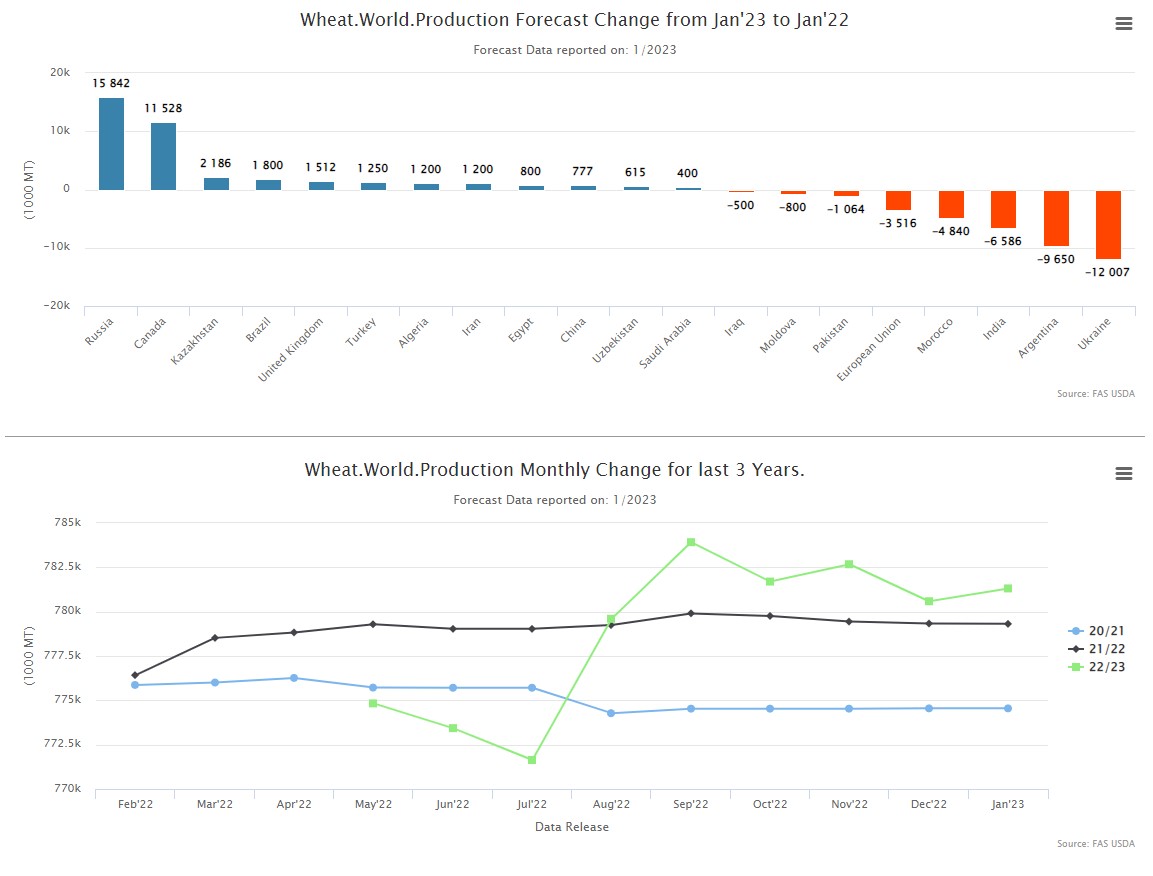

Ending stocks in the United States and around the world remain at relatively low levels, the lowest since 2018. Simultaneously, production outlook for the coming season starts to be revised higher

Production outlook improved significantly in the middle of 2022 and may improve further due to a warmer-than-average winter period. Source: USDA

Production outlook improved significantly in the middle of 2022 and may improve further due to a warmer-than-average winter period. Source: USDA

WHEAT trades close to an important support level. If it is breached, scenario from 2008 may repeat. Source: xStation5

WHEAT trades close to an important support level. If it is breached, scenario from 2008 may repeat. Source: xStation5