Oil

-

OPEC Secretary General said that increasing import quotas in China is a positive signal for oil demand

-

According to OPEC, Chinese demand will increase by around 0.5 million barrels per day this year

-

China is reopening, what is reflected in increased mobility, including air traffic. This may suggest that Chinese oil imports will also increase in the coming days

-

China will continue to benefit from discounts offered by Russia on its oil. Price of Russian oil coming from European ports is even 2 times lower than from Asia ports

-

China managed to greatly increase its oil inventories, thanks to purchasing Russian crude from European ports. However, it should be said that majority of this additional supply is being stored on water, what puts under question Chinese ability to boost oil imports

-

OPEC signals that it has higher production capacity than before. OPEC says it must balance its deliveries between strong growth in Asia and weakening in the West

WTI (OIL.WTI) is testing $80 per barrel area, after climbing above 50-session moving average. A strong bear camp is located in the $80-82 area, what may limit crude's ability to launch a new trend. Of course, we continue to weakening of the US dollar what is a positive for countries importing oil. Source: xStation5

WTI (OIL.WTI) is testing $80 per barrel area, after climbing above 50-session moving average. A strong bear camp is located in the $80-82 area, what may limit crude's ability to launch a new trend. Of course, we continue to weakening of the US dollar what is a positive for countries importing oil. Source: xStation5

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appEuropean Natural Gas (DE30, EURUSD)

-

European natural gas prices continue to drop and move to levels below €60 per MWh. This is a result of low demand due to high temperatures on the Old Continent

-

Natural gas withdrawals from the system are even as much as 3 times smaller than usually in this period of the year

-

EU countries are importing less gas from Norway than they did a year ago while quantity of imported LNG is insufficient

-

Having said that, one cannot rule out further issues on the European gas market, especially if Russia decides to halt remaining gas exports to Europe (via southern pipelines)

-

Nevertheless, from a market point of view low natural gas prices are positive for EURUSD and DAX

-

European natural gas prices still remain above historical averages for the period

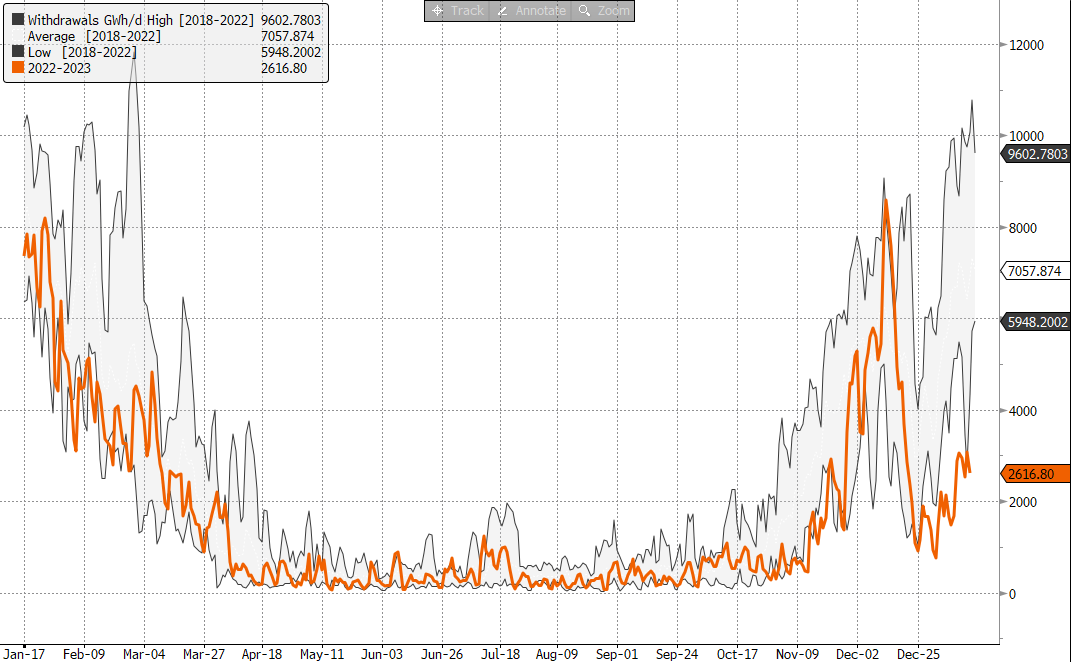

Gas consumption by EU countries is currently at a very low levels thanks to above-average temperatures on the Old Continent. On the other hand, gas imports are lower than they were a year ago and maintaining consumption at low levels may be key to keeping prices in check in 2023. Source: Bloomberg

Gas consumption by EU countries is currently at a very low levels thanks to above-average temperatures on the Old Continent. On the other hand, gas imports are lower than they were a year ago and maintaining consumption at low levels may be key to keeping prices in check in 2023. Source: Bloomberg

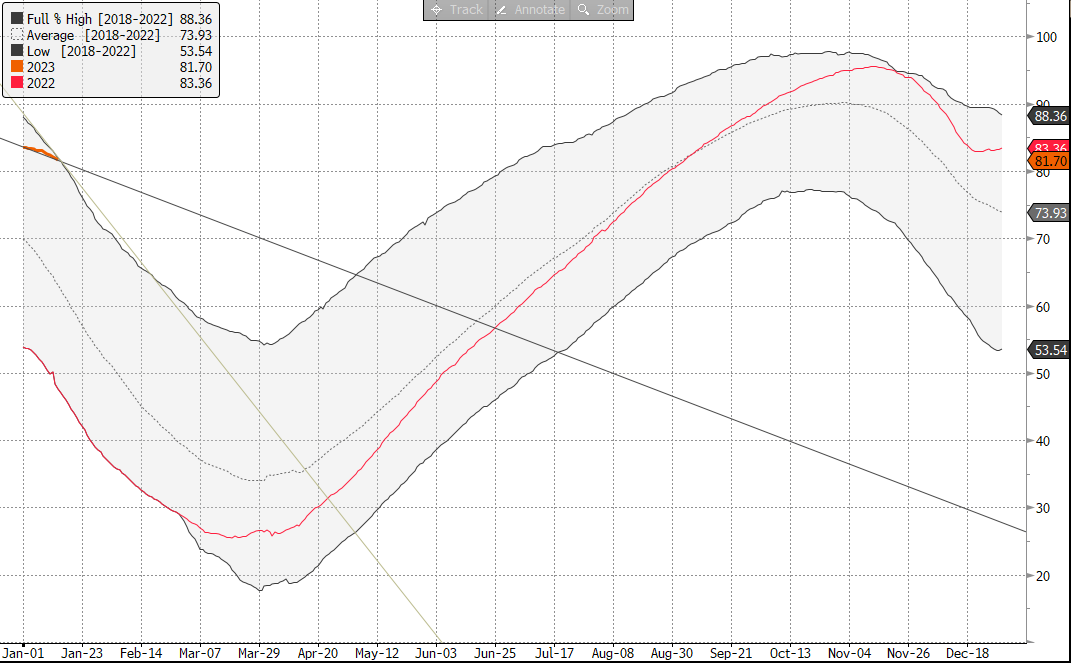

European gas inventories are over-80% full. Should current trend and pace of inventory drawdowns continue, inventories may be even 70% at the end of heating season! On the other hand, European imports are lower than a year ago (even excluding Russia) therefore one cannot rule out elevated volatility on the European gas market in Q2 and Q3 2023. Source: Bloomberg

European gas inventories are over-80% full. Should current trend and pace of inventory drawdowns continue, inventories may be even 70% at the end of heating season! On the other hand, European imports are lower than a year ago (even excluding Russia) therefore one cannot rule out elevated volatility on the European gas market in Q2 and Q3 2023. Source: Bloomberg

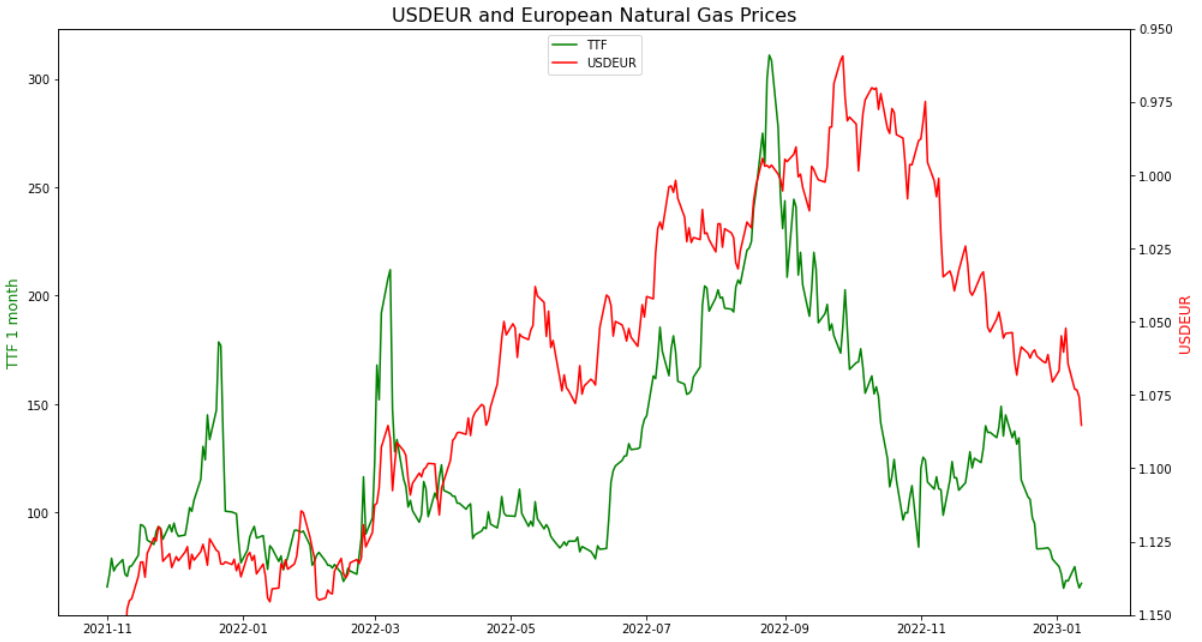

Keeping natural gas prices at low levels will be key for EURUSD. Imports prices were crucial for the European economy in 2022. High commodity prices exerted pressure on commodity, what further boosted import prices. Currently we can see reversal in this trend. Source: Bloomberg, XTB

Keeping natural gas prices at low levels will be key for EURUSD. Imports prices were crucial for the European economy in 2022. High commodity prices exerted pressure on commodity, what further boosted import prices. Currently we can see reversal in this trend. Source: Bloomberg, XTB

Low natural gas prices would also be beneficial for German DAX and other stock markets. However, it should be noted that room for further declines is limited given current price of around €50 per MWh therefore room for further declines in natural gas prices may also be limited. Source: XTB, Bloomberg

Low natural gas prices would also be beneficial for German DAX and other stock markets. However, it should be noted that room for further declines is limited given current price of around €50 per MWh therefore room for further declines in natural gas prices may also be limited. Source: XTB, Bloomberg

US Natural Gas (NATGAS)

-

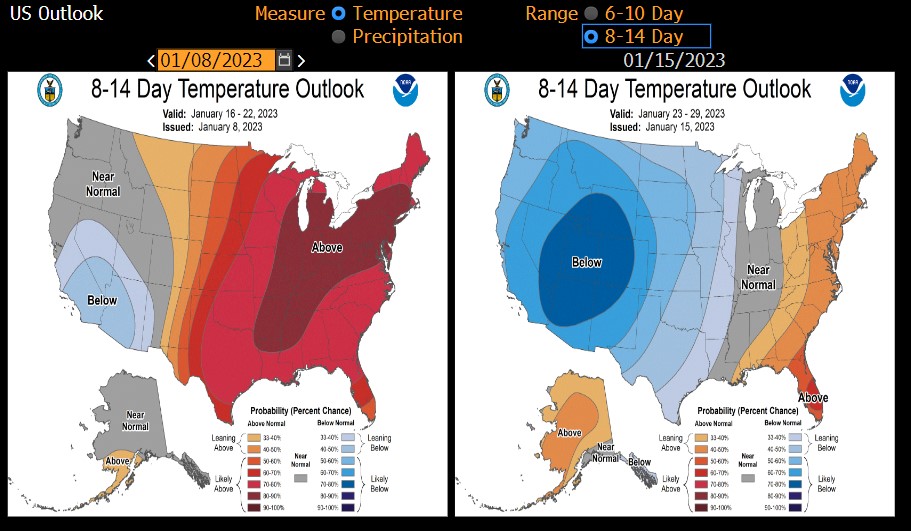

Weather forecasts for the United States are changing and the last week of January is expected to see a below-average temperatures for this period of the year

-

Weather changes suggest that harsh winter conditions may return to the United States in February, what will lead to an increase in gas consumption

-

Moreover, Freeport LNG export terminal is said to resume operations in mid-January

-

Comparative stockpiles in the United States suggest that natural gas may be already priced in-line with fundamentals. Market is not tight and currently there are no signs suggesting that natural gas shortages will be a thing

-

Future trend in the inventory changes compared to historical values will show whether US natural gas prices have a chance to launch another upward impulse this year

-

Future expansion of US LNG exports to Europe and Asia may help narrow divergence between US and European gas prices

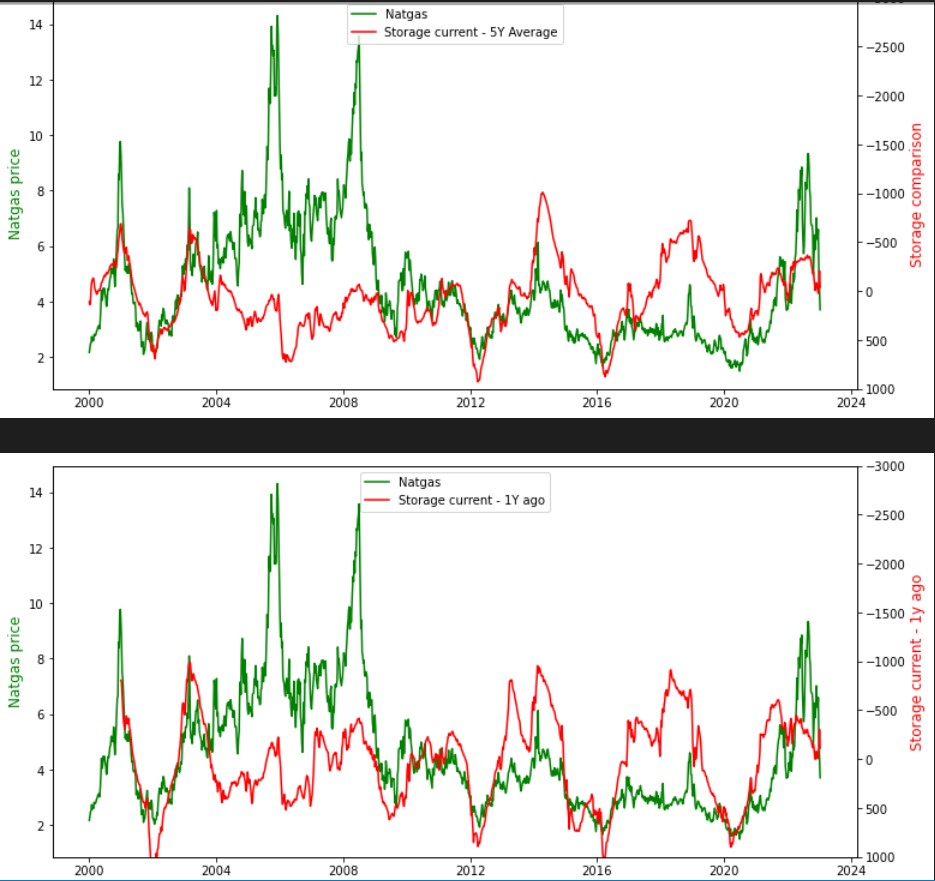

Taking a look at US natural gas stockpiles compared to historical values (5-year average) we can see that inventories do not look drained and did not justify steep price increases we saw in 2022. On the other hand, the launch of new export terminals may change the situation. Source: Bloomberg, XTB

Taking a look at US natural gas stockpiles compared to historical values (5-year average) we can see that inventories do not look drained and did not justify steep price increases we saw in 2022. On the other hand, the launch of new export terminals may change the situation. Source: Bloomberg, XTB

US weather forecasts show that temperatures may drop significantly in late-January and early-February therefore a small price rally cannot be ruled out in the coming weeks. Source: Bloomberg

US weather forecasts show that temperatures may drop significantly in late-January and early-February therefore a small price rally cannot be ruled out in the coming weeks. Source: Bloomberg

Seasonal patterns suggest that we are nearing a local low. Moreover, beginning of this week was very positive for gas prices and may help snap a 4-week losing streak. Source: xStation5

Seasonal patterns suggest that we are nearing a local low. Moreover, beginning of this week was very positive for gas prices and may help snap a 4-week losing streak. Source: xStation5

Gold/Platinum/Palladium

-

A very interesting divergence between palladium and platinum prices, which was not been spotted for the past few years

-

A significant spike in palladium demand from automotive sector could be observed just before Covid-19 pandemic broke out but recent crisis led to higher use of platinum at expense of palladium

-

Most likely palladium prices would have to fall further in relation to platinum prices for automotive industry to return to palladium

-

Automotive sector is currently in retreat, including green energy sector, and this could cap gains for platinum

-

On the other hand, platinum is much less correlated with gold, what is linked to platinum being used as investment asset much more often than in case of palladium

A significant divergence between palladium and platinum prices can be spotted since September 2022. Palladium prices are still much higher than platinum prices and therefore further widening of the divergence cannot be ruled out. Nevertheless, it should be noted that palladium trades near an important support marked with local lows from early-2020 and December 2021. Source: xStation5

A significant divergence between palladium and platinum prices can be spotted since September 2022. Palladium prices are still much higher than platinum prices and therefore further widening of the divergence cannot be ruled out. Nevertheless, it should be noted that palladium trades near an important support marked with local lows from early-2020 and December 2021. Source: xStation5

When it comes to history, price ratio of palladium-to-platinum rarely exceeded 0.5 but palladium prices rallied significantly in relation to platinum prices during the dot-com bull market and just ahead of the Covid-19 pandemic. It looks likely that this ratio will head towards lower levels now. There is a chance that due to changes in demand outlook, one cannot rule out a repeat of the situation from the early 2000s when the price ratio dropped from around 1.8 to 0.25. Source: Bloomberg

When it comes to history, price ratio of palladium-to-platinum rarely exceeded 0.5 but palladium prices rallied significantly in relation to platinum prices during the dot-com bull market and just ahead of the Covid-19 pandemic. It looks likely that this ratio will head towards lower levels now. There is a chance that due to changes in demand outlook, one cannot rule out a repeat of the situation from the early 2000s when the price ratio dropped from around 1.8 to 0.25. Source: Bloomberg

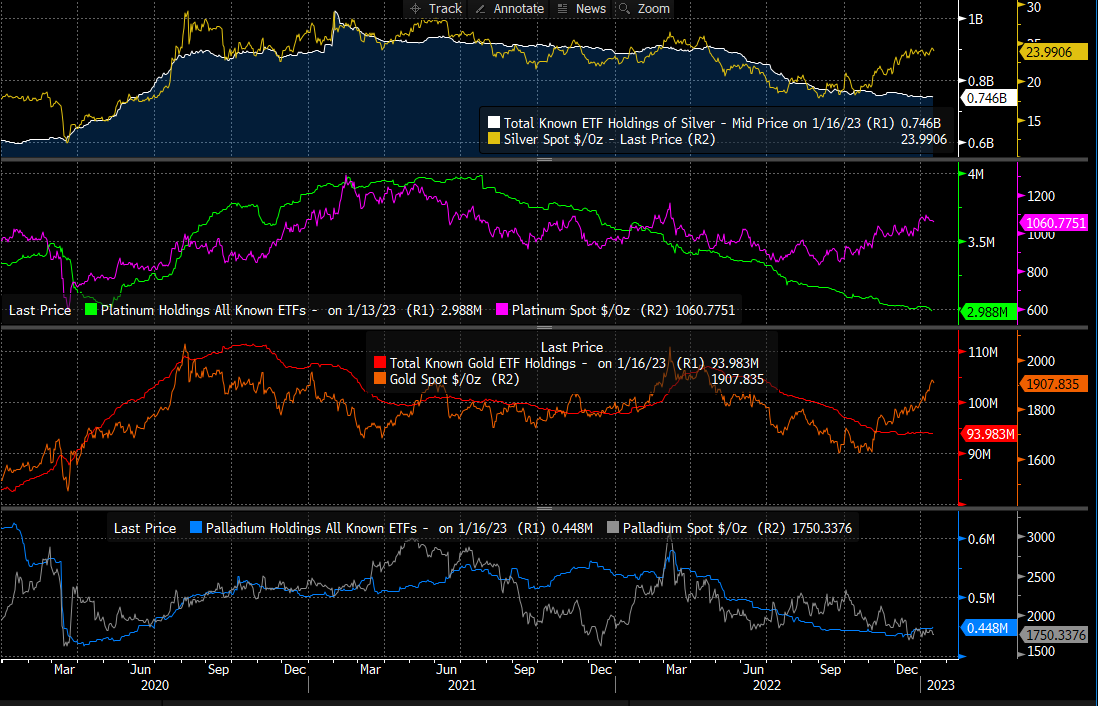

Majority of ETFs are selling out of precious metals. However, a reversal in this trend can be spotted when it comes to gold ETFs. In the case of palladium, a recovery can also be spotted but it does not necessarily point to a high demand. ETFs were unable to boost their palladium holdings earlier due to limited availability of the precious metal. Source: Bloomberg

Majority of ETFs are selling out of precious metals. However, a reversal in this trend can be spotted when it comes to gold ETFs. In the case of palladium, a recovery can also be spotted but it does not necessarily point to a high demand. ETFs were unable to boost their palladium holdings earlier due to limited availability of the precious metal. Source: Bloomberg