The monthly reading of the University of Michigan's consumer sentiment index came in weaker than analysts' expectations:

Current consumer sentiment: Reading: 54.9 Expectations: 59.5 Previously 59.9

Expected consumer sentiment: Reading: 52.7 Expectations: 55.5 Previously: 56.2

Short-term inflation expectations (annual): Reading: 5.1% Expectations: 5.1% Previously: 5,0%

Long-term inflation expectations (5 years): Reading: 3.0% Expectations: 2.9% Previously: 2,9%

Annual inflation expectations turned out as expected and 0.1% higher than previously, while long-term inflation expectations increased. Significantly, neither short- nor long-term inflation expectations declined (!) The data has mixed overtones and signals still lively concerns around price pressures in the US economy. Still very high inflation expectations could be also Fed warning signal against lowering interest rates too quickly.

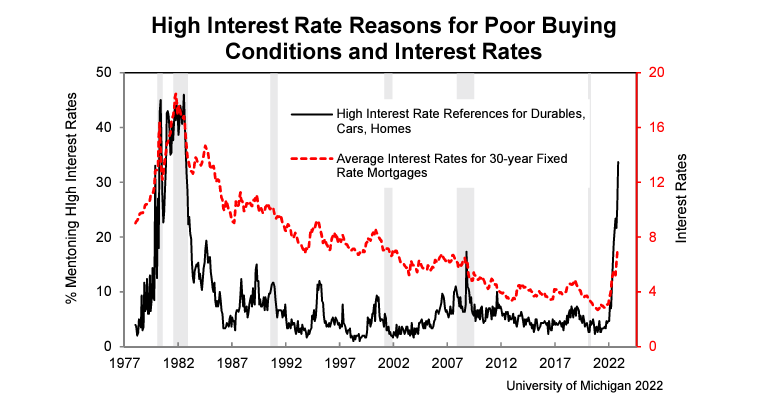

High interest rates are a cause of poor buying conditions and unfavorable interest rates, helping to choke demand in the US economy. The impact is particularly evident in durable goods, cars and homes. It's worth noting the similarities with the 'inflationary' period of the 1970s but average mortgage rates back then were substatnially higher. Source: University of Michigan

High interest rates are a cause of poor buying conditions and unfavorable interest rates, helping to choke demand in the US economy. The impact is particularly evident in durable goods, cars and homes. It's worth noting the similarities with the 'inflationary' period of the 1970s but average mortgage rates back then were substatnially higher. Source: University of Michigan

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Strong Service ISM Reading as activity expanded most since 2022

BREAKING: Stronger than expected ADP fails to support the dollar 🇺🇸