Cryptocurrencies opened Monday’s trading session with sharp declines, as a wave of sell-offs triggered nearly $1.7 billion in liquidations. The U.S. dollar index is down more than 0.2% today, but this has not translated into a rebound in Bitcoin’s price. Unlike gold—which is up over 1% to above $3,700 per ounce—Bitcoin has failed to follow the same upward trend.

Despite the lack of direct causes for this move, the “blame” can be placed on a heightened appetite for hedging against potential downturns, which has outweighed bullish bets—even in the face of a Federal Reserve rate cut and broad gains on Wall Street. Today’s cryptocurrency decline may also serve as a warning signal for the equity market. Data from Deribit signals stronger demand on hedging near $110k due to the negative dealers' gamma.

Bitcoin Under Pressure

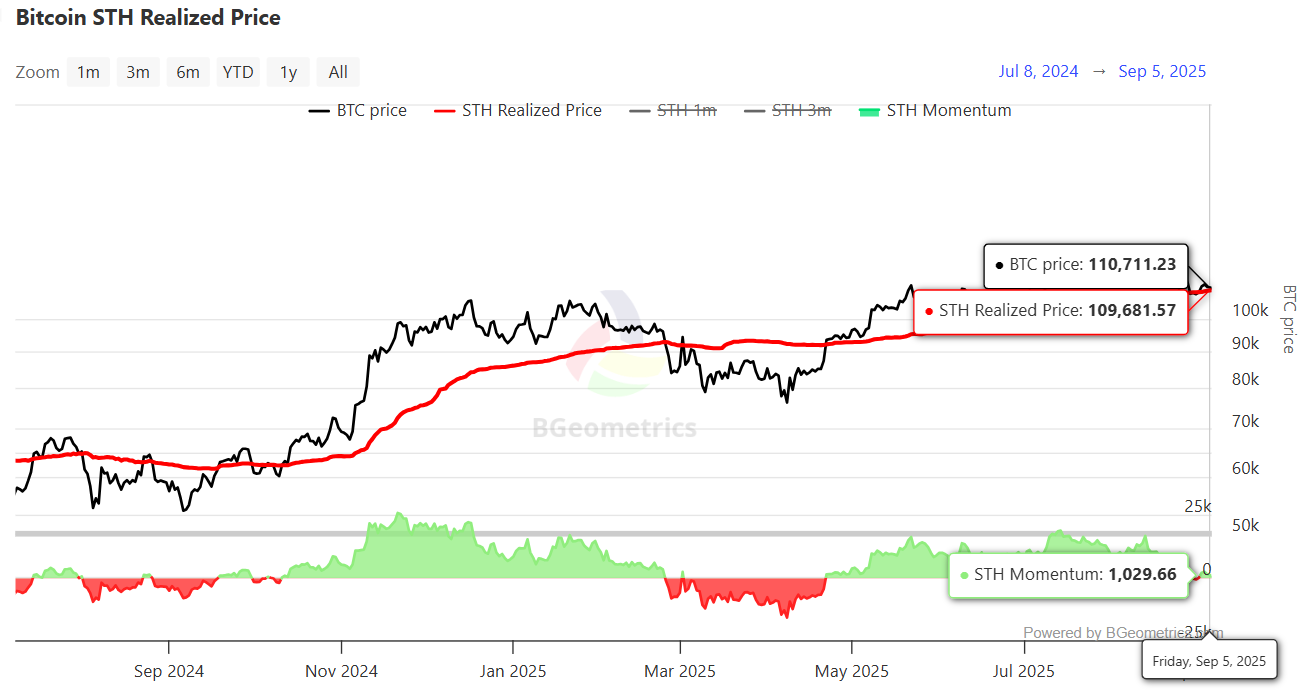

Bitcoin’s price has once again fallen back toward the average entry level of short-term investors. The key “balance” level for the market appears to be around $110,000. A drop below this threshold could trigger liquidations among short-term investors withdrawing funds from BTC, as well as a surge in demand for hedging.

Source: BGeometrics

ETF Inflows Gradually Returning

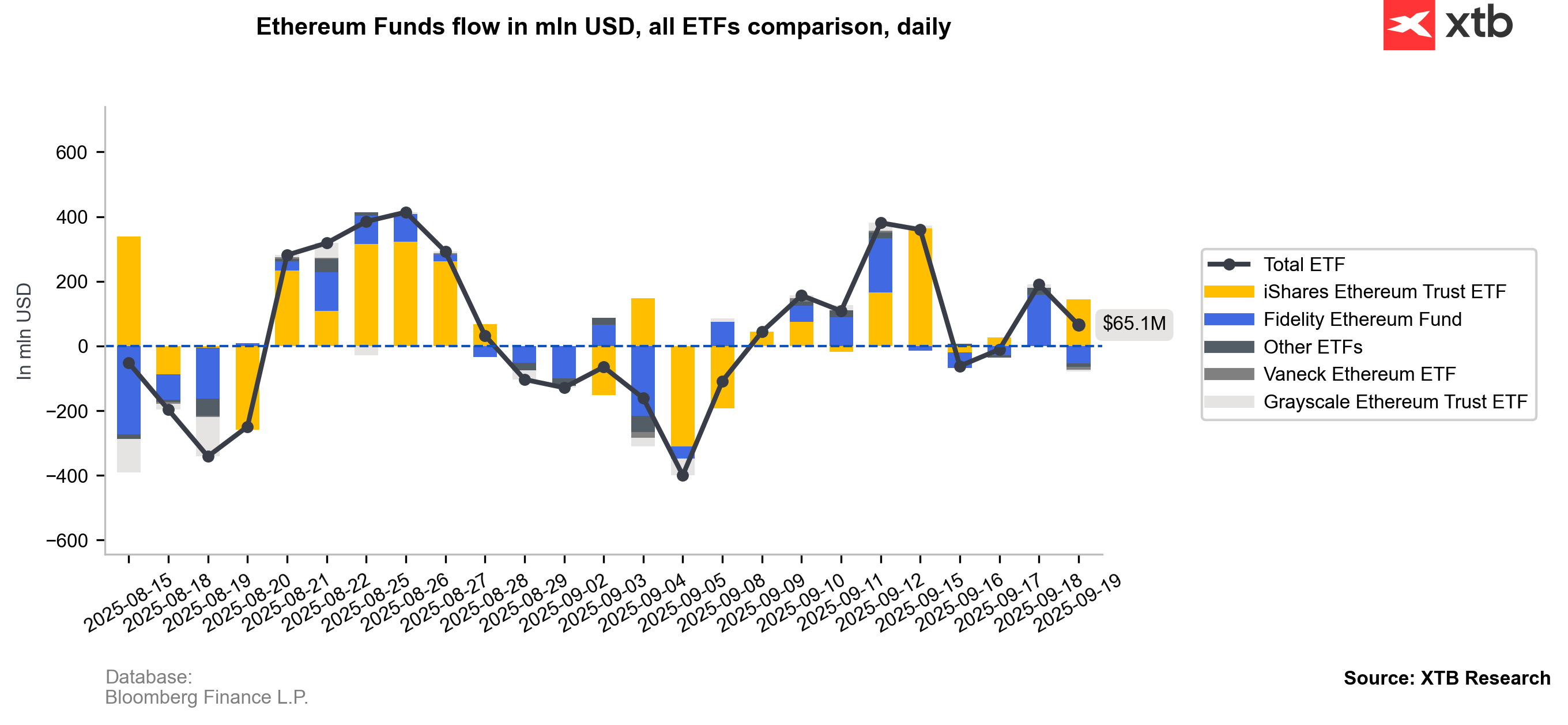

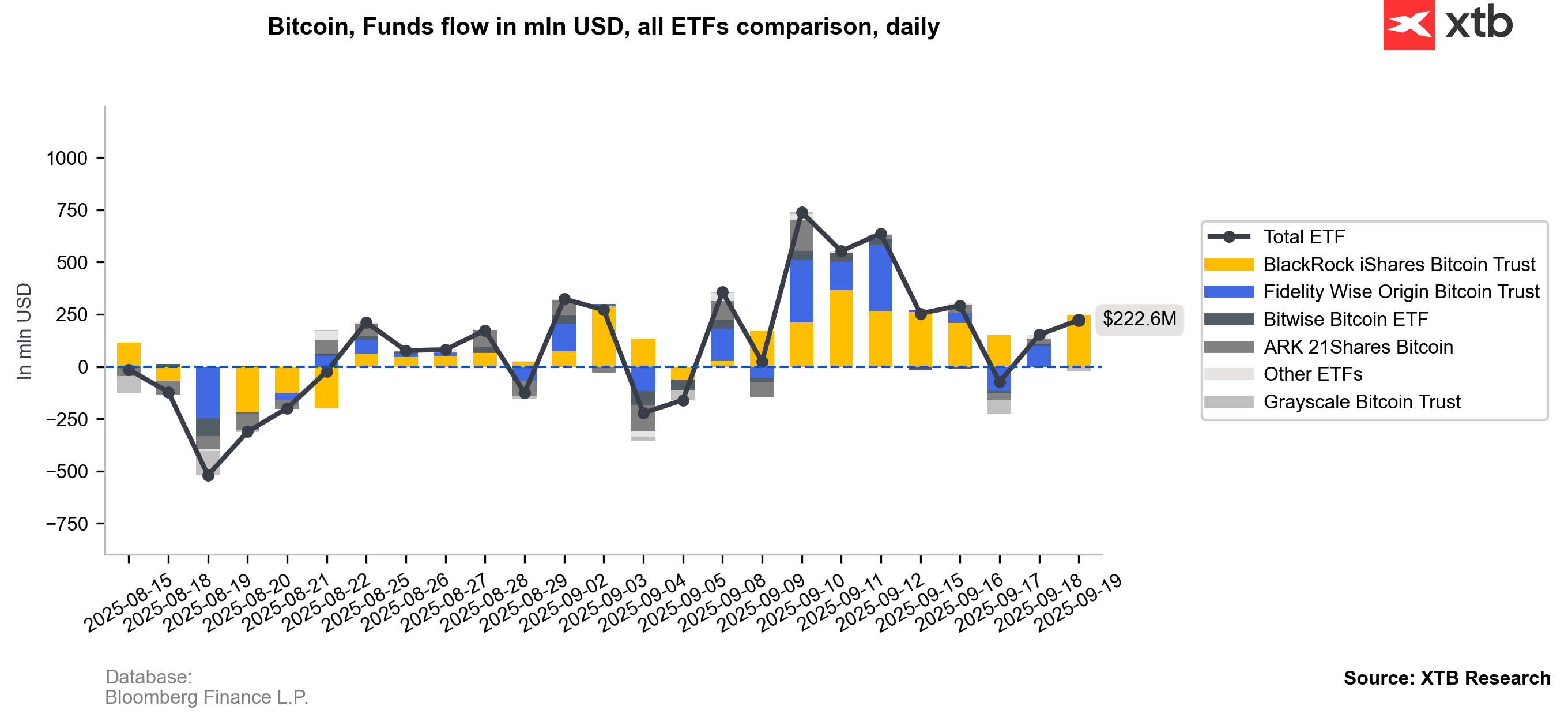

Although U.S. exchange-traded funds have seen positive inflows, neither Bitcoin nor Ethereum has managed to climb to new highs. Last Thursday and Friday, following the Fed’s decision, Ethereum attracted over $130 million in inflows, while Bitcoin saw more than $300 million.

Source: Bloomberg Finance L.P, XTB Research

Source: Bloomberg Finance L.P, XTB Research

Source: Bloomberg Finance L.P, XTB Research

Charts (Bitcoin, Ethereum, D1 Interval)

Bitcoin pulled back to around $112,000, with key Fibonacci retracement support located near $111,000. This further reinforces the $110,000 zone as crucial for determining future momentum. A move back above $115,000 could prove highly significant from a price action perspective.

Source: xStation5

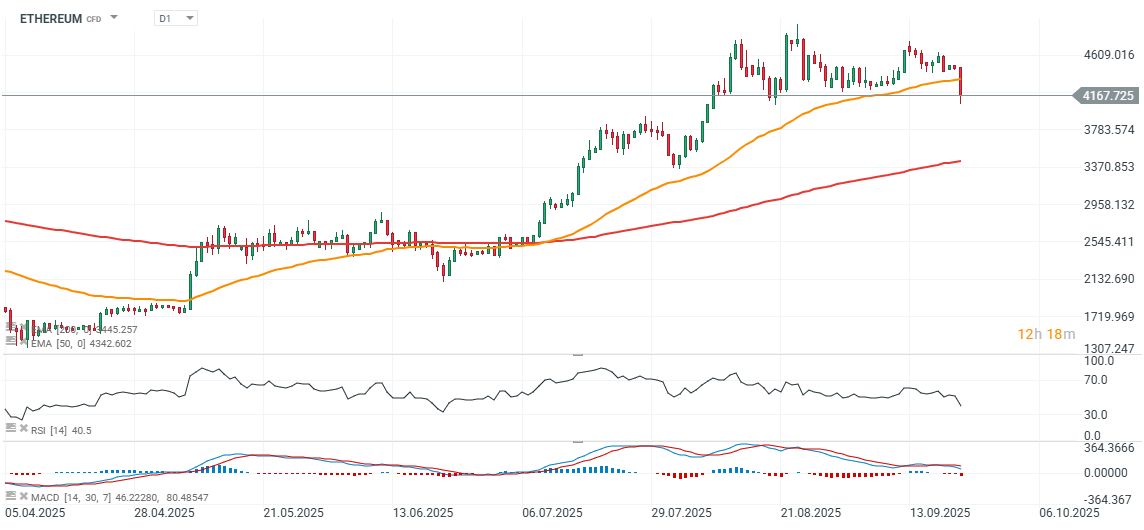

Ethereum, meanwhile, has once again tested its local lows from August 21, dropping to $4,100 per ETH.

Source: xStation5

Daily Summary: Middle East Sparks Oil Market

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

Oil Under Pressure as G7 Decision Remains Pending

Crypto up 4 % despite tension📈