Cryptocurrencies are trading down today although the dollar index is losing more than 0.3% and indices are slowly gaining. Potentially, this shows that the reasons for this sell-off are supported by events or expectations specific only to the crypto market. Such an event could be the estimated September 13 approval of the liquidation of $3.4 billion worth of cryptocurrency reserves belonging to the failed FTX exchange. This would also be confirmed by the momentum of declines on altcoins and Solana, which is currently losing nearly 6% and has broken through important supports - not even the positive comments on its blockchain from Visa helped.

FTX risk arises again?

-

FTX court documents indicate that, faced with liquidating assets, between $100 million and $200 million could 'land' in the market each week

- Analysts point out that even if FTX is approved for liquidation as of September 13 - the exchange may not proceed with the plan immediately

- However, it seems that the uncertainty factor surrounding the liquidation topic may 'add to' the overall weakness in the crypto market, where Bitcoin has failed to recover from recent sell-offs and is trading at $25,700

SEC vs. Ripple - CDN?

-

The SEC continues its battle against Ripple LABS and pushes for new regulation of the crypto sector - Ripple's price reacts by falling below $0.5. The SEC vs Ripple case is systemic for the entire crypto market, and for the moment the scales still seem to tip slightly in favor of Ripple;

- SEC regulators want to establish new regulatory aspects in a grievance with the appellate court while the case is still pending before the court of first instance - it is already known that there can be no settlement or SEC acceptance of the preliminary verdict.

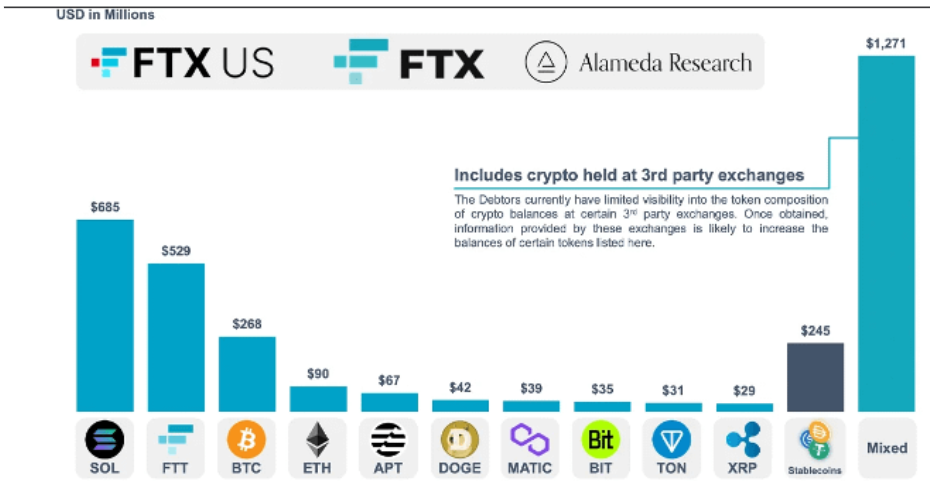

A huge FTC reserves of Solana is worth more than $685 million (nearly 10% of Solana's market cap) indicates that the token could potentially be the 'main victim' of FTX asset sales in the market. The third and fourth largest 'holdings' are Bitcoin and Ethereum however liquidity on both cryptocurrencies is much higher, as is capitalization. Source: BeInCrypto, FTX

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appTechnical analysis

SOLANA dived below $18, breaking the 71.6 Fibonacci retracement levels of the upward wave from June. If the momentum continues a deeper 10% drop and a retest of the early summer lows is not out of the question.

Źródło: xStation5

![]() Source: xStation5

Source: xStation5

Looking at BITCOIN quotes, we see that the MACD has generated a potentially 'contrarian buy signal', and the risk premium may be more attractive to buyers. The price stopped at the 38.2 Fibonacci retracement of the upward wave from the fall of 2022, near $25,500. A fall below this boundary could indicate a test of $21,700 and, in the extreme case, $20,000 per BTC - at both of these levels we see two ;next' key levels of the 61.8 and 71.6 abolitions. The RSI is signaling 40 points, which is still quite far from oversold. The key for the bulls will be to stop the declines from the current levels. Source: xStation5

Source: xStation5