The cryptocurrency market opened the week in a slightly weaker mood as Bitcoin failed to climb above $24,000 over the weekend. The correction may be a signal of profit-taking in the face of a week full of macro events and the Fed decision (Wednesday, 8pm) and Jerome Powell conference, which could weigh on the prices of risky assets. Indexes on Wall Street with which cryptocurrencies correlate also open the week lower.

Start investing today or test a free demo

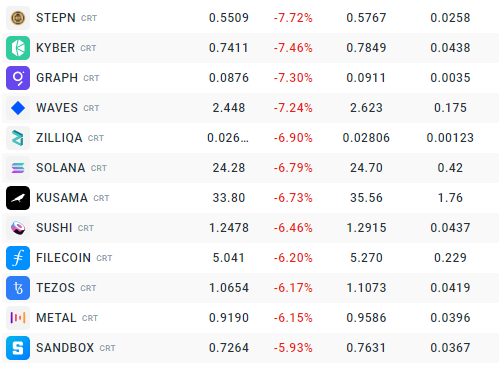

Create account Try a demo Download mobile app Download mobile appDeclines prevail in the market today, with altcoins losing the most and Bitcoin itself testing support at $23,000. Source: xStation5

Bitcoin has approached the 200-week moving average (WMA200), which has turned from historical support at 2022 to resistance and is running near $25,000. Historically, the level near the WMA200 has signaled an imminent unwinding, however, overcoming the key long-term resistance could be a challenge, for the bulls, and if the positive sentiment on the exchanges does not persist, it could herald longer-term weakness. Source: Coinglass

Bitcoin has approached the 200-week moving average (WMA200), which has turned from historical support at 2022 to resistance and is running near $25,000. Historically, the level near the WMA200 has signaled an imminent unwinding, however, overcoming the key long-term resistance could be a challenge, for the bulls, and if the positive sentiment on the exchanges does not persist, it could herald longer-term weakness. Source: Coinglass

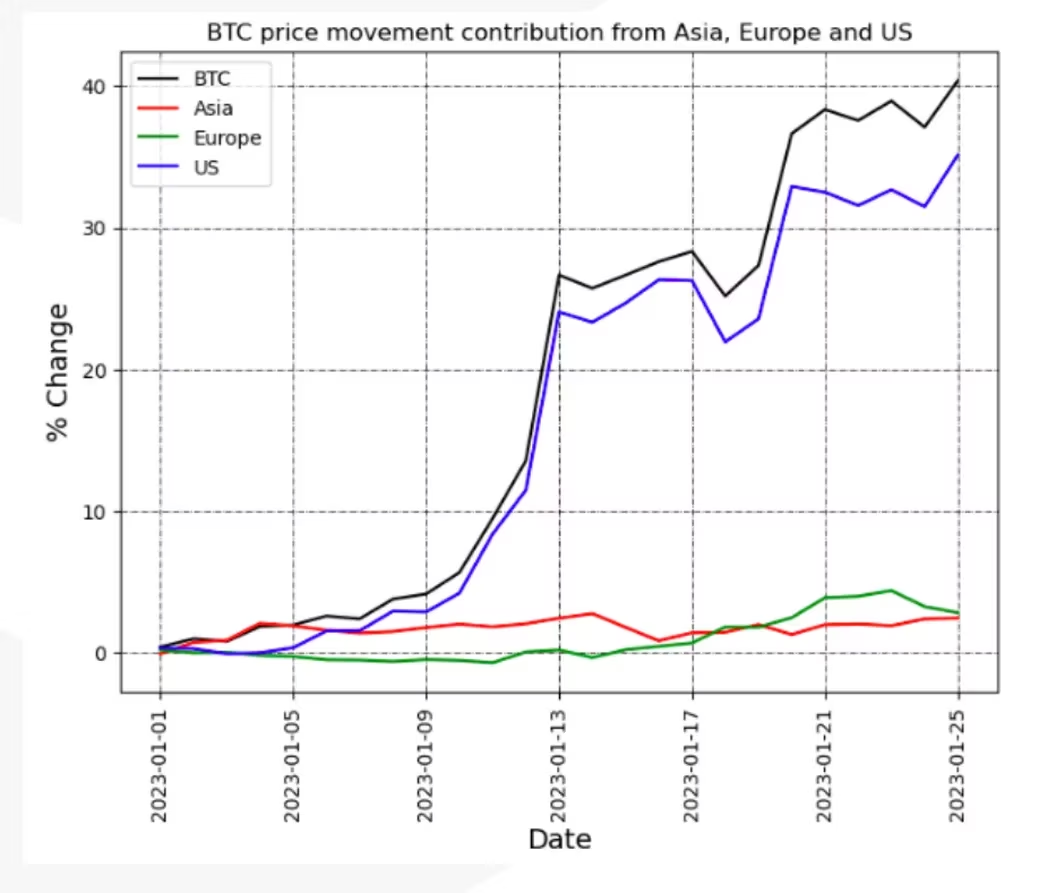

Bitcoin's gains mainly occur during the US session signaling a correlation with Wall Street indices and interest from US investors. Crypto market speculation indicates activity from US institutional investors against retail investors weakened by inflation, interest rates and 2022 declines. Source: Cointelegraph

Bitcoin's gains mainly occur during the US session signaling a correlation with Wall Street indices and interest from US investors. Crypto market speculation indicates activity from US institutional investors against retail investors weakened by inflation, interest rates and 2022 declines. Source: Cointelegraph

We can assume that the increase in the total volume of the cryptocurrency market on exchanges indicates the strength of the market and the growing interest in price speculation in the face of favorable market circumstances. Currently, the momentum of transfer volumes on cryptocurrency exchanges still remains negative (pink line). The monthly average (pink line) is gently increasing but at this stage is still well below the annual average value (blue line). According to Glassnode, a breakout `above 875 million (annual average) could prove to be the catalyst, which would indicate new, fresh demand - the strength of returning or first-time investors. Source: Glassnode

We can assume that the increase in the total volume of the cryptocurrency market on exchanges indicates the strength of the market and the growing interest in price speculation in the face of favorable market circumstances. Currently, the momentum of transfer volumes on cryptocurrency exchanges still remains negative (pink line). The monthly average (pink line) is gently increasing but at this stage is still well below the annual average value (blue line). According to Glassnode, a breakout `above 875 million (annual average) could prove to be the catalyst, which would indicate new, fresh demand - the strength of returning or first-time investors. Source: Glassnode Analyzing the average prices of BTC withdrawn from exchanges by the largest holders (above 1,000 BTC), we can see significant price levels to watch. The average whale portfolio active since mid-2017 (yellow line) in 2022 suffered losses when the price was below $18,000. In contrast, the group of whales accumulating since 2018 given the average of $23,800 is near 'break even' level signaling possible active supply (purple line) on their part in the face of a possible return of risk aversion. Whales buying BTC since March 2020 are still recording unrealized losses against the average roughly to $28,000 per BTC. Source: Glassnode

Analyzing the average prices of BTC withdrawn from exchanges by the largest holders (above 1,000 BTC), we can see significant price levels to watch. The average whale portfolio active since mid-2017 (yellow line) in 2022 suffered losses when the price was below $18,000. In contrast, the group of whales accumulating since 2018 given the average of $23,800 is near 'break even' level signaling possible active supply (purple line) on their part in the face of a possible return of risk aversion. Whales buying BTC since March 2020 are still recording unrealized losses against the average roughly to $28,000 per BTC. Source: Glassnode

Bitcoin, H4 interval. If risk aversion dominates investor sentiment this week, the key level to watch will be the SMA 100 (black) 71.6 Fibonacci retracement of the upward wave initiated in the spring of 2020, the support near $22,000 to which the price has recently reacted positively several times. Another important level in case of a correction is the psychological level of $20,000, where the 200-hour average (red) runs. The RSI has cooled and stands at 47 points. Source: xStation5

Bitcoin, H4 interval. If risk aversion dominates investor sentiment this week, the key level to watch will be the SMA 100 (black) 71.6 Fibonacci retracement of the upward wave initiated in the spring of 2020, the support near $22,000 to which the price has recently reacted positively several times. Another important level in case of a correction is the psychological level of $20,000, where the 200-hour average (red) runs. The RSI has cooled and stands at 47 points. Source: xStation5