- Whales continue to accumulate BTC

- On-chain activity and user adoption of ETH is on the rise

- Overall interest in crypto derivatives hit a peak last week

The past week was a negative one for the cryptocurrency market. Bitcoin jumped above $52,000 late Monday, however the price fell sharply on Tuesday after El Salvador adopted the largest cryptocurrency as legal tender, becoming the first country to do so. Altcoins in general followed Bitcoin and recorded heavy losses. Bitcoin's market dominance decreased to 41.5%. The capitalization of all digital assets in circulation fell slightly to 2.026 trillion, while an average daily trading volume is registered at $117.0 billion.

Bitcoin whales take advantage of recent price crash

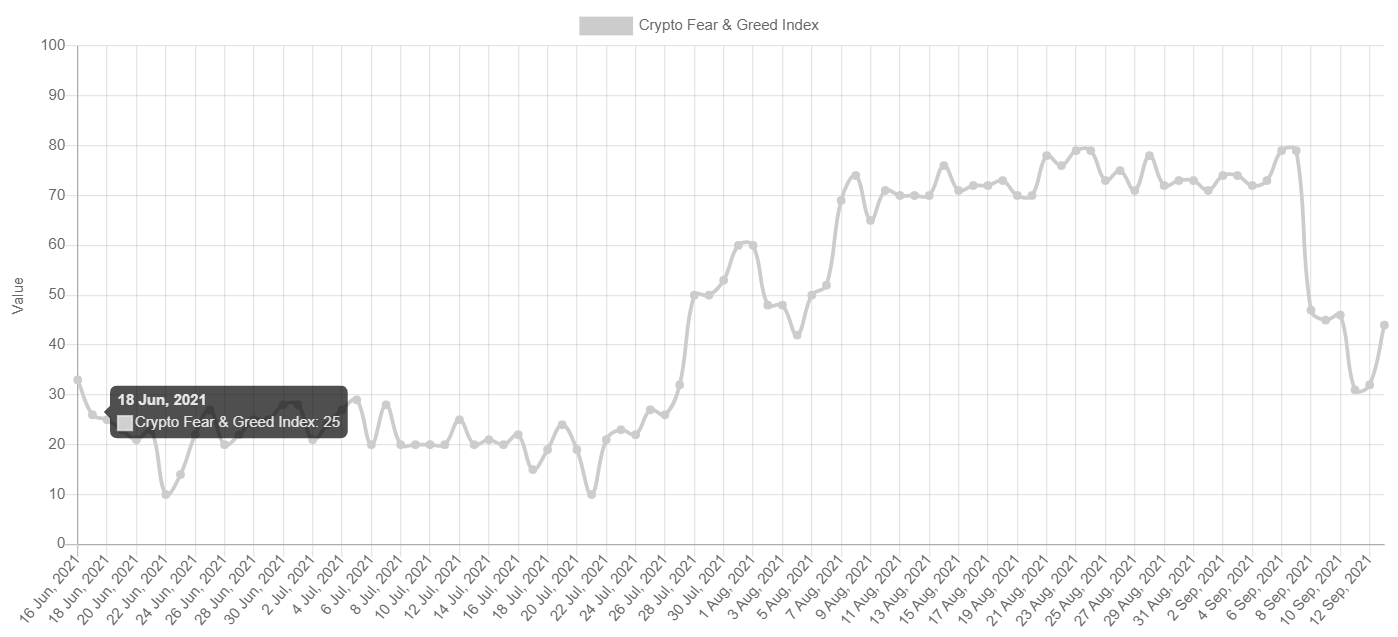

Bitcoin plunged 11% last week which is the biggest single-week percentage decline since May. Some analysts believe that short-term bullish outlook has weakened and the most popular cryptocurrency could consolidate between $44,000 and $48,000 in the near future. Also sentiment turned to negative last week. The Bitcoin Fear & Greed Index, which is based on a multifactorial sentiment analysis, fell to 31 on Saturday and reached “fear” level.

The Crypto Fear & Greed Index fell sharply last week. Source: alternative.me

The Crypto Fear & Greed Index fell sharply last week. Source: alternative.me

Meanwhile large investors, so-called "whales" took advantage of the recent sell-off to increase their holdings. Last week saw excess supply dumped onto the market by speculators eagerly bought up by strong hands. Historically, such actions sometimes led to price rally.

Whales continue to accumulate BTC despite negative market sentiment. Source: charts.woobull.com/@woonomic.Willy Woo/ Twitter

Recently, every class of Bitcoin investors has either added to their positions or stayed neutral. Source: Willy Woo/Twitter

93% of Bitcoin's supply hasn't moved within the last 4 weeks. This is an all-time high. Source: Glassnode/William Clemente/ Twitter

Bitcoin price appears to be losing momentum as a potential bearish death cross formation emerges on the 4-hour chart. The 50 SMA (green line) trends lower, knocking against the 200 SMA (red line). Should break below major support at $44,000 occur, then downward move may be extended to the $42,465 handle or even support at $37,500 where August lows are located. However if the buyers manage to halt decline here, then nearest resistance lies at $47,000 and is marked with earlier broken lower limit of the 1:1 structure and previous price reactions. Source: xStation5

The altcoin’s open interest in perpetual futures contracts reached new record level

Ethereum price rose sharply in August thanks to the launch of another ETH2 protocol upgrade. Many analysts believe that ETH will secure a significant part of the DeFi and NFT market, boosting the demand and utility for Ether. As a result altcoin’s open interest in perpetual futures contracts reached a new record level of $7.8 billion. This may be a sign that at least some investors are expecting further price rally

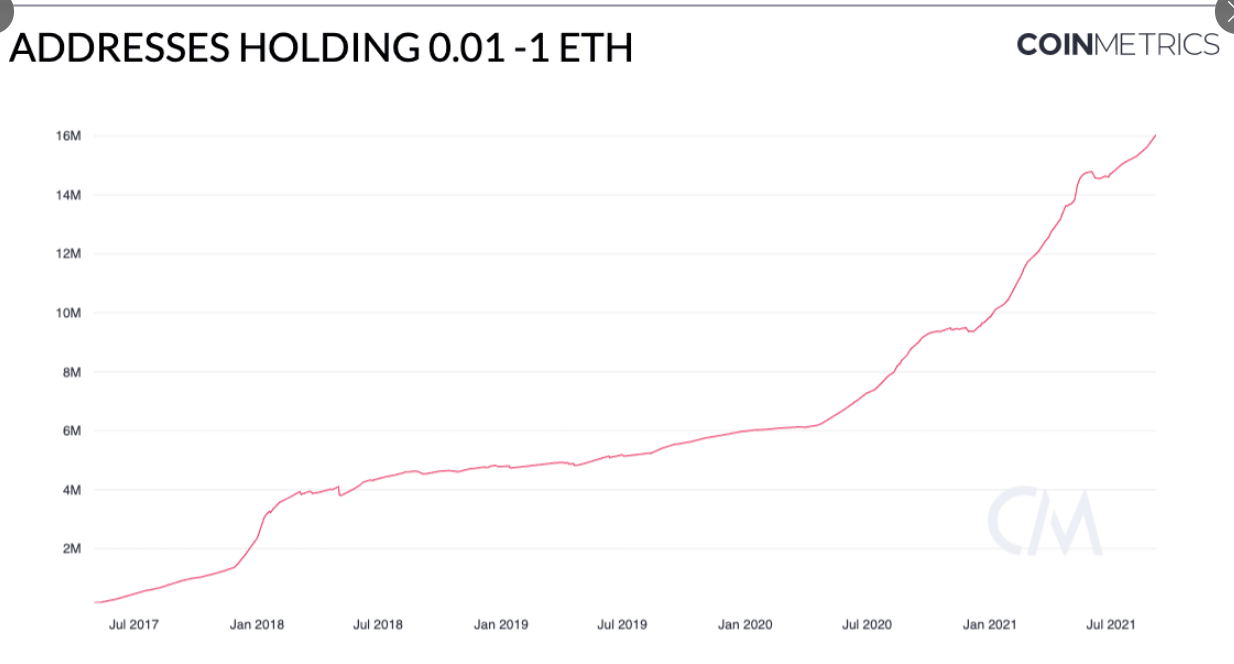

Despite the recent sell-off, many analysts believe that the fundamental picture remains intact, which is confirmed by the growing interest of users. Since the beginning of 2021, Ethereum has added over 6.2 million wallet addresses (holding 0.01 to 1 Ether). Source: CoinMetrics

Despite the recent sell-off, many analysts believe that the fundamental picture remains intact, which is confirmed by the growing interest of users. Since the beginning of 2021, Ethereum has added over 6.2 million wallet addresses (holding 0.01 to 1 Ether). Source: CoinMetrics

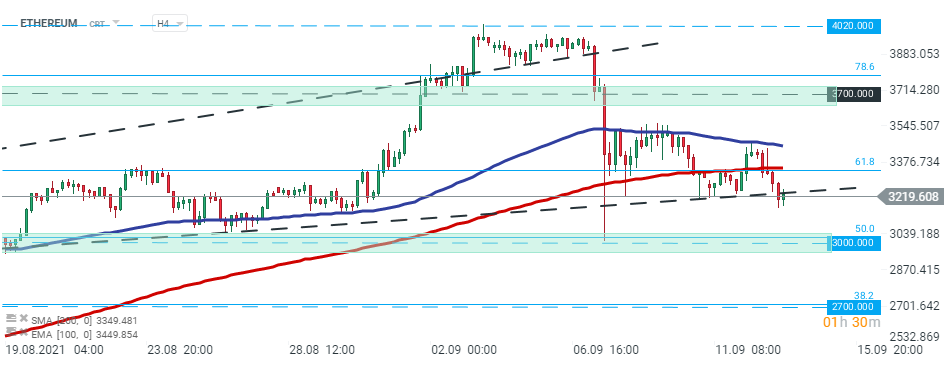

Ethereum price is testing the lower limit of the wedge formation. Should break lower occur, then downward move may accelerate towards psychological support at $3000.00 which is marked with the 50.0% retracement of the pullback launched in mid-May 2021 and previous price reactions. Source: xStation5

Ethereum price is testing the lower limit of the wedge formation. Should break lower occur, then downward move may accelerate towards psychological support at $3000.00 which is marked with the 50.0% retracement of the pullback launched in mid-May 2021 and previous price reactions. Source: xStation5

Crypto decline amid weak sentiments on Wall Street 📉

Morning Wrap (05.11.2025)

Daily Summary - Global Sell-Off: Stocks and Crypto Down

Crypto Market Under Pressure!↘️