- Musk is not planning to sell his crypto holdings

- Cardano large wallet investors increase their holdings

The past week was another negative one for the cryptocurrency market as the ongoing Ukraine-Russia military conflict and the expected first interest rate hikes by the FED weighed on the market sentiment. Nevertheless sentiment improved after recent comments from Elon Musk. "What are your thoughts about the probable inflation rate over the next few years,"Tesla's CEO tweeted late Sunday. Musk added that he would continue to hold bitcoin, ether and dogecoin even though buying physical assets is often the best way to ride an inflationary wave. Also news on talks between Ukraine and Russia officials during the weekend were much more positive than in the previous week. Bitcoin's market dominance increased to 42.6%. The capitalization of all digital assets in circulation rose to 1.737 trillion, while an average daily trading volume is registered at $ 72.50 billion.

BITCOIN

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile app- Michael Saylor, founder and CEO of MicroStrategy, believes that with rising inflation, he expects the capital cash flow will move away from traditional fiat into scarce assets such as Bitcoin.

- Brevan Howard Asset Management LLP and Tudor Investment Corp decided on a portfolio expansion, adding more Bitcoins to their cryptocurrency holdings.

- One of the Apple founders, Steve Wozniak, said that bitcoin would reach $100,000, which will be facilitated by the general interest in cryptocurrency. At the same time, he has a negative attitude towards altcoins and non-fungible tokens (NFTs).

- According to Glassnode data, Bitcoin balance on exchange is decreasing, which indicates that long-term investors are not willing to sell their holdings.

Bitcoin balance on exchanges making new lows. Source: Glassnode

Bitcoin balance on exchanges making new lows. Source: Glassnode

- Last week large investors borrowed over 1,500 BTC for funding short positions according to data from Datamish, a crypto intelligence platform. A total of 3,603 BTC have been lent to investors. In the past suc actions led to price decreases.

Traders have borrowed nearly 1500 BTC for short positions. Datamish

Traders have borrowed nearly 1500 BTC for short positions. Datamish

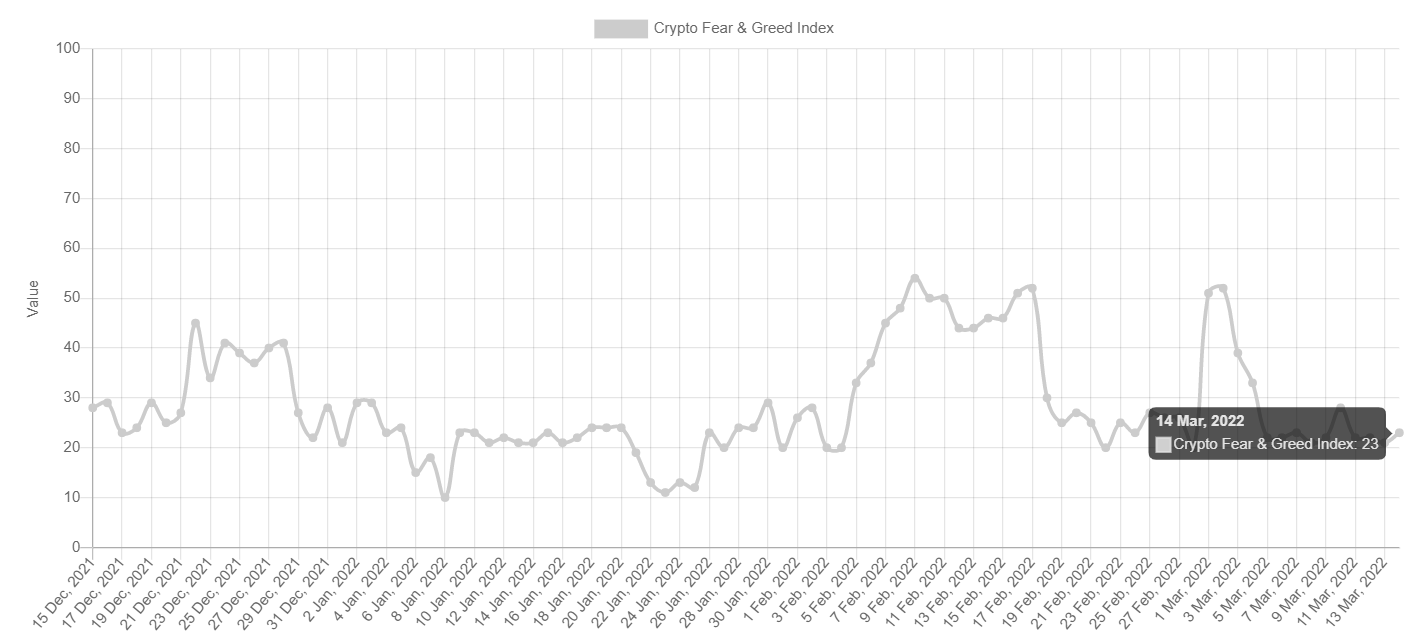

The Crypto Fear & Greed Index remains in “extreme fear” territory, near the 20/100 level, which acted as major support in recent months.

Fear and Greed index added 2 points in a day to 23, but still remains in "extreme fear" territory.

Fear and Greed index added 2 points in a day to 23, but still remains in "extreme fear" territory.

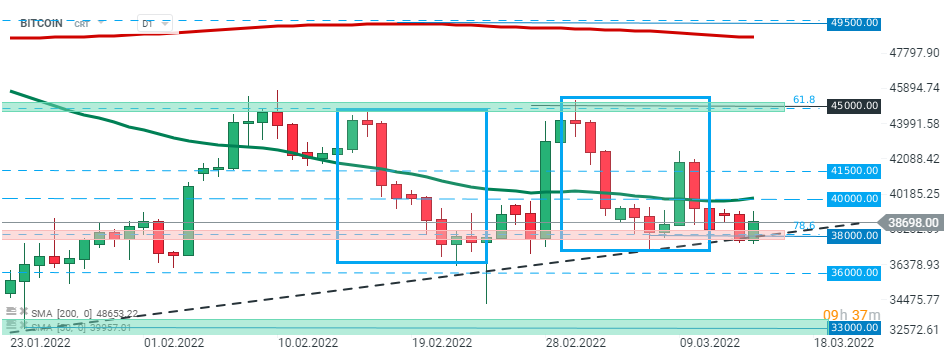

Bitcoin price took a hit in recent days, however sellers failed to break below the major support zone around $38,000, which is marked with a lower limit of the 1:1 structure and upward trendline. As long as the price sits above, another upward impulse towards key resistance at $45,000 may be launched. Source: xStation5

Bitcoin price took a hit in recent days, however sellers failed to break below the major support zone around $38,000, which is marked with a lower limit of the 1:1 structure and upward trendline. As long as the price sits above, another upward impulse towards key resistance at $45,000 may be launched. Source: xStation5

Ethereum

- Some analysts believe that the second most popular crypto may face selling pressure ahead of the merge.

- Developers are committed to upgrading the altcoin's network to Proof-of-Stake (PoW)as the final testnet goes public.

- The Kiln testnet is the final testnet before the migration from Proof-of-Work (PoW) to Proof-of-Stake (PoS). Once the merge is complete, the Ethereum consensus layer would be 60% complete. The consensus layer would be nearly complete once sharding is fully deployed on the Ethereum testnet, at 80%.

Ethereum price fell over the weekend, however buyers managed to halt declines around the lower limit of the triangle formation around $2485.00. However if sellers managed t0 regain control, then downward move may accelerate towards next support at $2170.00, where January lows are located. The nearest resistance lies at $2800 and coincides with the upper limit of the aforementioned formation and 23.6% Fibonacci retracement of the last downward wave. Source: xStation5

Ethereum price fell over the weekend, however buyers managed to halt declines around the lower limit of the triangle formation around $2485.00. However if sellers managed t0 regain control, then downward move may accelerate towards next support at $2170.00, where January lows are located. The nearest resistance lies at $2800 and coincides with the upper limit of the aforementioned formation and 23.6% Fibonacci retracement of the last downward wave. Source: xStation5

Cardano:

- The number of whales that accumulated Cardano has increased, their holdings are up 40% within the past year.

- The total value locked in the Cardano network increased consistently, from $1 million to an all-time high of $162 million over the past year, which is a sign of rising demand.

- Wallet addresses with 1 million to 10 million hold a combined 12 billion ADA tokens. According to crypto intelligence firm IntoTheBlock these holdings are worth $10 billion.

- The introduction of Hydra and off-chain ledgers on Cardano's blockchain could push the supported capacity of transactions to 1 million TPS. This would leave behind Visa's 65,000 TPS.

Cardano price has been consolidating in recent days within the triangle formation. Only a decisive break out from this structure may lead to bigger price movements. Source: xStation5