-

Major cryptocurrencies are trading sideways

-

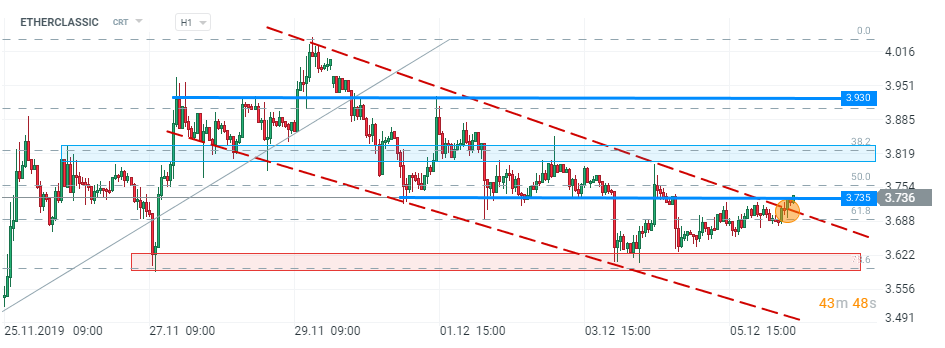

Ethereum Classic trades near the upper limit of the downward channel

-

Mnuchin and Powell do not see need for Fed to develop digital currency

The week nears its end but cryptocurrency investors are still looking for hints on what comes next. Most of the major cryptocurrencies are trading sideways and it seems that there is no near-term catalyst for a bigger move. This week we take a look at Ethereum Classic and cryptocurrency pair ADA/BTC.

Source: xStation5

Source: xStation5

Taking a look at ETC chart from a technical point of view, one can see that the altcoin is trading near the upper limit of the downward channel and short-term resistance level ($3.735). In case of a break above, there is a chance for the trend to reverse. Should such a scenario materialize, the $3.80-3.84 resistance zone could come into play. Key near-term resistance can be found at $3.93. On the other hand, should bears regain control, the coin may look to test the support at $3.63.

Source: xStation5

Source: xStation5

Moving to the ADA/BTC chart, one can see that the crypto pair has been trading in a downtrend since the end of the previous week. Following a test of the upper limit of the Overbalance structure, the pair pulled back to the lower limit. However, no break below occurred and the pair began to move sideways. Price action on this market eased and the pair is swinging around the 78.6% Fibo level. Upward moves seem to be limited by the 50-hour moving average. However, a break above it could pave the way towards the resistance level at 0.052.

Crypto News

Investors, who were hoping for a quick and broad adoption of the cryptocurrencies in the US, will be disappointed by stance of two US top officials. Steven Mnuchin, the US Treasury Secretary, said that he has discussed cryptocurrencies with Fed Chairman, Jerome Powell, and the two do not see a need for the US central bank to issue its own digital currency in the next five years or so. The two were discussing costs and benefits of developing state-backed cryptocurrency. However, the European Central Bank is holding similar discussion and suggested it may go forward with the plan in case private sector fails to make cross-border payments cheaper and faster.

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?