The cryptocurrency market reacted euphorically to reports regarding the regulation of the industry in the US. Most likely by mistake yesterday, the US Treasury Department revealed the contents of Joe Biden's executive order on the regulation of cryptocurrencies. The executive order was not supposed to be posted until today, i.e. 9 March, the entry was removed immediately after publication. However, on the internet, such information is not likely to escape the attention of investors, especially the crypto industry, which for many months has been demanding a clear position of the authorities on the regulation of the industry. Bitcoin's price quickly found its way above $40,000 and pulled the quotes of other cryptocurrencies with it.

Treasury Secretary Janet Yellen has described the upcoming regulation of the industry as 'historic'. Yellen conveyed that the Treasury Department's efforts in issuing an executive order will complement the work already done, including the report of the President's Working Group on Markets. The secretary praised Biden's upcoming regulation, reporting that it is balanced between supporting innovative technologies and addressing risks. In a since-deleted statement, Yellen also said that the approach outlined in the regulation "will support responsible innovation that can deliver significant benefits to the nation, consumers and businesses." Alpha Impact CEO Hayden Hughes points out that "For years, the cryptocurrency market has been hampered by a lack of regulatory clarity in the US" and "If clear guidelines are enacted, this could be a watershed moment for the industry."

Recently, major news agencies including Reuters have been sounding the alarm that a US presidential decree to regulate the cryptocurrency market is a matter of time. Reports of regulatory decisions for the crypto industry have also come from India. Yesterday, Finance Minister Nirmala Sitharaman conveyed that the position will be clear once the ongoing consultations are completed.

The favorable position of regulators may give hope for a positive decision by the SEC (U.S. Securities and Exchange Commission) regarding the acceptance of an ETF investment fund, buying Bitcoin on behalf of clients directly from the market. Until now, proposals from investment funds have been consistently rejected by the SEC. Recently, however, the regulator, following an enquiry and intervention by a US senator, conveyed that making such a possibility available to investors is still under consideration and widely discussed. The release of an ETF on Bitcoin's spot price could drive demand by allowing people without accounts on cryptocurrency exchanges to engage in the crypto market.

In the near term, we can expect increased volatility in the cryptocurrency market, which will closely follow the news coming from regulators in the US and India.

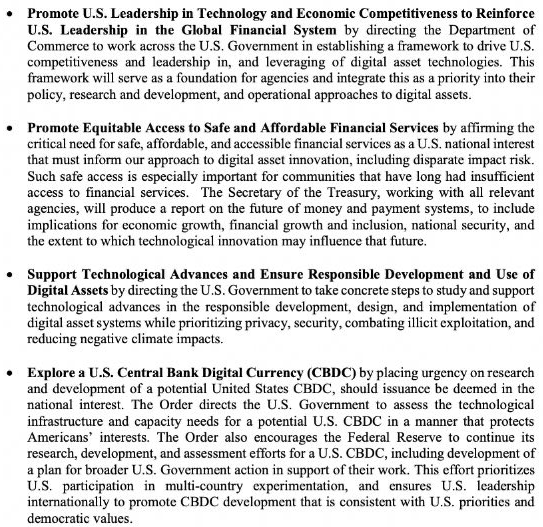

Key points from Biden’s executive crypto order. Source: FxMacro via Twitter

Bitcoin chart, D1 interval. The most popular of the cryptocurrencies gains after promising comments from the White House and rises near the psychological barrier of $42,000. As we can see on the chart, Bitcoin is moving in an incomplete ascending triangle formation, which usually ends with a top breakout. However, it is worth remembering that just one negative comment can disrupt the current situation on the crypto market. Source: xStation 5

Bitcoin chart, D1 interval. The most popular of the cryptocurrencies gains after promising comments from the White House and rises near the psychological barrier of $42,000. As we can see on the chart, Bitcoin is moving in an incomplete ascending triangle formation, which usually ends with a top breakout. However, it is worth remembering that just one negative comment can disrupt the current situation on the crypto market. Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?