Global equity markets finished last week's trading in risk-on moods and upbeat sentiment can also be spotted at the beginning of new week's trading. Major stock market indices from the Old Continent are trading over 1% higher. German DAX (DE30) is one of top performers with a 1.5% gain at press time. An improvement in moods is accompanied by weakening of the US dollar and a drop in US yields. Meanwhile, EUR jumped to a 4-week high against US dollar on the back of hawkish comments from ECB members over the week.

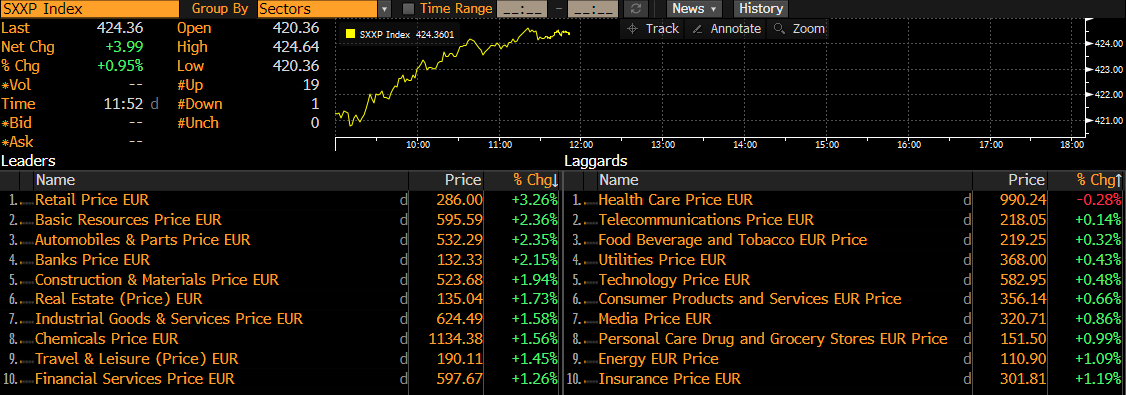

It is hard to pinpoint a reason that drives today's rebound. However, a look at sectors in the Euro Stoxx 600 index offers a hint. Today's rally is fuelled by solid performance of cyclical stocks - retailers, miners, carmakers, builders and banks. As such one may say that concerns over the condition of the global economy are easing, providing a lift for stocks. However, this upbeat narrative will be put to a test later this week with releases of 2 crucial pieces of data from the United States - CPI inflation on Tuesday, 1:30 pm BST and retail sales on Thursday, 1:30 pm BST. They will not only highlight how the US economy performs but may also offer hints on the path Fed will take at the coming meetings.

Cyclical stocks drive today's rally in Euro Stoxx 600 index. Source: Bloomberg

Cyclical stocks drive today's rally in Euro Stoxx 600 index. Source: Bloomberg

DE30 trades 1.5% higher today. Index reached 13,330 pts resistance but the first attempt of breaking above was a failed one. Source: xStation5

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments