-

US indices traded under pressure today as banking sector woes continue to linger

-

PacWest Bancorp slumped over 40% today after the company confirmed that it is reviewing strategic options. First Horizon traded over 30% lower after company terminated merger agreement with TD Bank

-

Other US regional banks also trade under pressure. Western Alliance dropped 40% after Financial Times reported that the bank is also looking at strategic options. However, Western Alliance rejected FT report as 'absolutely false'

-

European stock market indices traded lower today, pressured by banking concerns as well as ECB decision

-

The European Central Bank slowed down the pace of rate hikes and delivered a 25 basis point hike today, in-line with expectations. Deposit rate increased to 3.25% - the highest level since late-2008

-

President Lagarde said that it is clearing ECB is not pausing yet

-

Reuters reported that some members of ECB governing council expect 2-3 more rate hikes ahead

-

Norges Bank delivered a 25 bp rate hike, in-line with expectations, putting the main interest rate at 3.25%

-

Chinese manufacturing PMI dropped from 50.0 to 49.5 in April (exp. 50.3)

-

Euro area PPI inflation slowed from 13.3 to 5.9% YoY in March (exp. 6.2% YoY)

-

US Challenger job-cuts report came in at 67k in April - below 89.7k reported in March

-

US trade deficit for March came in at $64.2 billion (exp. -$63.4 billion) as exports increased and imports dropped slightly

-

US jobless claims came in slightly above expectations at 242k (exp. 240k)

-

EIA report showed a 54 billion cubic feet build in US natural gas inventories (exp. 52 bcf)

-

Apple is set to announced fiscal-Q2 results after market close today

-

WTI experienced a flash crash overnight which is blamed on a 'fat finger' of an institutional trader. US oil benchmark briefly plunged to below $64 per barrel before recovering losses quickly

-

Gold briefly traded at the record highs slightly below $2,080. However, precious metal pulled back later on and now trades in the $2,050 area

-

Cryptocurrencies traded mostly lower today with Bitcoin dropping below $29,000 mark

-

NZD, CAD and AUD are the best performing G10 currencies while EUR, CHF and USD lag the most

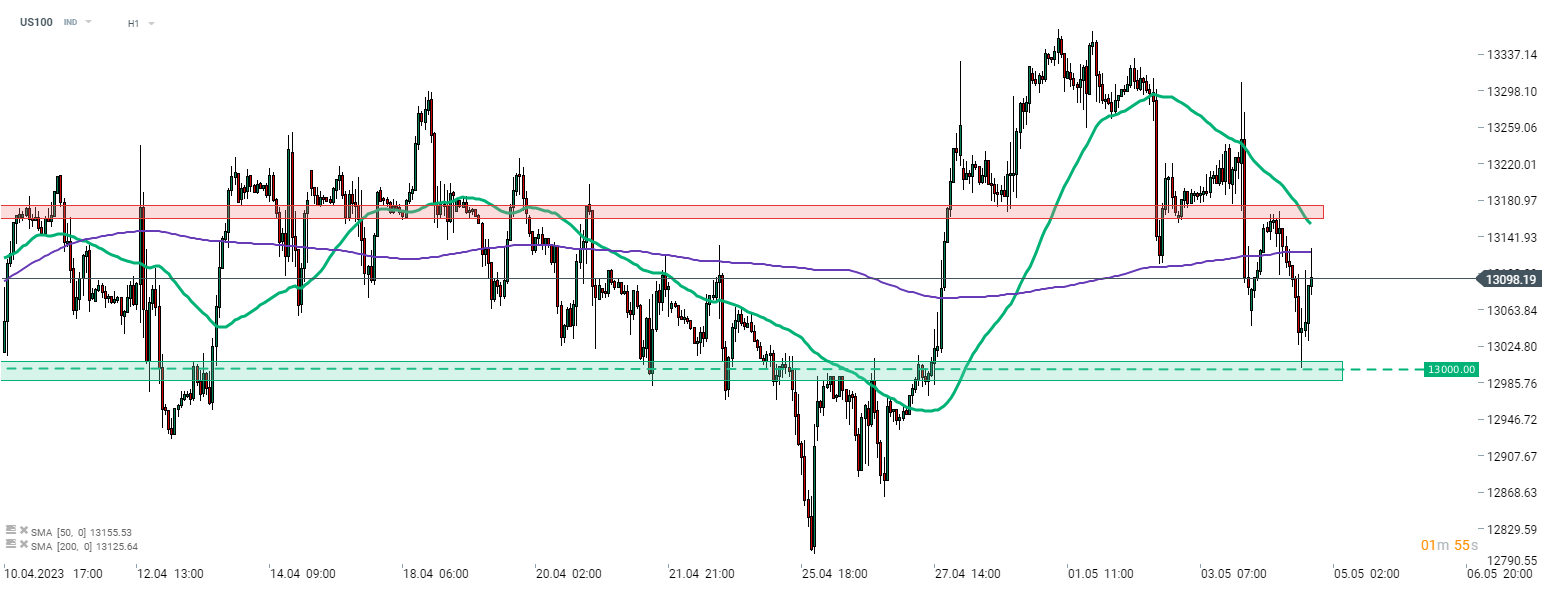

Nasdaq-100 (US100) outperforms other Wall Street indices today, like S&P 500, Dow Jones or Russell 2000. This is because the tech-heavy index does not have any banking shares in it. However, the final of 5 US megatech companies - Apple - is set to report earnings today after market close, which could be an important driver for US100. US100 bounced off the 13,000 pts area today and rallied back to 200-hour moving average (purple line). However, bulls have failed to break above it. Source: xStation5

Nasdaq-100 (US100) outperforms other Wall Street indices today, like S&P 500, Dow Jones or Russell 2000. This is because the tech-heavy index does not have any banking shares in it. However, the final of 5 US megatech companies - Apple - is set to report earnings today after market close, which could be an important driver for US100. US100 bounced off the 13,000 pts area today and rallied back to 200-hour moving average (purple line). However, bulls have failed to break above it. Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street