-

In the broad market today, we a gradually camling sentiment. Both the US500 and US100 are trading on a slight upside. The gains were somewhat limited later in the day.

-

The dollar is strengthening and remains one of the stronger currencies today alongside the Australian dollar. The euro is losing ground, with the EURUSD currency pair trading 0.75% lower.

-

Bitcoin momentarily crossed the $35,000 level today, which was linked to the narrative regarding the imminent approval of an ETF for spot Bitcoin. Increases on some cryptocurrencies have exceeded as much as 15% since the beginning of this week

-

As history shows, the emergence of an ETF for a given market is a net positive for prices, against which it was Bitcoin that gained very strongly

-

In the late afternoon, mixed news was released, which limited the rise in cryptocurrency prices. The ticker of a potential ETF from Blackrock disappeared from the DTCC website, which led to the beginning of strong gains yesterday

-

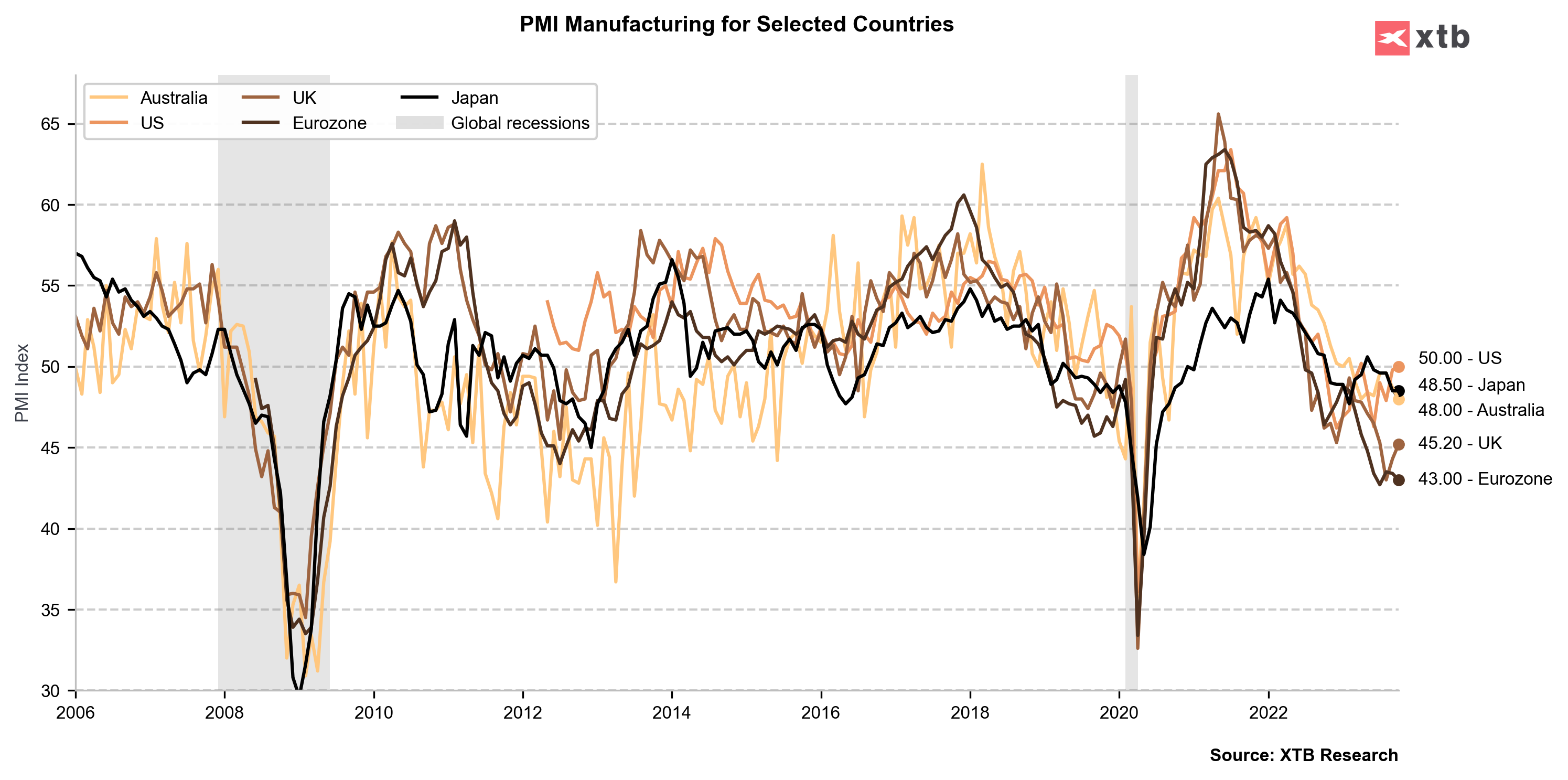

Preliminary PMI indexes fared mixed today - on the one hand, a slight improvement in Germany, where the industrial PMI rose to 40.7 points from 39.6 points. On the other hand, the services PMI fared worse, coming in at 48 points from 50.3 earlier.

-

In the U.S., on the other hand, the PMI indexes surprised positively, with the industrial index coming in at exactly 50 points, while the services index came in at 50.9 on expectations of a drop below 50 points

-

Verizon (VZ.US) shares are gaining after the release of quarterly results. The company reported very solid cash flow and better performance in the broadband sector.

-

After the Wall Street session, Microsoft and Alphabet results will be published. For Microsoft, the key questions will be the impact of AI on the company's results, while for Alphabet, further growth in the advertising and cloud computing segments. Alphabet is gaining about 1% ahead of the earnings releases, while Microsoft is losing marginally.

-

WTI crude oil fell below $85 per barrel today amid speculation that OPEC+ would raise production in the face of supply tensions. On the other hand, the lack of escalation of the conflict in the Middle East is also working to limit recent gains.

-

On the other hand, gold prices recovered from around $1,950 to $1,975 per ounce at the end of the U.S. session

Preliminary PMI data shows a slight rebound in the industry, but the data still indicates an economic contraction zone.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)