- Signs of progress in the Russia-Ukraine talks

- China is reportedly ready to provide military aid to Russia

- Commodity currencies and Wall Street indices under pressure

European indices finished today's session higher, with DAX gaining over 2% amid hopes of diplomatic resolution to the Russia-Ukraine conflict as both countries reported progress in peace talks yesterday, despite Russian forces continuing their military operations. Ukraine officials said it had begun hard talks with Russia on a ceasefire, immediate withdrawal of troops and security guarantees. On the data front, Germany’s monthly WPI inflation fell to 1.7% in February, above analysts estimates of 0.9%.

However, moods deteriorated in the afternoon. US indices erased early gains and are currently trading in red after White House informed its NATO allies that China had expressed a willingness to provide military and economic assistance to Russia. China foreign minister Wangyi emphasized today China has a legitimate right to safeguard its interest and hopes not to be impacted by sanctions on Russia. The Dow trades around the flat line, while the S&P 500 and the Nasdaq dropped 0.8% and 1.9%, respectively.

Downbeat moods prevail in the commodities markets amid a stronger dollar, which puts additional pressure on commodities currencies. US 10-year Treasury yields jumped to 2.12% while precious metals took a hit. Gold price pulled back to $1955 level, while silver is approaching support at $25.00. Also, oil markets extended losses from the previous week and were down more than 6%. Major cryptocurrencies moved higher during today's session, however bulls cut some gains after the US open. Bitcoin price jumped briefly above 39,000, however buyers failed to uphold momentum and price pulled back to $38,500. Ethereum trades around $2520 level after an unsuccessful attempt to breach the $ 2,600 mark.

The Australian dollar and other commodity currencies are facing intense selling pressure on Monday. AUDUSD air is currently testing local support at 0.7200, which coincides with 50 SMA (green line) and previous price reactions. Source:xStation5

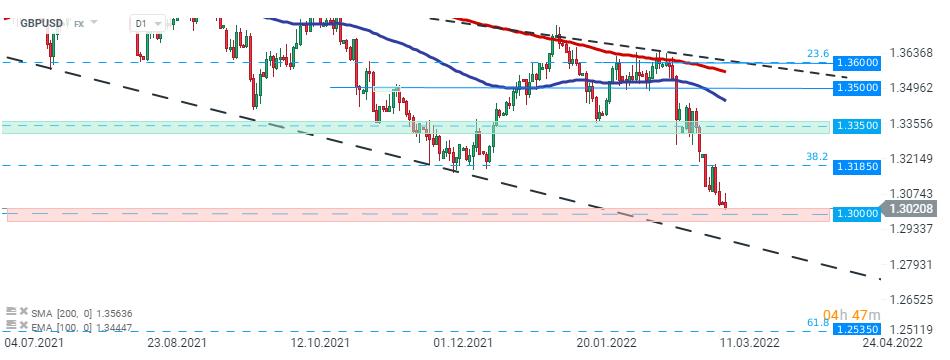

GBPUSD pair fell sharply in recent days and is currently approaching psychological support at 1.3000. Should break lower occur, downward move may accelerate towards lower limit of the wedge formation or even support at 1.2535, which coincides with 61.8% Fibonacci retracement of the upward wave launched in March 2020. On the other hand, if buyers manage to regain control, then the nearest resistance to watch is located around 1.3185. Source: xStation5

GBPUSD pair fell sharply in recent days and is currently approaching psychological support at 1.3000. Should break lower occur, downward move may accelerate towards lower limit of the wedge formation or even support at 1.2535, which coincides with 61.8% Fibonacci retracement of the upward wave launched in March 2020. On the other hand, if buyers manage to regain control, then the nearest resistance to watch is located around 1.3185. Source: xStation5

Chart of the day: OIL.WTI (14.11.2025)

BREAKING: French and Spanish inflation came in line with expectations 📌

Morning Wrap (14.11.2025)

Daily Summary: Shutdown ends, rate cut fades and risk is off