• European stocks close mostly in the red

• Pelosi sets 48-hour deadline for White House on stimulus talks

US indices are trading lower on Monday despite a positive start, as investors are waiting for more details regarding new stimulus deal. House Speaker Nancy Pelosi set a Tuesday deadline for the Trump administration to reach an aid deal before the Nov. 3 election. Meanwhile, coronavirus continues to worry investors as Covid-19 cases are growing by 5% or more in 38 states as of Friday. Nationwide, the daily case average has risen by more than 16% on a week-over-week basis to nearly 55,000 according to CNBC analysis of Johns Hopkins University data.

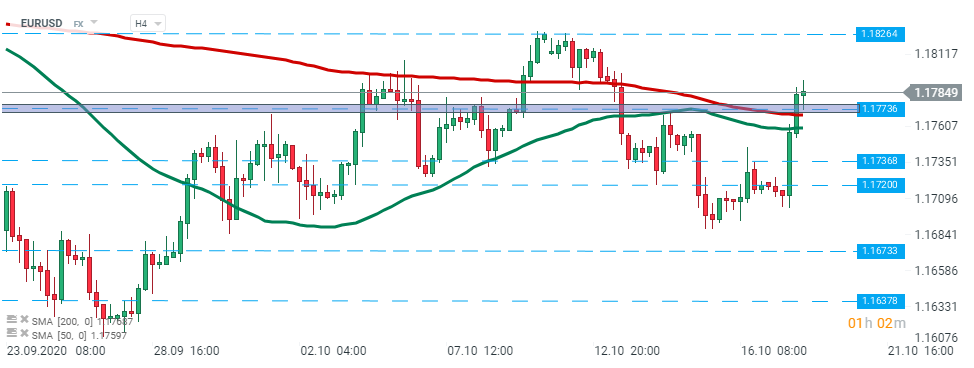

EURUSD – pair broke above and re-tested major resistance at 1.1773 which is additionally strengthened by 200 SMA (red line). Should buyers manage to uphold momentum then next resistance at 1.1826 may be at risk. Source: xStation5

EURUSD – pair broke above and re-tested major resistance at 1.1773 which is additionally strengthened by 200 SMA (red line). Should buyers manage to uphold momentum then next resistance at 1.1826 may be at risk. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉