- European indices recorded heavy losses on Wednesday, with Dax down 3.27% after Credit Suisse woes renewed concerns over the health of the global banking sector.

-

Credit Suisse plunged 24% to a new record low after the lender's top shareholder Saudi National Bank ruled out further financial aid if another call for additional liquidity was needed. Credit Suisse CDS reach crisis levels as banks seek protection.

-

Tomorrow traders will focus on the ECB policy statement, with policymakers expected to raise interest rates by at least 25 bps. Interest rate futures pricing just a 20% chance of 50 bps hike

-

Mounting risk aversion is visible on Wall Street, however moods improved slightly following news that the Swiss government now holds talks on options to stabilize Credit Suisse. Swiss Regulator FINMA will likely make a statement regarding troubled lender. Major US indices erased a large chunk of early losses and now Dow Jones is trading 0.90% lower, while S&P500 and Nasdaq fell 0.80% and 0.11% respectively.

-

Nevertheless negative sentiment continues to weigh on shares of medium and larger US lenders, including Well Fargo and Bank of America.

-

SVB explores bankruptcy filing as one option for asset sales, according to Reuters

-

On the data front, the Labor Department's PPI report showed that headline and core inflation slowed more than expected in February, while US retail sales fell 0.4% mom in February, compared to analysts estimates of 0.3% decline, and following an upwardly revised 3.2% surge in January which was the biggest gain since March of 2021.

-

Energy commodities took a massive hit during today's session. Demand for oil and natural gas declined as the market fears that turmoil in the banking sector combined with interest rate hikes by major central banks will cause a serious economic slowdown. WTI oil is now trying to regain some ground after falling over 8% earlier in the session. Similar situation can be observed in the natural gas market.

-

Early in the session turmoil in the worldwide banking sector supported US dollar and precious metals as investors poured into haven assets. The dollar index surged over 1% to around 105, while EUR, and CHF are among the worst performing G10 currencies. The EURUSD pair fell nearly 2.0%, however buyers launched a recovery move from the support zone around 1.0530.

-

Gold jumped to $1937 handle, while silver reached a 5-week high around $22.38, however later in the session demand for bullion eased. Gold returned to $1915 level, while silver erased all of the early gains and is trading slightly below the flatline.

-

The cryptocurrency market is also subject to downward pressure, but the scale of declines is not so severe. Bitcoin is currently losing nearly 2%, and Ethereum fell more than 4.0%.

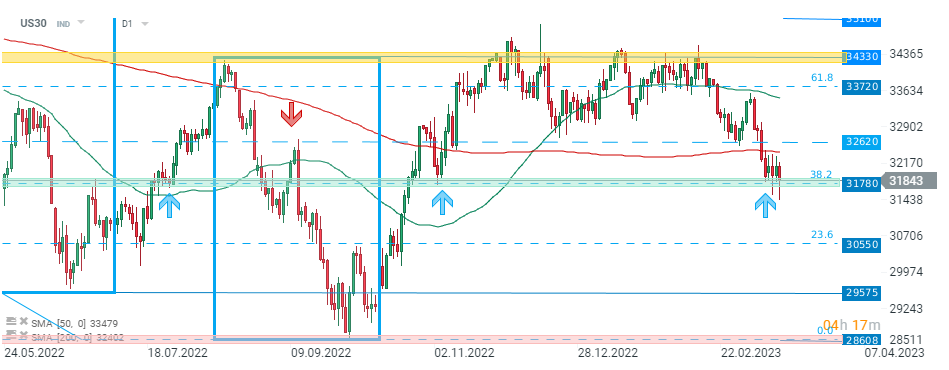

Despite negative sentiment US30 managed to climb back above 31780 pts mark, which coincides with 28.2% Fibonacci retracement of the downward wave started in January 2022. As long index sits above the aforementioned level, another upward move may be launched towards local resistance at 32620 pts. Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

Bitcoin loses the momentum again 📉Ethereum slides 5%