-

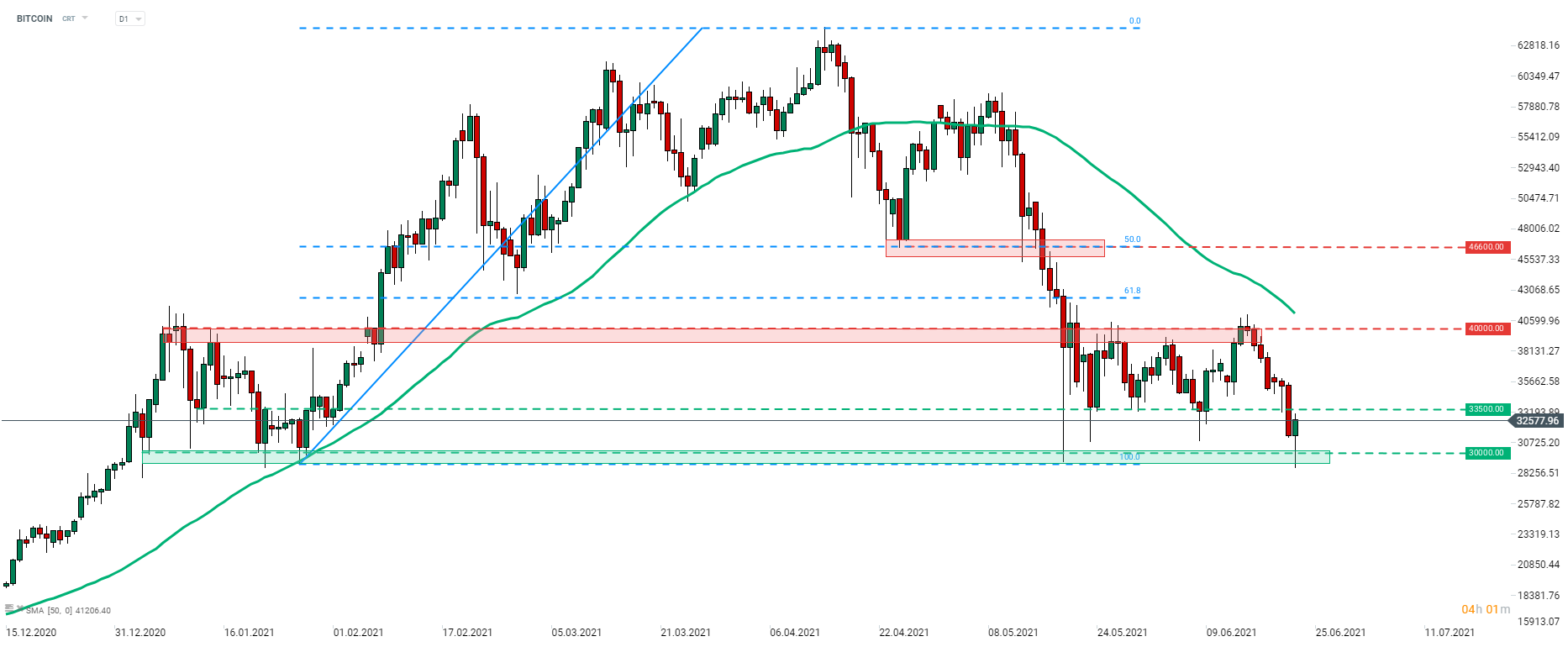

Bitcoin recovered above $32,000 after plunging below $30,000

-

Stocks in Europe and the United States advance

-

US dollar mixed against major peers

-

Fed members try not to move markets

-

US 10-year yields jump above 1.5% but drop back below later on

Equity markets in Europe launched Tuesday's trading lower and threatened to erase Monday's rally. However, moods began to improve later on and ultimately major benchmarks from the Old Continent managed to finish the day slightly higher. Similar situation could have been spotted on Wall Street, where major indices launched the day slightly lower but managed to recover later on.

There was a lot of action on the cryptocurrency market after China widened its clampdown on digital assets. PBOC reminded Chinese lenders and payments companies that offering cryptocurrency-related services is banned in the country. Bitcoin was trading below $30,000 mark at one point but began to regain ground later on. The major cryptocurrency is trading near $32,500 at press time.

Trading on the FX market has been rather calm. None of the major currencies experienced large moves. Japanese yen is the weakest among G10 currencies while SEK gains the most. HUF seesawed after Hungarian central bank delivered a 30 basis points rate hike, to 0.9%. Moreover, Hungarian central bank said that the rate-hike cycle has begun and interest rates may increase on a monthly basis from now on.

US dollar traded mixed against major peers. Speeches from 3 Fed members failed to move the greenback as central bankers were cautious not to cause too much market volatility after Bullard's latest comments. Fed Chair Powell is set to testify in Congress at 7:00 pm BST. However, the text of his speech was published earlier and it looks like he will not make any mention of near-term policy changes. 10-year US yields jumped above 1.5% in the morning but pulled back later on as moods on stock markets began to improve.

BITCOIN tested $29,000 area and traded at the lowest level since late-January 2021. However, cryptocurrency started to regain ground later on and now trades positive on the day in the $32,500 area. Source: xStation5

BITCOIN tested $29,000 area and traded at the lowest level since late-January 2021. However, cryptocurrency started to regain ground later on and now trades positive on the day in the $32,500 area. Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Bitcoin jumps above $70k USD despite stronger dollar📈

Daily summary: Markets capitulate under the influence of the Persian Gulf