Weak NFP lifted gold, but had limited impact on markets

Indices surge higher

CAD attempts to recover on data

The NFP date is always crucial for investors. Today markets were surging higher – both indices and the US dollar, ahead of the report. Indices were cutting off any Middle East concerns and the dollar was gaining in anticipation of a strong report after the outstanding ADP report on Wednesday (ADP is the alternative measure of private employment). The NFP was a disappointment though. The report showed a deceleration of employment growth to 145k in December from 256k in November and wage growth slowed down to 2.9% y/y, potentially signaling cautious approach among companies.

However, market reaction was very benign. Precious metals recovered some ground, once again showing that long-term traders could be using correction to re-enter the markets, but indices barely moved. US500 is more than 100 points above weekly lows (after the Iranian strike) and could see another record close today. Here investors are already looking forward to the next week, when a signing of the PhaseOne deal is expected and the Q4 earnings season begins.

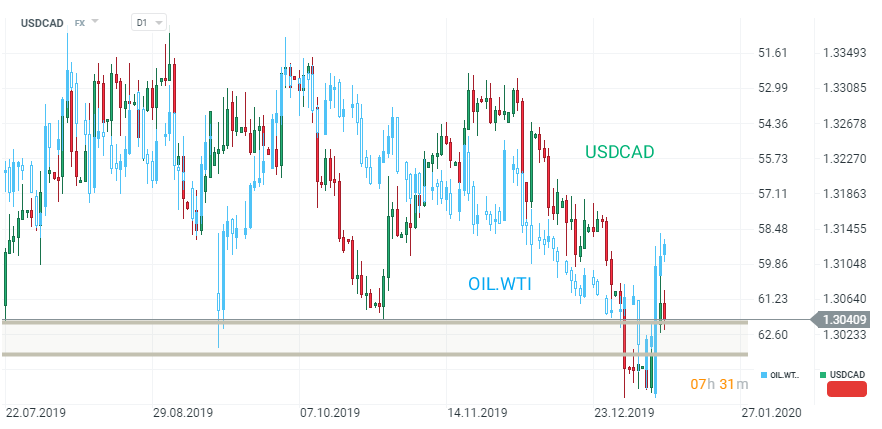

The report was clearly negative for the US dollar but reactions were moderate. Even the Canadian dollar is struggling to gain despite a very strong local NFP (the unemployment rate declined from 5.9 to 5.6% and employment gain was above expectations) as OIL and OIL.WTI continue moving lower.

USDCAD is trying to end upwards correction after a strong report but much will depend on oil prices going forward. Source: xStation5

USDCAD is trying to end upwards correction after a strong report but much will depend on oil prices going forward. Source: xStation5

The UK parliament accepted the divorce bill but such outcome was broadly anticipated and had little impact on the GBP.

Finally, we’ve seen some life on the crypto currency market and this despite abating geopolitical concerns. Worth mentioning are BitcoinCash (+9.5%) and Litecoin (+7.7%). The former trades at the highest level since mid-November,

Daily Summary: Middle East Sparks Oil Market

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

US Open: Oil too expensive for Wall Street!

Further cracks in the private credit market: BlackRock limits withdrawals