- Mixed session in Europe

- DE30 reached fresh ATH

- Wall Street higher on upbeat data

- EURUSD under selling pressure

The US dollar completely dominated the forex market during Tuesday's session, and is one of the best performing major currencies besides GBP. The dollar gained the most against NZD, where the move reached 0.7%. In turn, the AUD and CHF fell around 0.5% while CAD and JPY lost approx. 0.4%. EURUSD pair extended downward movement and is approaching 1.1300 level after ECB President Lagarde announced that factors pushing prices higher would fade next year, and that policy action to curb inflation would do more harm than good.

Indices from Europe finished today’s session in mixed moods. However, it is worth mentioning that the DE30 index managed to break above 16,200 pts and set a new all-time high. Meanwhile, upbeat sentiment prevails on Wall Street, where all three major indices are trading in green and the S&P 500 approaches record level following better-than-expected retail sales and industrial production data for October and solid quarterly results from major retailers. Walmart posted strong revenues and earnings in Q3 while raising its forecast for the year. Home Deport figures also surprised on the upside, adding to evidence that consumer spending remains resilient.

As for the commodity market, gold started the day with gains, but the second part of the session is controlled by sellers partially because of the stronger dollar (although the correlation with the USD has weakened recently). Looking at the D1 interval, bearish candlestick pattern - shooting star is building up. In turn, on the oil market we could observe mixed sentiment recently. The International Energy Agency said in its monthly report the oil market rally may ease off as high prices could provide a strong incentive to boost production, particularly in the US. Last week, OPEC cut its world oil demand outlook for the fourth quarter by 330,000 barrels per day from the previous month’s forecast, as higher energy prices dampened demand return. Also, some governments in Europe are re-imposing lockdowns due to a surge in Covid-19 infections, while China is battling the spread of its biggest outbreak caused by the Delta variant. In the evening, the price of WTI fell below $81.00, while the Brent price rose above $82.40.

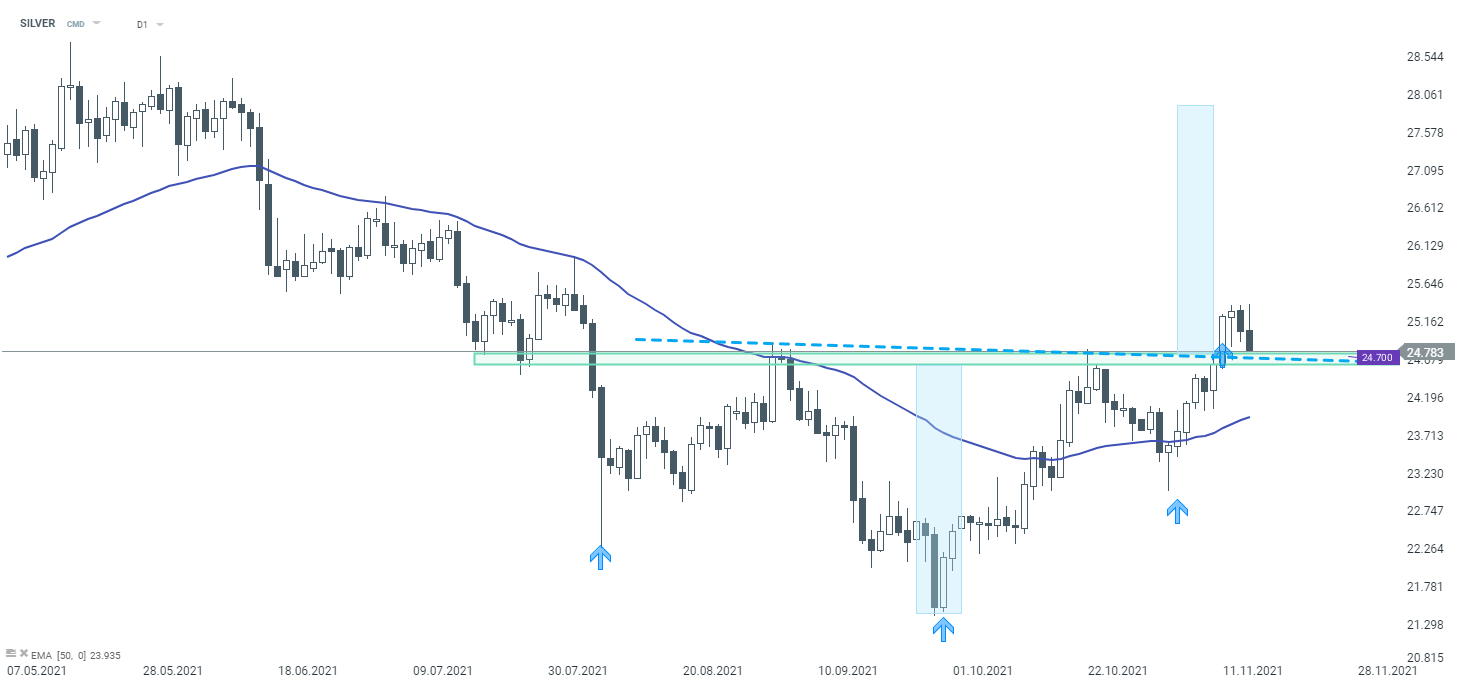

SILVER - last week, the price of silver broke above the key resistance zone at $ 24.7, which, according to the classic technical analysis, could indicate a trend reversal. The aforementioned zone coincides with the neck line of the inverted head and shoulders formation. Currently we can observe a strong pullback, but if buyers manage to halt declines at $ 24.7 area, then another upward impulse may be launched. On the other hand, should the break below occur, downward move may accelerate. Source: xStation5

SILVER - last week, the price of silver broke above the key resistance zone at $ 24.7, which, according to the classic technical analysis, could indicate a trend reversal. The aforementioned zone coincides with the neck line of the inverted head and shoulders formation. Currently we can observe a strong pullback, but if buyers manage to halt declines at $ 24.7 area, then another upward impulse may be launched. On the other hand, should the break below occur, downward move may accelerate. Source: xStation5

BREAKING: EIA gas inventories change slightly above expectations

BREAKING: Germany's CPI above expectations! 💶🔥

Breaking: Update on Soybean - China to Buy 12 mt Soy This Year

Chart of the day - Soybean (30.10.2025)