- The dollar is the weakest among the major currencies

- Rebound in the stock market

- Higher prices of precious metals

- Cryptocurrencies under pressure

While Mondays usually do not bring much volatility, there was quite a lot going on in the market today. The dollar appreciated in the second half of the previous week and today we saw a strong correction move. At the end of the day, the US currency is losing almost 1% against the pound and the New Zealand dollar. AUD and CAD gain around 0.8%, while EUR and CHF are trading around 0.5% higher against the US currency. Only the Japanese yen lags behind.

As for the precious metals market, today we saw an upward movement, which can be explained by the weakness of the dollar. At the end of the day, gold is trading 1.2% higher, while silver is rising 0.9%. Palladium (4%) and platinum (1.8%) are also strong today.

Upbeat mood prevails on the stock market today. The main stock indices in Europe finished today's trading in green, the DAX returned above 15,600 points. Positive sentiment is also visible on the American market, where all major indices regained ground.

Meanwhile, the cryptocurrency market continued to decline. Bitcoin is listed today almost 9% lower, while the declines of Ethereum, Ripple and Litecoin exceed 13%. This is due to the recent actions of the Chinese authorities and further attempts to limit the presence of digital currencies in China. Possible restrictions and prohibitions may hit the entire cryptocurrency market.

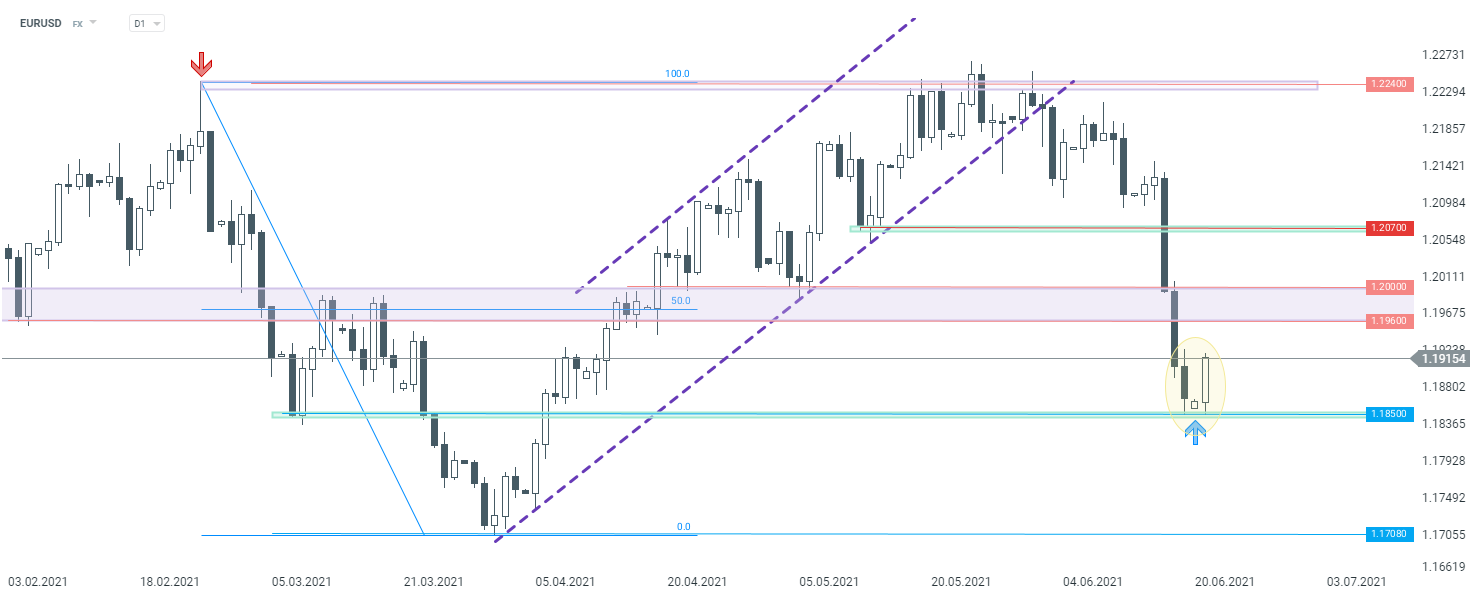

Looking from a technical point of view at the EURUSD chart on the D1 interval, it can be seen that the declines stopped near the support at 1.1850. If today's session ends at the current level or higher, then a bullish candlestick formation will form - the morning star. If the upward move continues then the zone at 1.1960-1.200 should act as the nearest major resistance. Source: xStation5

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS