Why is this reading important?

Retail sales are one of the key indicators of consumer health in the US, which accounts for most of the economic growth. The data, especially when excluding cars and fuel, allows for an assessment of the real strength of demand and the current pace of economic activity. Continued sales growth indicates consumer resilience despite high interest rates. From the Federal Reserve's perspective, this reading influences the assessment of demand pressure and expectations for future rate cuts, and for financial markets, it shapes the valuation of the dollar, bonds, and stocks and reduces concerns about a sharp economic slowdown.

Retail sales results for December

- Retail sales (m/m): actual 0% (forecast 0.4%; previous: 0.6%)

- Sales excluding cars (m/m): actual 0% (forecast 0.3%; previous: 0.5%)

- Sales excluding cars and fuel (m/m): actual 0% (previous: 0.4%)

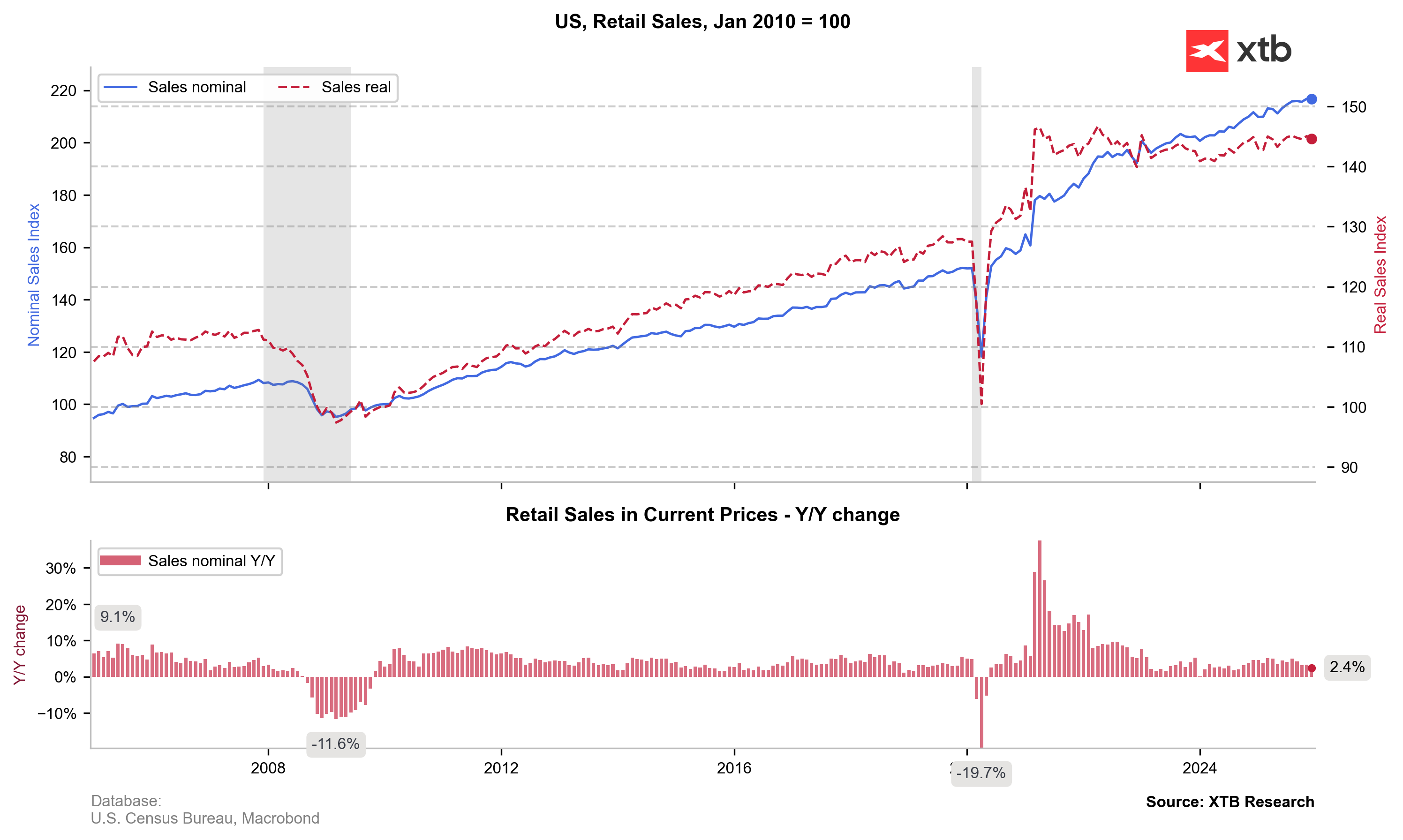

- Retail sales (y/y): actual 2,4% (previous 3.3%)

Source: XTB Research

Actual results

December US retail sales came in clearly weaker than market expectations. Headline retail sales were flat on a month-over-month basis, missing the 0.4% consensus forecast and slowing sharply from the previous 0.6% increase. Sales excluding autos also showed no growth, disappointing relative to expectations of a 0.3% rise and the prior 0.5% reading. More importantly, sales excluding autos and fuel stalled after a 0.4% increase in the previous month, pointing to a slowdown in underlying consumer demand. On a year-over-year basis, retail sales growth decelerated to 2.4% from 3.3%, confirming a loss of momentum in consumption toward year-end. Overall, the data suggest that tighter financial conditions are increasingly weighing on household spending and may reinforce market expectations for a more accommodative Fed policy stance in the coming months. As a result of this release, the US dollar weakened significantly, with falling Treasury yields and a clear reduction in the dollar’s rate advantage providing strong support for EUR/USD.

Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment