- European indices finished today's session in mixed moods, with the regional FTSE 100 down roughly 0.86% and the DAX 40 up 0.35% ahead of tomorrow’s highly anticipated ECB decision. Utilities climbed on reports that emergency measures to control spiking power prices are being considered by European officials.

-

US indexes erased early losses as bond yields eased. The Dow rose 0.90%, while the S&P 500 and the Nasdaq jumped 1.15% and 1.3% respectively following comments from several FED members.

-

Fed vice chair Brainard said that soft European and Chinese demand are disinflationary, however the central bank needs 'several months of low inflation readings' to gain confidence.

-

Fed Mester said it is far too soon to conclude that inflation has peaked while wage pressures show little sign of abating. Therefore, in her opinion, the US central bank needs to raise rates to 'somewhat above 4%' by early next year, then hold it there.

-

The Bank of Canada raised interest rates by 75 bps to 3.25%, in line with analysts’ estimates, pushing borrowing costs to the highest since 2008. Also, policymakers said interest rates will need to rise further given the outlook for inflation.

-

Oil prices fell to the lowest level since January 2022 as worries over lower global demand overshadowed warnings from President Putin about the potential withdrawal of all forms of Russian energy. Disappointing data from biggest importer China and renewed restrictions in several cities damped demand outlook.

-

Also EIA raised 2022 oil demand forecast by 20,000 bpd to +2.10mbpd y/y, however lowered 2023 demand growth by 90k bpd to 1.97 mbpd y/y

-

Gold jumped above $ 1715 per ounce, while silver approaches $18.40 level amid a weaker US dollar.

-

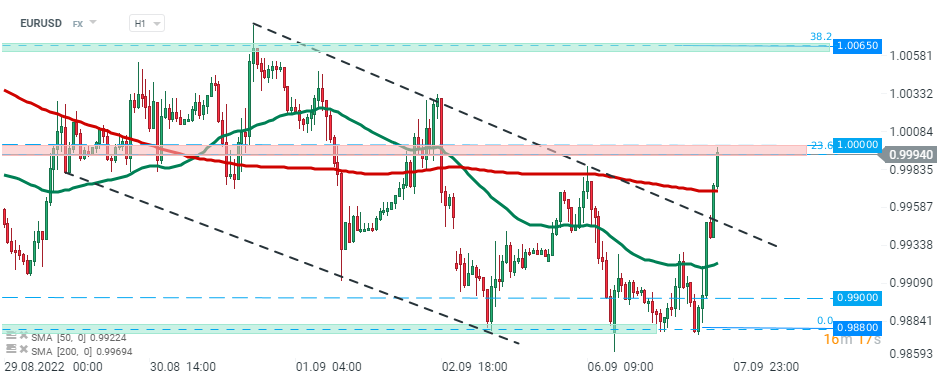

On the FX market the British Pound tested pandemic lows, while yen reached its lowest level since 1998. Euro briefly fell to the lowest level since 2002, however buyers became more active in the evening and EURUSD pair hit parity level. Currently EUR and CHF are the best performing major currencies while GBP and JPY lag the most.

-

Major cryptocurrencies are trading slightly lower. Bitcoin price hovers around $19.000, while Ethereum is testing $1550 level following Bellatrix's update.

EURUSD - buyers managed not only to defend key support around 0.9880, where recent lows are located, but also launched an impressive upward correction. Currently the most popular currency pair is testing parity level. Should a break higher occur, the next target for bulls can be found around 1.0065, which is marked with 38.2% Fibonacci retracement of the last downward wave. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉