- FED left monetary policy unchanged

- Oil price highest since mid-March

- President Biden's first address to Congress

European bourses finished today's choppy session mostly higher amid upbeat earnings from the banking sector. Deutsche Bank's net income came in well above analysts’ estimates, as it avoided the fallout from collapsed Archegos Capital. Lloyds Banking Group posted upbeat quarterly profits thanks to the release of bad loan provisions, and Santander recorded the biggest profit in a decade. On the data front, the GfK consumer climate in Germany unexpectedly declined in May.

US indices saw little reaction to the Fed's monetary policy however the dollar fell sharply. The Central Bank left interest rates and its monthly bond-buying program unchanged despite the improving economic outlook. The Fed believes that inflation rise largely reflects transitory factors and gives no clues about when it may begin tapering. On the earnings front, Apple and Facebook will provide their quarterly results after market close. Now investors will focus on President Biden's first speech to Congress as he is set to propose a $1.8 trillion plan aimed at families and tax hikes for the wealthiest Americans.

WTI crude rose more than 1.2% and is trading around $63.80 a barrel, while Brent is trading 1.0% higher around $67.00 a barrel after a recent EIA report showed a smaller-than-expected increase in US stockpiles last week. Elsewhere gold rose 0.25% to $ 1,781.00 / oz, while silver is trading flat, around $ 26.00 / oz.

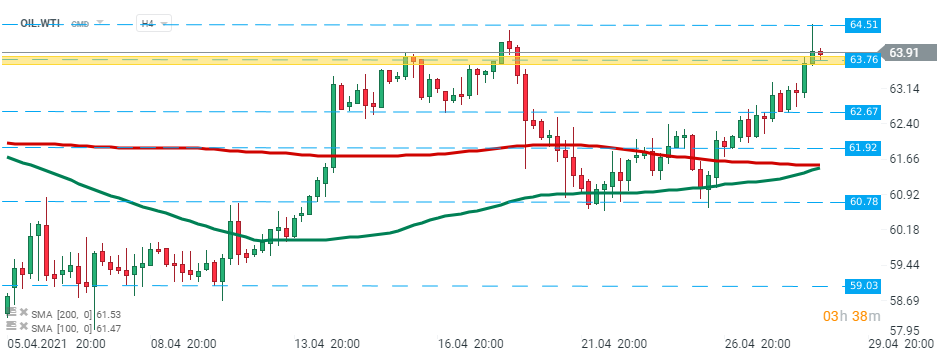

WTI Oil (OIL.WTI) price rose sharply after the publication of today’s EIA report and reached $64.51 which is a level not seen since mid-March. However buyers failed to uphold momentum and price pulled back to the local support at $63.76. Should beak lower occur, then downward move may accelerate towards $62.67. On the other hand, if buyers will manage to halt declines here, then another upward impulse towards aforementioned resistance at $64.51 could be launched. Source: xStation5

WTI Oil (OIL.WTI) price rose sharply after the publication of today’s EIA report and reached $64.51 which is a level not seen since mid-March. However buyers failed to uphold momentum and price pulled back to the local support at $63.76. Should beak lower occur, then downward move may accelerate towards $62.67. On the other hand, if buyers will manage to halt declines here, then another upward impulse towards aforementioned resistance at $64.51 could be launched. Source: xStation5

GBPUSD pair rose sharply during the FED Chair Powell conference and broke above resistance at 1.3918. Source: xStation5

GBPUSD pair rose sharply during the FED Chair Powell conference and broke above resistance at 1.3918. Source: xStation5

Morning Wrap - Oil price is still elevated (07.03.2026)

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz