• US President signed executive orders on coronavirus relief

• China announced sanctions against 11 US politicians and heads of organizations

• Oil higher as Saudi Aramco’s sees higher demand prospects

European indices finished first session of the week slightly higher as investors welcomed further stimulus from the US President Trump and better-than-expected inflation data from China which raised hopes of an economic recovery in the world's second-largest economy. During today’s session DAX finished flat, while CAC 40 and FTSE 100 both added 0.3%.

US indices are trading mixed, with the Dow Jones rising 1% , S&P 500 swinging between small gains and losses, Nasdaq losing 0.8%. Over the weekend President Trump signed four executive orders to pause the collection of payroll taxes, provide help on rent, assist with student-loan payments and extend unemployment benefits as US lawmakers failed to reach an agreement on a new aid package. Today both House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin said they were willing to resume talks. Meanwhile geopolitical tensions continue to rise. Beijing said it would impose sanctions on a group of senior politicians in retaliation of last week's US sanctions on Hong Kong and Chinese top officials.

Oil is trading higher on Monday after Saudi Aramco Chief Executive Amin Nasser said that he sees a rebound in oil demand in Asia as more economies gradually reopen after lockdowns due to the pandemic and despite a resurgence of cases in some places. Meanwhile, Iraq announced on Friday that will reduce its oil production by a further 400,000 barrels per day in August and September in order to compensate for its overproduction in the past three months. WTI futures rose 2% to $42 a barrel and the Brent crude added 1.5% at $45 a barrel.

Gold is trading flat around $2,038 per ounce. Last week precious metal hit all-time high of $2,075, as investors rushed for safe-haven assets due to spike in coronavirus cases, stimulus from major central banks and concerns about inflation. Meanwhile silver rally continues despite the rebound of the U.S. dollar. Currently silver is approaching resistance located at $29.00 per ounce.

Economic calendar for Tuesday does not seem to be particularly interesting. Labour figures from the UK and ZEW Economic Sentiment Index are the key releases scheduled for European session, while US PPI figures and API Crude Oil Stock Change report will be on watch during US trading hours.

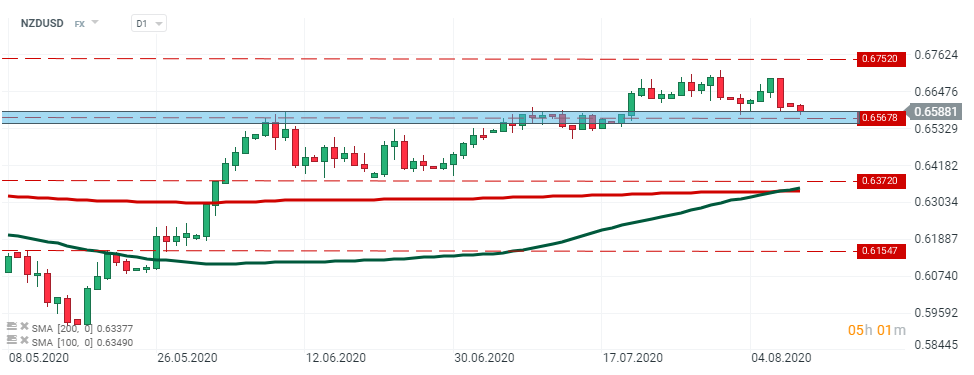

NZDUSD - currency pair is approaching major support at 0.6567. If sellers manage to break below it, an downward impulse towards 0.6372 could be launched. However if buyers manage to halt declines here, an upward move into 0.6752 is possible. Source: xStation5

NZDUSD - currency pair is approaching major support at 0.6567. If sellers manage to break below it, an downward impulse towards 0.6372 could be launched. However if buyers manage to halt declines here, an upward move into 0.6752 is possible. Source: xStation5

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report