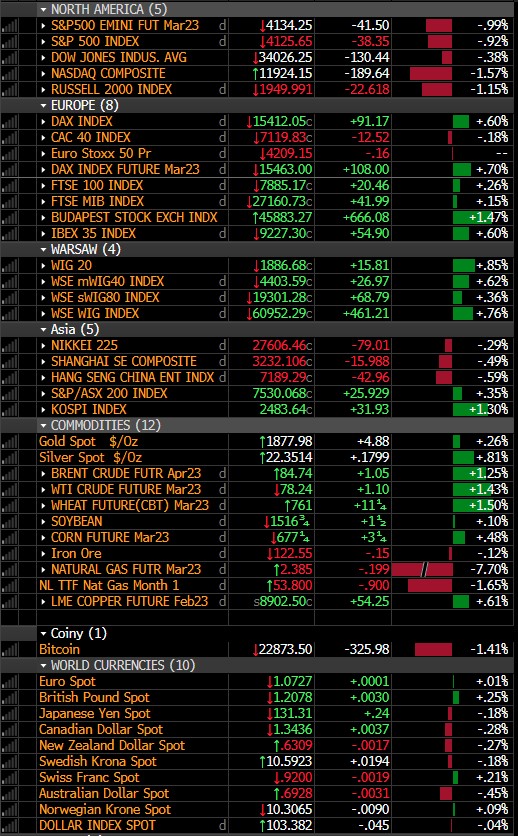

Wednesday's session on the Old Continent ended in a good mood, with the main stock market benchmarks posting gains. Germany's DAX gained 0.6% and the UK's FTSE 100 gained 0.26% and held at historic highs.

Stocks on Wall Street fared much worse, subject to pressure imposed by comments from Fed bankers. Both Williams, Cook, Waller and Kashkari have communicated that the FED needs to maintain a restrictive monetary policy for an extended period of time and that rates could be raised to levels not priced in by the market. The Nasdaq 100 index is currently losing 1.5% and the S&P500 is down nearly 1%.

Alphabet (GOOGL.US) shares lost sharply in value after a question was misinterpreted by the company's AI messaging service BARD, which the company was developing to show off at a conference in Paris.

On the forex market, the British pound and the Swiss franc are currently performing best. The Australian dollar and the New Zealand dollar are recording sizable declines.

The DOE report showed an increase in oil stocks, but the strong increase in gasoline stocks is particularly surprising. Interestingly, oil throughput was high, but despite this, stocks of the basic commodity rose anyway.

Precious metals are recording gains today. Gold breaks out above the $1,875 level.

Natural gas extends dynamic declines, losing more than 7.5% today. Nevertheless, speculative players are increasing their exposure to the market quite a bit, even with high production and favorable weather, which may suggest some changes in the market.

The crypto market is seeing a deterioration in investor sentiment today. Bitcoin is currently trading close to 1.5 per cent down and falling below the $23,000 barrier.

Source: Bloomberg

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Arista Networks closes 2025 with record results!

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure