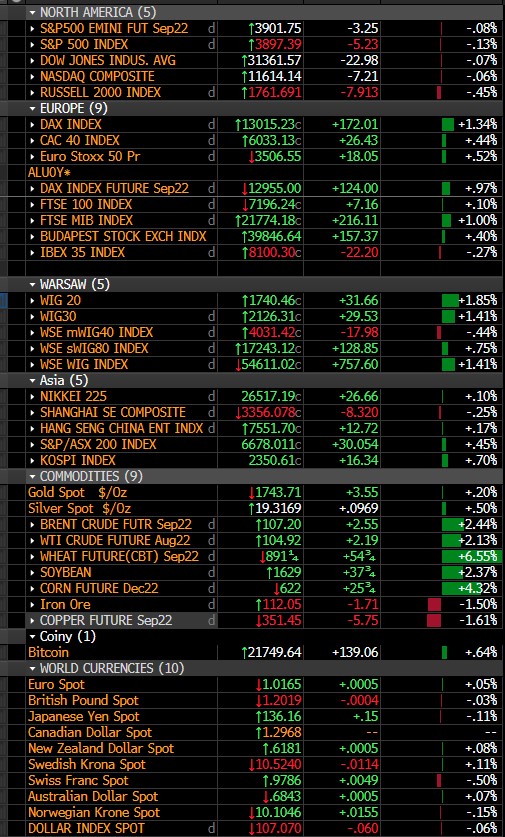

Stock markets on the Old Continent finished today's trading higher. DE30 gained 1.34%, UK100 posted 0.1% gains, and FRA40 gained 0.44%.

Good data from the U.S. labor market put pressure on the valuation of U.S. stocks, which are worried about the specter of aggressive monetary tightening by the Fed. At the time of writing, Wall Street indexes are trading at moderate lows. The US100 is trading down 0.24%, the US500 is losing 0.23%. The worst performing index is the US2000, which is down 0.51%.

The US economy unexpectedly added 372k jobs in June, compared to 390k increase in May and well above market expectations of 270k. Figures came in line with the average monthly gain of 383K over the prior 3 months, still pointing to a tight labor market. Notable job growth occurred in professional and business services, leisure and hospitality, and health care. The jobless rate remained unchanged at 3.6%, in line with market estimates. Closely watched wage growth fell to 5.10% YoY, from an upwardly revised 5.3% increase in May, above analysts expectations of a 5.0% YoY. The data gives the green light for a 75bp hike in July, which is more than 90% priced in by the market at this point.

The EURUSD pair fell almost to parity today. The ECB decision is still almost 2 weeks away, but the market may begin to look for the prospect of a recovery in the near term, although the energy situation in Europe remains tense

Oil prices have rebounded noticeably, which is still linked to tight fundamentals, but also to a recovery in commodity markets. Large gains are recorded in wheat (+6.5%) or corn (+3.1%), among others. Palladium prices are up 8% today.

The cryptocurrency market is seeing mixed levels today. Bitcoin gains 0.5%, while Ethereum loses nearly 1%. The big gainers are Polygon, which gains 5.4%.

The passing week is likely to bring a sizable rebound in the world's major stock markets, even though the specter of a recession remains in play. Many have indicated that a recession would cause a backlash against major interest rate hikes, particularly from the Fed. However, today's labor market data changes that outlook, as it gives the green light for more hikes. Next week will show us inflation from the U.S., which will definitely give over the answer of what we should expect from the Fed. For the moment, stock markets are slightly stronger, cryptocurrencies have recovered a lot of losses, and the dollar can still count on parity against the euro.

Source: Bloomberg

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉