-

Europe closes mostly in the red, US markets try to recover

-

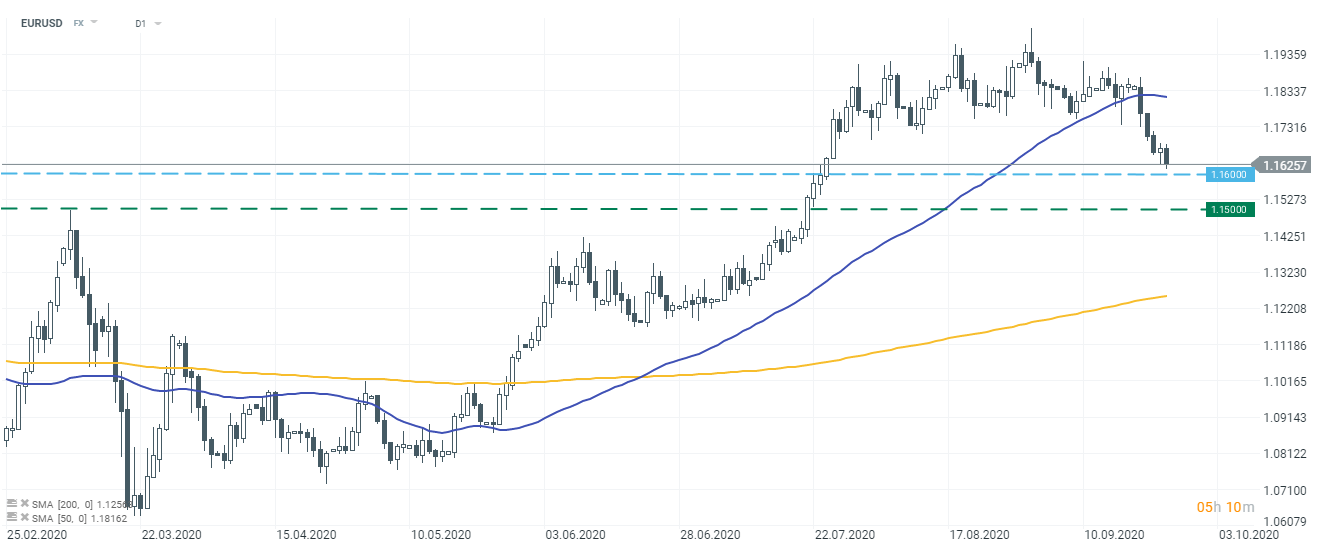

EURUSD approaching the 1,16 mark

-

U.S. durable goods orders below market consensus

European markets closed mostly below the flatline on Friday as investors remain concerned about rising COVID-19 cases on the Old Continent. DAX fell 1.09% while CAC 40 finished the day 0.69% lower. FTSE 100 managed to gain 0.34%. U.S markets opened mostly lower as well, yet American equities try to rebound. Nasdaq is adding almost 1.30% while S&P 500 is advancing 0.65%.

Precious metals are trading lower as both gold and silver are falling almost 1%. Oil prices tend to fall as well, but WTI is still slightly above $40 a barrel. U.S. dollar remains strong compared to the euro and the main currency pair is slowly approaching the 1,16 mark.

As far as economic calendar is concerned, today’s most important data came from the U.S. - durable goods orders in August came in below expectations (0.4% MoM vs exp. 1.5%). Still, last month’s figures were revised higher. Markets are still to witness Baker Hughes oil rig count in the evening which might be particularly relevant for oil traders.

Monday will not bring many crucial macro data. Sweden and Norway will release their retail sales report for the month of August while the ECB’s President Lagarde is expected to speak in the afternoon. Investors will most likely focus on the newsflow and coronavirus updates from Europe.

Following recent strength of U.S. dollar, the main currency pair got close to the 1,16 barrier which might become the nearest support level. The dollar remains extremely strong compared to other currencies as well. Source: xStation5

Following recent strength of U.S. dollar, the main currency pair got close to the 1,16 barrier which might become the nearest support level. The dollar remains extremely strong compared to other currencies as well. Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street