- UK eases COVID-19 related restrictions

- Dow Jones hits new ATH, but S&P and Nasdaq under pressure

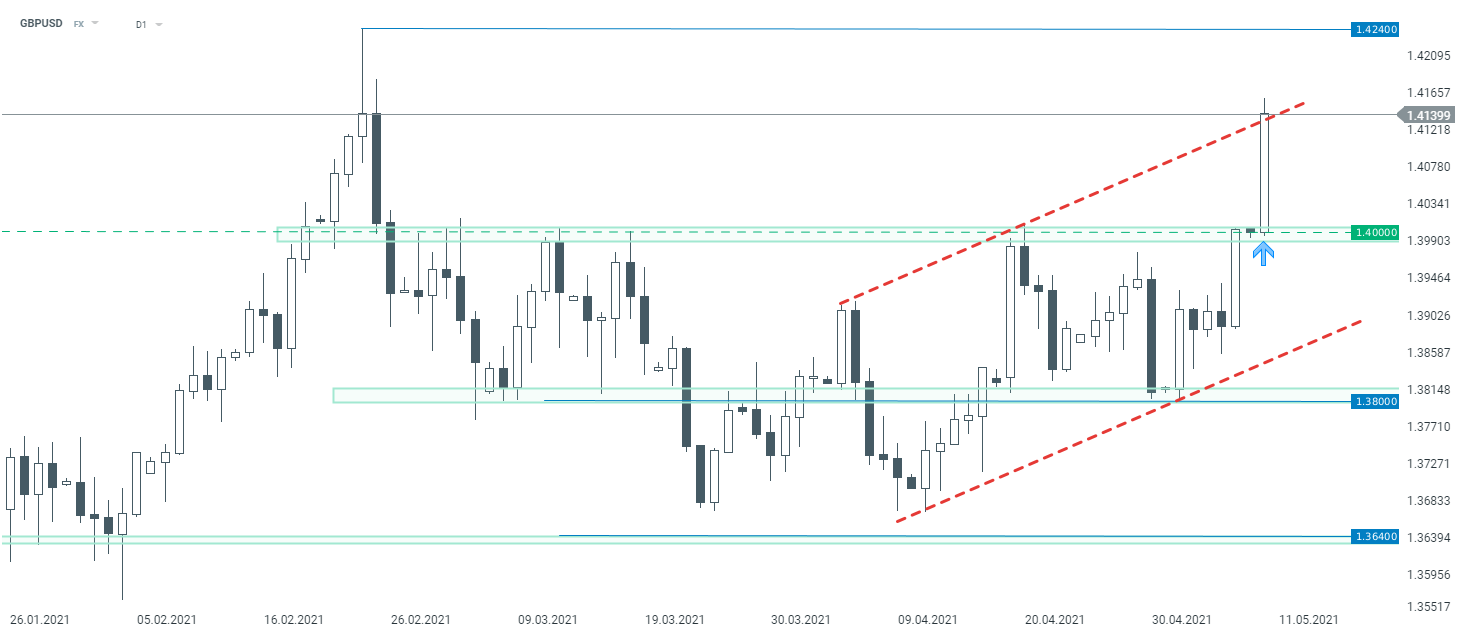

- Pound rallies over $1.40

European indices finished today's session flat, near their record highs as the market continues to benefit from the upward momentum seen last week. ECB Chief Economist Philip Lane told a French newspaper that the central bank could still increase bond purchases at its June meeting if such a move is needed to keep borrowing conditions favored. Meanwhile Scottish Nationalist Party did not manage to secure a majority in the new Scottish Parliament, but there is still a chance for another referendum on independence. British pound surged after Prime Minister Boris Johnson announced the next phase of reopening from the COVID-19 lockdown, with the ban on international travel being lifted and indoor hospitality resuming on May 17th. Dax rose 0.02%, CAC40 finished flat and FTSE100 fell 0.08%.

The Dow Jones extended recent gains as miners and energy stocks led gains after a major US fuel pipeline network on the East Coast was shut down following a cyberattack. Meanwhile S&P 500 and the Nasdaq came under pressure, dragged by tech stocks lower as investors worried that rising commodity prices and supply chain issues could negatively affect future earnings.

Both WTI crude and Brent rose 0.1% and are trading respectively at $64.95 a barrel and around $68.34 a barrel. Elsewhere gold rose to $1845/oz early in the session, the highest level since February, however buyers failed to uphold momentum and price pulled back to $1,836.00 / oz, while silver is trading flat, around $ 27.40 / oz amid weaker dollar and higher Treasury yields which rose to 1.60%.

When it comes to the forex market, the British pound is undoubtedly the star of the session, gaining more than 1% against the US dollar. The upward movement accelerated after the break of the resistance at 1.40. Currently, the GBPUSD pair has reached another resistance resulting from the upper limit of the upward channel, which may lead to a local correction. However, if buyers manage to maintain the current momentum, an attack on the February summits cannot be ruled out.

GBPUSD D1, interval. Source: xStation5

GBPUSD D1, interval. Source: xStation5

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS