- Data from the US labour market was the key event of the day. NFP report surprised positively, the number of jobs significantly exceeded market expectations and now investors expect more hawkish FED.

-

Following today's data, the third consecutive interest rate hike of 75 bp became the baseline scenario. At the same time Bank of America expects that most central banks by the end of this year or early next year will bring some form of forward guidance back.

-

Shortly after the data release, we could observe a dynamic reaction on the market - risky assets took a hit, while USD strengthened.

-

Despite the initial dynamic downward reaction, the EURUSD, the pair failed to break below the support zone at 1.0120-1.0140, and continued to move sideways.

-

Nevertheless buyers on Wall Street became more active in the evening and major bourses managed to erase the majority of the losses. Now markets attention shifts to next week's US CPI report

-

The main European stock indices closed the day lower, although downward move was limited. DAX fell 0.65% and the London FTSE100 lost just 0.11%. In Europe, data showed the German and French industrial output unexpectedly rose in June.

-

Brent crude erased early losses and is trading above $95.00 per barrel, while WTI managed to defend key support at $88.00 per barrel but still is heading for an over 9% weekly loss, wiping out all the gains triggered by Russia’s invasion of Ukraine.

-

Precious metals pulled back from recent highs following NFP release. Gold trades around $1775 per ounce, while silver fell below $20.00 per ounce amid a stronger dollar.

-

Currently USD and CAD are the best performing major currencies while NZD and CAD lag the most.

-

Despite downbeat sentiment, major cryptocurrencies are trading slightly higher. Bitcoin trades around $23.000 level, while Ethereum rose to $1670.

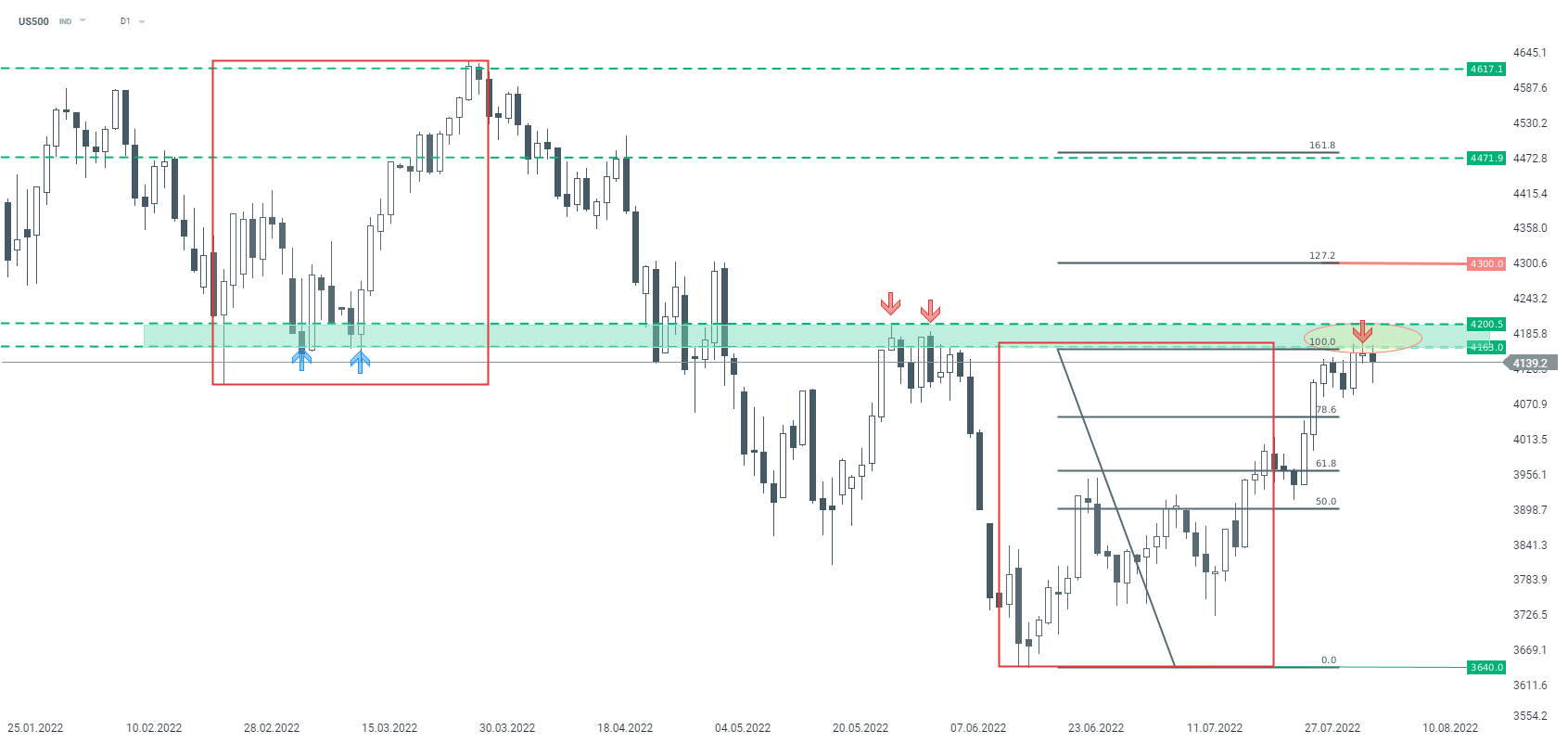

US500 dynamically retreated right after the publication of the NFP report, however buyers became more active later in the session. When looking at the D1 interval, one can notice that a candle with a long lower wick is forming, which could lead to another attack on the key resistance zone around 4,160-4,200 pts. However, as long as the index sits below, resumption of the downward trend is still possible. Source: xStation5

US500 dynamically retreated right after the publication of the NFP report, however buyers became more active later in the session. When looking at the D1 interval, one can notice that a candle with a long lower wick is forming, which could lead to another attack on the key resistance zone around 4,160-4,200 pts. However, as long as the index sits below, resumption of the downward trend is still possible. Source: xStation5

Three markets to watch next week (20.02.2026)

BREAKING: TRUMP’S GLOBAL TARIFFS STRUCK DOWN BY US SUPREME COURT 🚨🏛️

Market Wrap: Europe is back to green 🇪🇺 📈 Business activity finally accelerating ❓

BREAKING: European flash PMIs stronger than expected 📈EURUSD ticks higher