- The end of today's session brought a lot of turmoil to the markets after reports of possible changes to Japan's yield control program.

- In the wake of these announcements, the USDJPY pair fell sharply below the psychological barrier of 140.00. Moreover, the announcement almost significantly negated the day's rallies on US Wall Street.

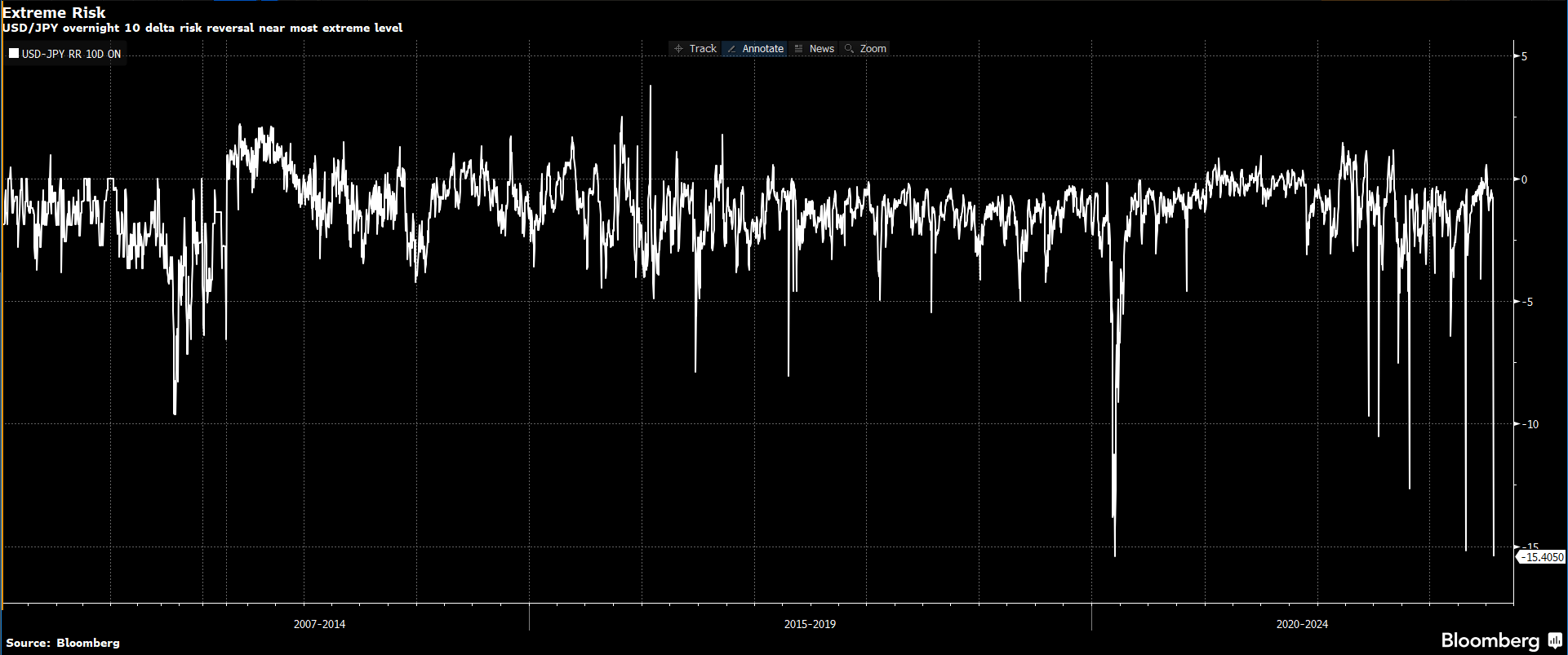

- Quite a lot of confusion is also observed in the options market, where positioning to hedge against a sharp decline in the USDJPY pair reached almost the highest values in 15 years.

- Tomorrow's BoJ meeting is expected to discuss programmatically allowing yields to rise above the 0.50% limit by a certain degree.

- At the moment, the best performing currency in the FX market is the Japanese yen, and the worst performing is the British pound.

- Indexes in Europe were euphoric today, with the DAX up 1.7% with the CAC40 rallying more than 2%.

- After the session, luxury goods giant Kering delivered a weaker-than-forecast Q2 report. After yesterday's surprise results from LVMH, investors are beginning to see opportunities for longer-term weakness in the fashion industry

- The ECB raised rates by 25 bps to 3,75% as expected, but during the press conference, President Christine Lagarde, despite her hawkish narrative, did not rule out a pause in the cycle and indicated that the bank would respond to data. This supported market sentiments and EURUSD weakened;

- The money market now assumes (after Lagarde's initial comments) that the ECB will raise rates by 25 bps at its September meeting with a probability of just under 40%.

- The strength of the US dollar resulting from Lagarde's dovish comments and strong macro data lifted gold prices below the psychological barrier of $1,950

- The macro data package from the US turned out to be much better than expected, which ultimately supported sentiment on the indices. S&P500 gains 0.2% at 0.8% - some of the gains were erased by reports from the Bank of Japan

- U.S. unemployment claims indicated 221,000 with 235,000 forecast and 228,000 previously. Continuing claims unexpectedly fell from 1.75 million to 1.69 million

- Durable Goods Orders surprised sharply upward, rising 4.7% m/m with an expected increase of 0.6% and 1.8% previously. Orders excluding transportation equipment also beat expectations by 0.5% m/m

- Annualized GDP reading indicated 2.4% vs. 1.7% forecast and 2% previously with core PCE inflation 0.2% lower than forecast - reading indicated 3.8% vs. 4.9% k/k previously

- US natural gas inventories data came in above expectations. Current: +16 bcf. Expected change: +14 bcf. Previous: +41 bcf

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Arista Networks closes 2025 with record results!

Economic calendar: US CPI in the spotlight (13.02.2026)

Morning Wrap: Global sell-off in the technology sector (13.02.2026)