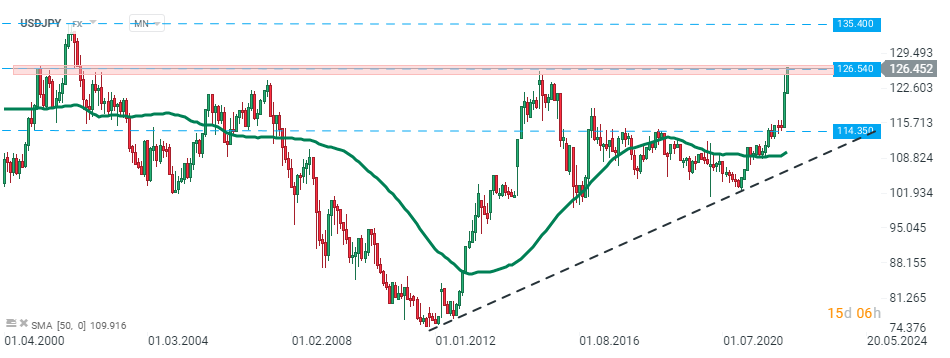

During today's session we observed limited volatility due to the fact that most of the market was closed due to Easter holidays. The stock and commodity markets were largely closed today, while the operating forex and crypto markets saw limited price action. The only exceptions were the USDJPY currency pair which continues to climb higher and reached a level not seen since May 2002 and Ripple which at one point gained 10.0% after CEO Brad Garlinghouse told attendees of the Paris Blockchain Week that the ongoing case with the SEC is going exceedingly well. On the data front, US industrial production rose 0.9% from a month earlier in March, the same as in the previous month and above market expectations of a 0.4% gain. The New York Empire State Manufacturing Index jumped to 24.6 in April, rebounding from a 22-month low of -11.8 in March, and easily beating market forecasts of 0.5. Next week investors will focus on flash PMIs from Europe and CPI data from Canada. Last but not least, traders will get some financial reports from major US tech companies.

USDJPY pair continued its upward rally and reached its highest level since May 2002. Source: xStation5

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks