- Netflix (NFLX.US) puts pressure on tech stocks

- Nasdaq again entered correction territory

- Bitcoin dropped below $40,000

Although today's session is not over yet, this week can be considered the worst in several months. European equity markets closed deeply in the red, with DAX and the pan-European Stoxx 600 shedding about 2% each, dragged down by automakers and banks stocks. Energy stocks were also under pressure as crude prices fell from recent seven-year highs. The Nasdaq is on track for its worst week since October 2020. Tech heavy index fell more than 10% from the recent local highs, which means that we are dealing with a technical correction. In the case of the S&P 500, declines are slightly smaller, currently around 8%. The Dow Jones is doing a bit better, although the losses are significant as well. Nevertheless both indexes are likely to book a 3rd straight week of losses.

The performance of major indexes from around the world this month is very poor, even though we usually deal with the January effect. However, next week's Fed meeting may change a lot. There is a chance that indices may resume their recent upward trend, if Powell announces that the Fed will not change its policy so strongly. On the other hand, not much has changed in terms of inflation - it is still the highest in several dozen years.

The sell-off on Wall Street also negatively affects sentiment in other markets. Oil, gold, and cryptocurrencies are all under pressure today. For the second time this month, the price of Bitcoin has dropped below the psychological support of $ 40,000, reaching $ 37,700 in today's session. Digital assets joined the sell-off of tech stocks, as a result of which the total cryptocurrency market capitalization fell by more than 3% and now stands at around $ 1.81 trillion. As Cointelegraph reports, the option expiry on Friday, involving an open interest of nearly $ 600 million, was found to be the main culprit behind the volatility spark.

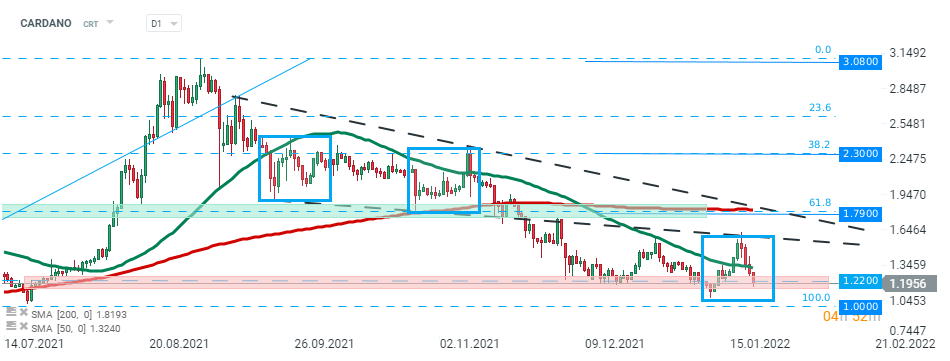

Cardano price launched the week in upbeat mood, however buyers failed to break above the upper limit of the 1:1 structure which coincides with the earlier broken lower limit of the triangle formation. As a result price pulled back sharply towards major support at 1.22. If sellers will manage to uphold downward pressure, then psychological support at $1.00 may be at risk. On the other hand, if bulls manage to halt declines, then another upward impulse towards recent highs may be launched. Source: xStation5

Cardano price launched the week in upbeat mood, however buyers failed to break above the upper limit of the 1:1 structure which coincides with the earlier broken lower limit of the triangle formation. As a result price pulled back sharply towards major support at 1.22. If sellers will manage to uphold downward pressure, then psychological support at $1.00 may be at risk. On the other hand, if bulls manage to halt declines, then another upward impulse towards recent highs may be launched. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉