- FOMC decided to keep rates unchanged in the 5.25-5.50% range. However, new set of forecasts turned out to be hawkish

- FOMC expects higher growth in 2023 and 2024 previously. While median rate forecast for end-2023 was left unchanged at 5.60% (one more 25 bp rate hike), forecast for 2024 was boosted from 4.6 to 5.1% (50 bp of rate cuts instead of 100 bp previously)

- Market reaction to FOMC decision and forecasts was hawkish - USD gained while stocks and gold dropped

- Wall Street indices are trading mixed - S&P 500 trades 0.3% lower, Nasdaq drops 0.6%, Russell 2000 trades flat and Dow Jones gains 0.3%

- European stock market indices finished today's trading higher - DAX gained 0.7%, FTSE 100 moved 0.9% higher, CAC40 jumped 0.7% and Dutch AEX traded 0.5% higher. Polish WIG20 was outperformer with 2.3% gain

- ECB Makhlouf said that in his opinion March 2024 is too early for a rate cut. Money markets currently see the first ECB rate cut by the end of Q2 2024

- UK Prime Minister Sunak said that he will not push for a ban on new Oil & Gas projects in the North Sea

- Bank of Canada minutes showed that further policy tightening remains an option given uncertain path of inflation

- EIA report showed a 2.14 million barrel drop in US oil inventories (exp. -2.5 mb) as well as 0.83 mb drop in gasoline inventories (exp. -0.2 mb) and 2.87 mb drop in distillate inventories (exp. -0.5 mb)

- UK headline CPI inflation decelerated from 6.8% to 6.7% YoY (exp. 7.0% YoY) while core CPI slowed from 6.9 to 6.2% YoY (exp. 6.8% YoY)

- Money markets now price in a less than 50% chance of Bank of England delivering a 25 basis point rate hike tomorrow, down from around 70% before CPI data release

- Japanese exports dropped 0.8% YoY in August (exp. -1.7% YoY) while imports were 17.8% YoY lower (exp. -19.4% YoY)

- Cryptocurrencies are trading mostly lower with Bitcoin and Dogecoin dropping 0.2%, Ethereum trading 0.8% lower and Litecoin plunging almost 4%

- Energy commodities are pulling back - oil drops 1.3% while US natural gas prices are down 3.5%

- AUD and USD are the best performing major currencies while GBP and JPY lag the most

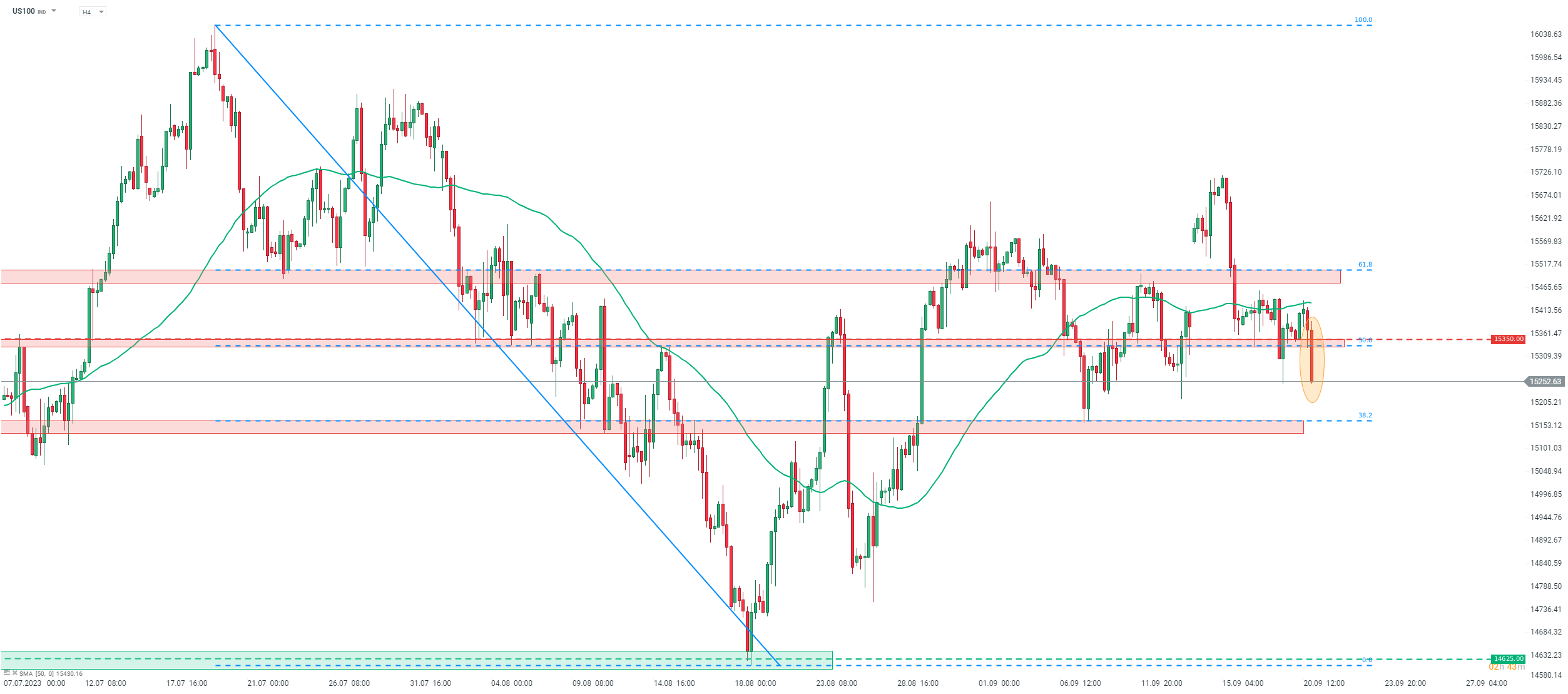

Hawkishness of Fed projections has triggered a sell-off in riskier assets like equities, especially tech shares. Nasdaq-100 futures (US100) are down 0.9% on the day and are testing daily lows. Source: xStation5

Hawkishness of Fed projections has triggered a sell-off in riskier assets like equities, especially tech shares. Nasdaq-100 futures (US100) are down 0.9% on the day and are testing daily lows. Source: xStation5

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales