-

Global stocks fall on new Covid-19 restrictions

-

U.S. Jobless claims highest since mid-August

-

EURUSD below the 1,17 mark

Global stock markets are under pressure of renewed virus-related restrictions in some European countries. Most indices from the Old Continent ended the day significantly lower. DAX plunged 2.49%, CAC 40 sank 2.11% while FTSE 100 lost 1.73%. U.S. markets opened lower as well, yet the scale of a pullback is not as serious as it was the case in Europe.

Gold prices fell below $1,900 mark today, but market bulls regained control in the afternoon. Silver prices are currently falling roughly 0.50% while oil prices remain above $40 a barrel barrier. The U.S. dollar strengthens against the euro, as a result EURUSD fell below 1,17 for a brief moment.

During today’s session investors might have felt disappointed with U.S. jobless claims report as the number hit highest level since mid-August (898k vs expected 825k). Still, continuing jobless claims fell to 10.018k, a figure better than anticipated. Philadelphia Fed Manufacturing Index turned out to be a positive surprise as well as the gauge rose in October to 32.3 (vs expected 14.0). As far as EIA’s data is concerned, crude oil inventories fell more than expected.

Tomorrow Japan and the euro zone will release their CPI figures for September. In the afternoon the U.S. will publish key retail sales report for the month of September, as well as industrial production data. One might also be interested in Michigan Consumer Sentiment.

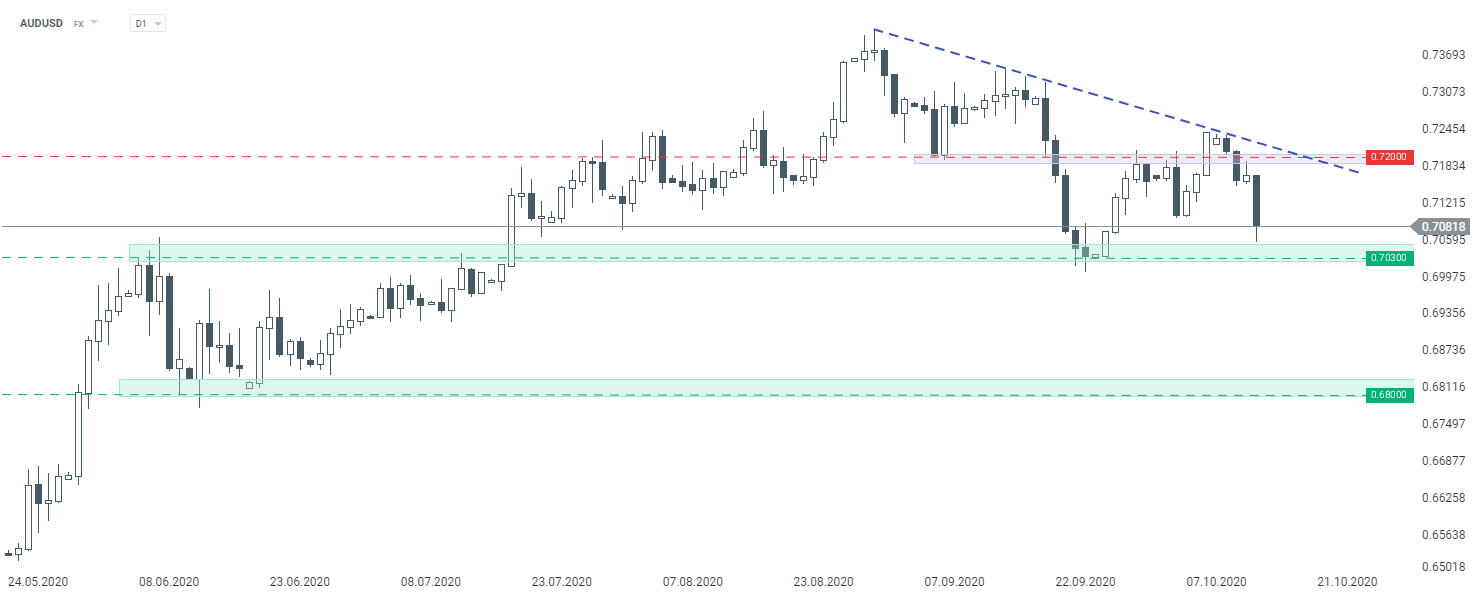

The Australian dollar drops over 1% against the U.S. dollar today. The currency pair returned below resistance area at 0.7200 and downward move accelerated afterwards. Should the price break below the support zone at 0.7030, the sell-off might deepen even towards 0.68 level. Source: xStation5

The Australian dollar drops over 1% against the U.S. dollar today. The currency pair returned below resistance area at 0.7200 and downward move accelerated afterwards. Should the price break below the support zone at 0.7030, the sell-off might deepen even towards 0.68 level. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

BREAKING: US jobless claims slightly higher than expected