- Nasdaq hit new record high

- Mixed session in Europe

- Strong US dollar

- Commodity prices fell sharply

Yesterday's Fed decision had a huge impact on many markets, and the effects of these events are also visible in today's trading. The moods on the European stock markets were mixed, although some indices managed to finish the day slightly positive - incl. German DAX (DE30), French CAC 40 (FRA40) or Dutch AEX (NED25). However, most stock markets in the region ended the day lower. Trade overseas is also mixed - tech companies are best performers, and the Nasdaq100 (US100) sets new records. In turn, the US30 and US2000 recorded declines, with the latter index reflecting small companies, fell by 1.50%.

During today's session we could observe further strengthening of the US dollar. The main currency pair tested 1.19 barrier today. The dollar appreciated against all major currencies except the Japanese yen. We also observe a very strong sell-off on the commodity markets - gold prices drop by over 4%, and silver is plunging by nearly 7%. Commodities are clearly not benefiting from strengthening of the dollar.

On the data front , US initial jobless claims rose to 412K, the first increase in 7 weeks and compared to forecasts of 360K. Today's decisions of three central banks did not surprise - Norges Bank, CBRT and SNB kept interest rates unchanged. The May reading of HICP inflation from the euro zone was in line with market expectations and reached 2.0% YoY.

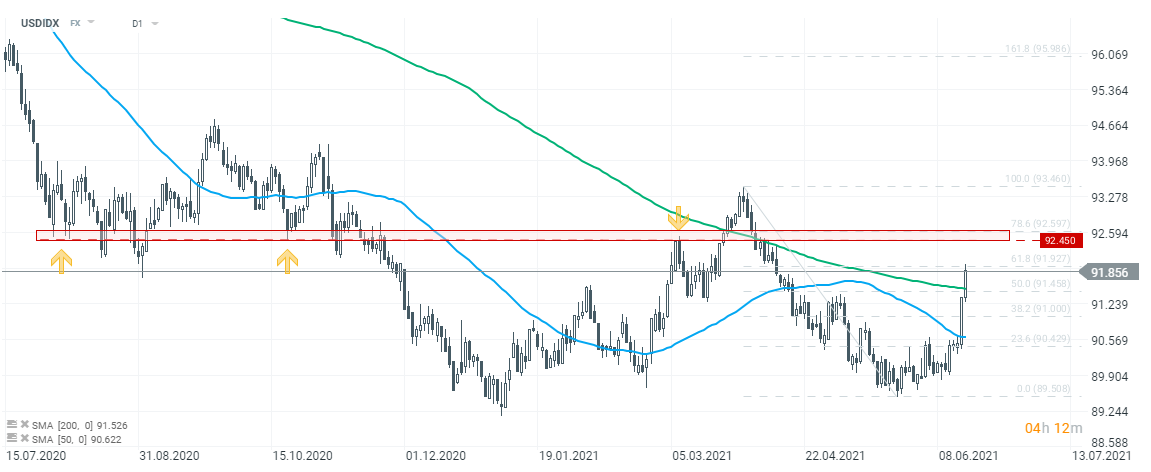

USDIDX - dollar index gained further ground on Thursday, breaking above the 92 mark for the first time since mid-April. If the current sentiment prevails and the index will manage to break above 61.8% Fibonacci retracement of the recent downward wave, then upward move may accelerate towards resistance at 92.45. On the other hand, if sellers manage to regain control then another downward move towards 200 SMA (green line) could be launched. Source: xStation5

USDIDX - dollar index gained further ground on Thursday, breaking above the 92 mark for the first time since mid-April. If the current sentiment prevails and the index will manage to break above 61.8% Fibonacci retracement of the recent downward wave, then upward move may accelerate towards resistance at 92.45. On the other hand, if sellers manage to regain control then another downward move towards 200 SMA (green line) could be launched. Source: xStation5

Three markets to watch next week (27.02.2026)

Daily summary: The beginning of the end of disinflation?

Wheat at its highest level in 8 months 📈

US Open: Rising oil and PPI pressure Wall Street 📉 Technology and financial stocks drop