- European stocks close flat

- US core CPI fell more than expected

- USD under pressure, precious metals are gaining

European indices finished today's session in mixed moods, with mining, banking and luxury goods sectors leading losers, while tech stocks rose. Frankfurt's DAX 30 rose 0.1% and Milan's FTSE MIB gained 0.4%. Meanwhile, London's FTSE 100 fell 0.5% and Paris' CAC 40 and Madrid's IBEX 35 lost 0.4% each.

US indices are trading lower as investors digested today's US CPI figures, which showed a smaller than expected increase in core consumer prices, which may be a sign that inflation in the US has reached a peak, although it may remain high for some time as supply constraints persist. Today's report has certainly brought relief to the Federal Reserve, which may delay plans to begin scaling back stimulus. However, comments from some economists suggest the central bank may still begin tapering its asset purchases in December.

Today’s inflation figures led to weakening of the US dollar. The EURUSD currency pair jumped to 1.1842 today, but has already erased some gains while the USDJPY pair reached its lowest level in two weeks. The yield on the benchmark 10-year Treasury note fell below 1.28%, the lowest since the end of August. The situation in the debt market and weaker dollar support gold, the price of the precious metal jumped above $ 1800 per ounce. WTI crude fell 0.2%, while Brent is trading 0.10% lower as investors balance worries over slowing demand recovery due to Covid-19 and signs of further supply disruptions as another storm could affect output in Texas this week.

Tomorrow, investors will face another intense day - important economic data will be published from China (e.g. industrial production and retail sales) and the USA (industrial production). European countries will release inflation data for August.

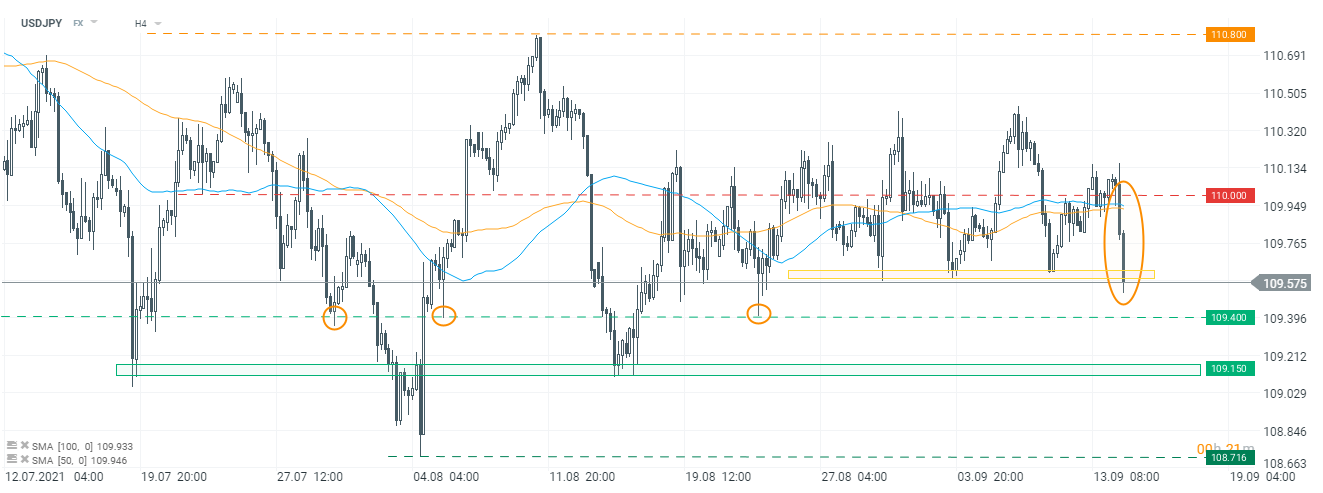

USDJPY pair fell below the recent local lows after the release of US inflation data. If the current sentiment prevails then downward move may be extended to the 109.40 handle or even support around 109.15. Source: xStation5

Daily Summary: Middle East Sparks Oil Market

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

Oil Under Pressure as G7 Decision Remains Pending

US Open: Oil too expensive for Wall Street!