-

Mixed session in Europe

-

Last trading day of 2020 in some countries

-

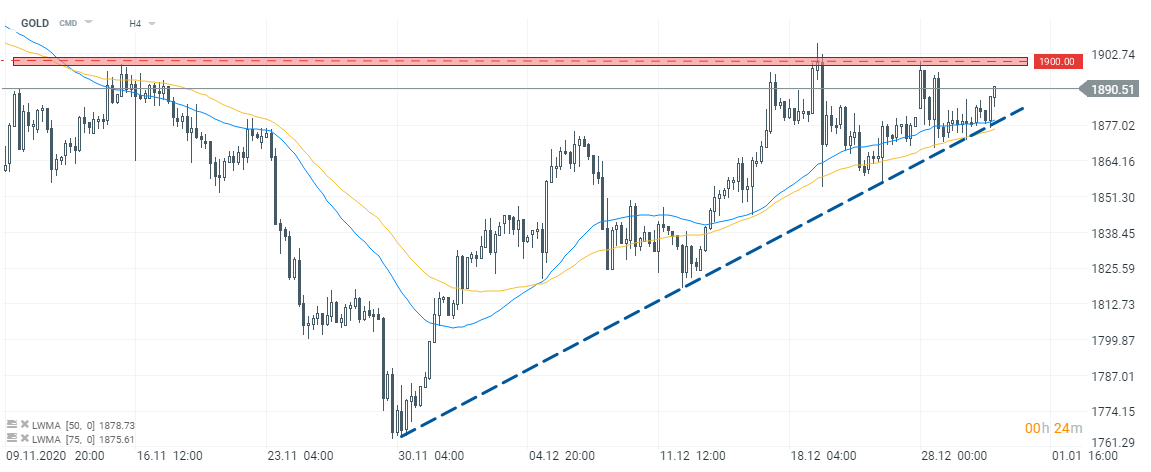

Gold approaching $1,900

Today’s session was the last trading day of the year for some stock exchanges. European indices finished the day mixed. The DAX lost 0.04%, CAC 40 dropped 0.20% while Euro Stoxx 50 gained 0.08%. Stocks in the United States push higher and Russell 2000 outperforms.

FTSE 100 may be found among today’s laggards as UK is set to impose tougher restrictions for millions of people. More regions will be placed into the toughest Tier 4 category as Covid-19 cases soar in the country. Meanwhile, UK lawmakers approved Brexit trade deal today and the agreement will be implemented on New Year’s Day.

Investors might spot some gains on precious metals markets today as gold prices has been approaching the $1,900 mark. Silver prices climbed above $26.60. Oil prices reached session highs following DOE’s oil inventories report, which showed that oil inventories declined more than anticipated. Chicago PMI for December came in above estimates (59.5 vs exp. 57.0).

Stock markets in some countries will be closed tomorrow (including Germany, Japan or Switzerland). Other exchanges will close earlier due to New Year’s Eve. As far as economic calendar is concerned, China will release its PMIs for December. Investors will also eye initial jobless claims from the US.

Gold climbed towards $1,890 and market bulls might eye critical $1,900 area again. Buyers were not able to smash through that barrier several times despite an upward impulse initiated a month ago. An upward trendline might serve as the nearest support. Source: xStation5

Gold climbed towards $1,890 and market bulls might eye critical $1,900 area again. Buyers were not able to smash through that barrier several times despite an upward impulse initiated a month ago. An upward trendline might serve as the nearest support. Source: xStation5

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report