-

European markets finish the day little-changed

-

Gold slowly approaching the $1900 mark

-

Portugal’s 10-year yield turns negative

Tuesday’s session on global stock markets was dominated by some mixed moods in the first part of the day. European indices were mostly falling, but somehow managed to cut losses and finished little-changed. DAX closed 0.06% higher, while FTSE 100 added 0.05%. CAC 40 fell 0.23%. American equities opened lower but at press time one might spot some minor gains on the US stock exchange with Russell 2000 outperforming its peers. S&P 500 climbed to fresh all-time highs at press time

Gold prices have been slowly approaching the $1900 mark, but silver lags behind today. EURUSD stays above 1.2100 level. Moves on oil markets are rather minor during today’s session. Some pointed out an interesting situation on bond markets as Portugal’s 10-year yield fell below 0% for the first time in history, which shows the impact of ECB’s monetary policy and its massive asset purchase programmes.

Today’s economic calendar was pretty light. Japan released revised 3Q GDP data, which turned out to be better-than-expected (5.3% QoQ vs expected 5.0% QoQ). ZEW headline index for December came in above expectations as well. Preliminary data for 3Q showed that euro area’s GDP rose 12.5% YoY (vs exp. 12.6%).

Tomorrow markets will pay attention to German trade balance data and Bank of Canada’s interest rate decision. Apart from that, EIA will release its crude oil inventories figures, which will be crucial for oil traders. Obviously markets will monitor the developments in terms of EU stimulus talks and post-Brexit trade negotiations

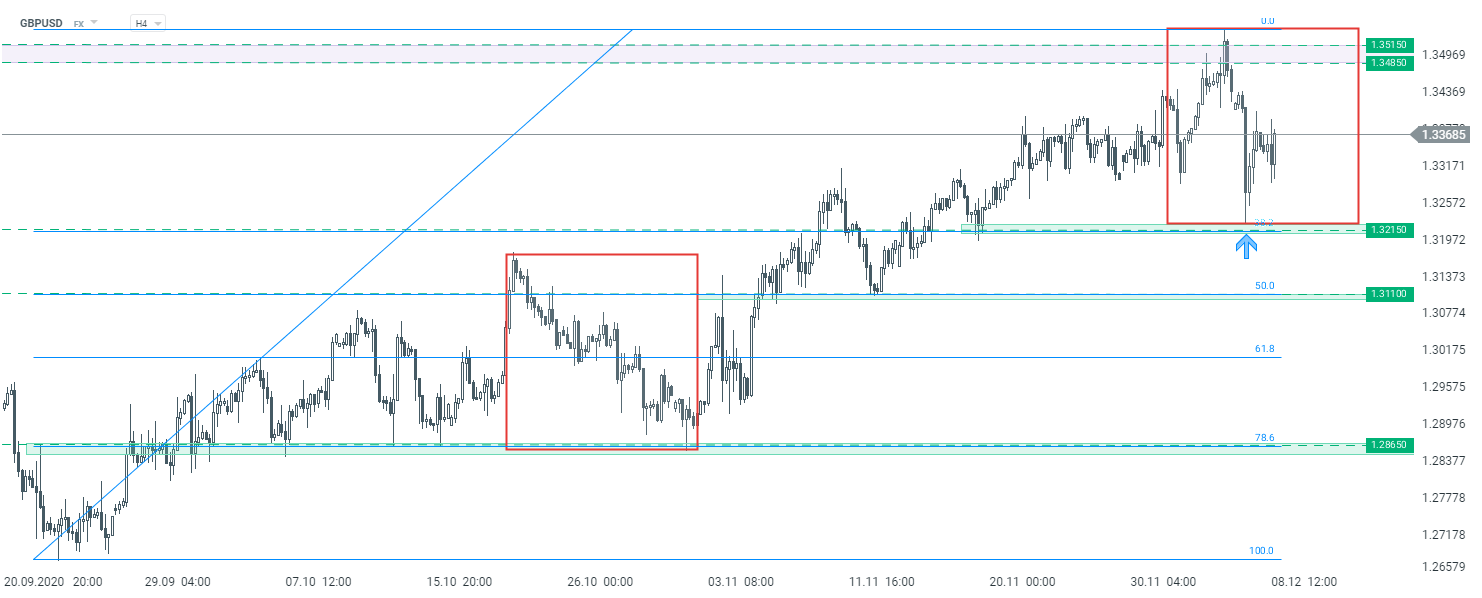

Despite yesterday’s sell-off, GBPUSD managed to bounce off key support at 1.3215 (38.2% Fibo retracement and lower limit of 1:1 structure). Should the currency pair stay above it, the potential attack on 1.3485-1.3515 resistance area may be on the cards. Source: xStation5

Three markets to watch next week (20.02.2026)

BREAKING: TRUMP’S GLOBAL TARIFFS STRUCK DOWN BY US SUPREME COURT 🚨🏛️

Market Wrap: Europe is back to green 🇪🇺 📈 Business activity finally accelerating ❓

BREAKING: European flash PMIs stronger than expected 📈EURUSD ticks higher