Economy and Currencies:

-

Eurozone Wages: Negotiated wages in the Eurozone grew by 3% in Q4 2025, aligning with broader wage growth metrics.

-

UK Retail Sales: Sales jumped 4.5% y/y and 1.8% m/m in January—the strongest performance in nearly two years. The non-food sector led gains (+5.3%), while department stores saw a decline (-1.3%). Fuel sales remained stable.

-

German PPI: Producer prices fell 3.0% y/y (-0.6% m/m) in January, driven primarily by an 11.8% drop in energy costs. Excluding energy, PPI actually rose 1.2% y/y. While capital goods and precious metals (+68.2%) grew more expensive, food prices dropped 1.3% (notably butter at -43.7% and pork at -14.1%).

-

Eurozone PMI: The Composite PMI rose to 51.9 in February (a 3-month high). Manufacturing hit a 44-month peak (50.8 pts), becoming the primary growth engine. While orders are rising, employment fell slightly. Input costs are increasing at their fastest pace in nearly three years, but selling price inflation has slowed as business optimism builds.

-

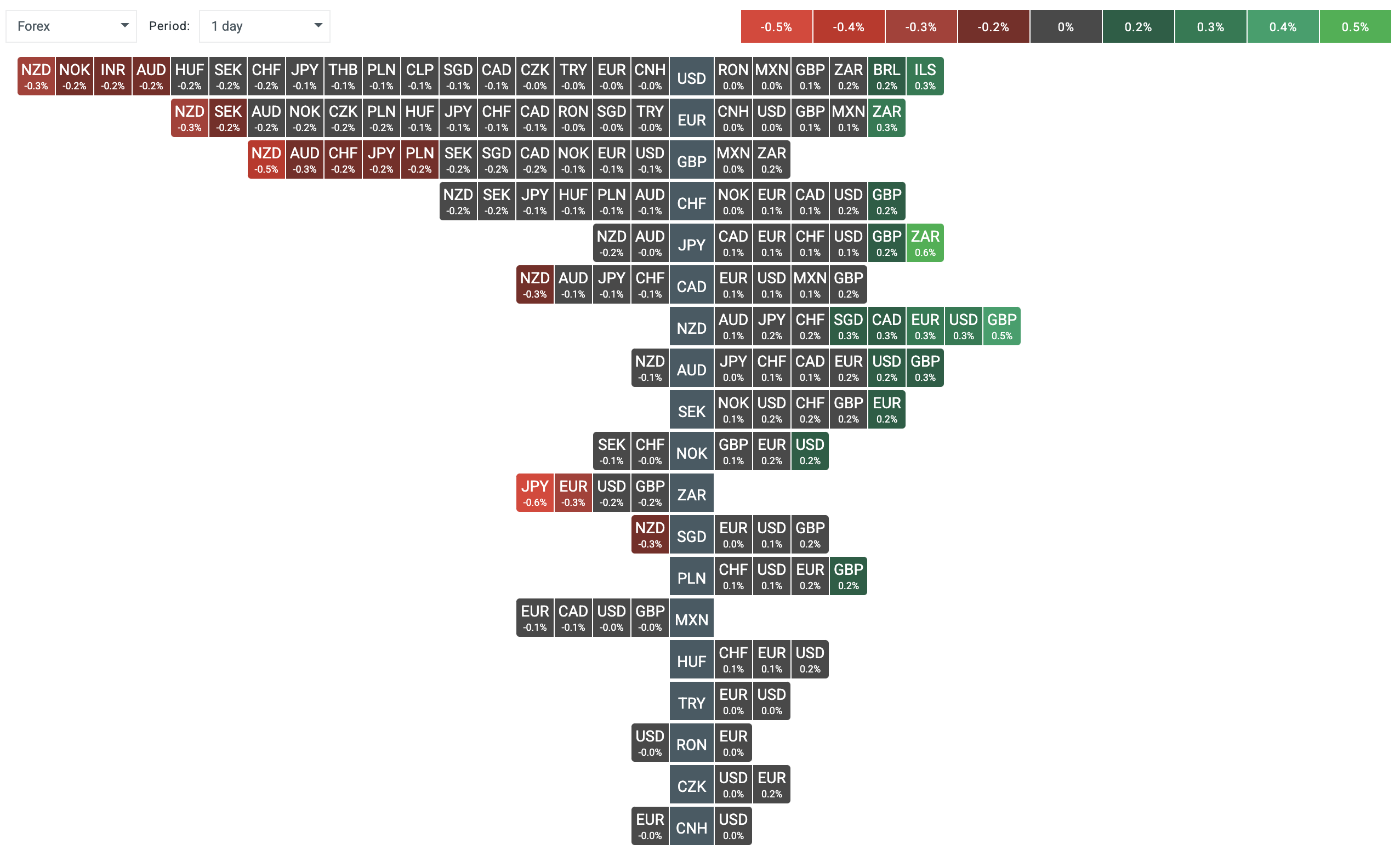

FX Market: The British Pound (GBP) saw the most significant move, rebounding from recent lows on solid retail data (GBPUSD: +0.1% after a 4-day slide; EURGBP: -0.1%; GBPJPY: +0.3%). The New Zealand Dollar (NZD)lagged (NZDUSD: -0.3%), weighed down by political risks surrounding Iran (also affecting the AUD) and comments from the RBNZ chief regarding “growth without inflation.” Otherwise, FX volatility remains muted (EURUSD flat at 1.176; USDIDX: +0.05%).

Volatility in the FX market rarely suprasses 0.1% today. Source: xStation5

Indices and Companies:

-

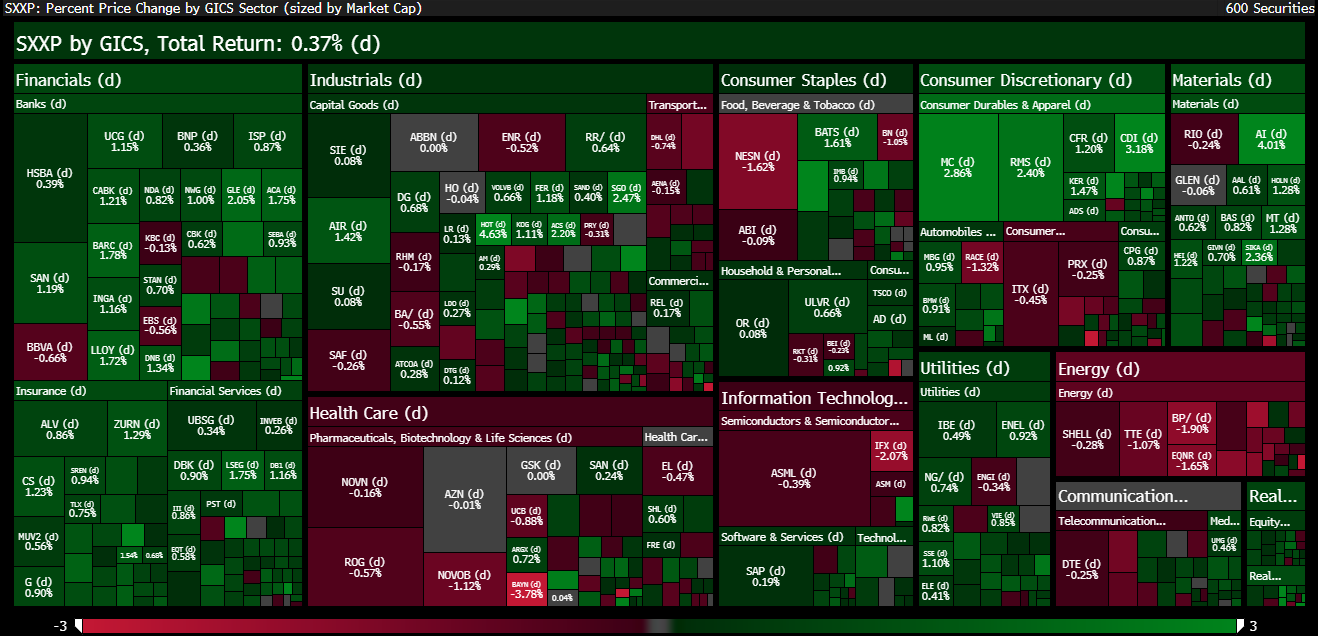

European Indices: Markets are ending the week with high optimism thanks to strong PMI data (EU50: +0.2%). Gains are led by France and Spain (+0.8%), with the DAX also in the green (+0.2%). Poland’s W20 fell 0.35%, primarily due to sell-offs in Kruk (-6%) and Allegro (-3%).

-

Aston Martin: Issued another profit warning, stating that the 2025 EBIT loss will exceed the projected £184m. Sales dropped 10%, and shares have halved in value over the past year. A £50m deal for perpetual F1 naming rights provided some cash relief, but US tariffs and high debt remain major hurdles.

-

Air Liquide: Shares rose 3.6% following an earnings beat. The company hiked its dividend by 12% (€3.70) and set a new margin improvement goal of +100 bps by 2027. Operating profit grew 3.5%, and net debt fell by nearly 9%.

-

Siegfried Holding: Shares tumbled 7.8% due to weak 2026 guidance. Despite solid 2025 EBITDA, investors were spooked by negative free cash flow and a lower-than-expected dividend. Analysts view the outlook as conservative, pending a large pharmaceutical contract.

-

Moncler: Shares surged 13% on results that significantly beat estimates. Success was driven by Asia (+11%) and strong demand for the Moncler and Stone Island brands. Revenue (€3.13bn) and dividends (€1.40) surpassed expectations, lifting the entire luxury sector (LVMH, Hermes).

The jump in risk appetite weighs on more defensive sectors (Health Care, Energy, some Consumer Goods). Source: Bloomberg Finance LP

BREAKING: TRUMP’S GLOBAL TARIFFS STRUCK DOWN BY US SUPREME COURT 🚨🏛️

BREAKING: US GDP growth rate collapse🚨📉

BREAKING: European flash PMIs stronger than expected 📈EURUSD ticks higher

Economic calendar: European PMIs and PCE, GDP, PMI data from the US 🗽