-

Wall Street indices traded lower today with small-cap Russell 2000 dropping over 1%, Dow JOnes trading 0.7% down and S&P/ASX 200 declining 0.3%. Nasdaq is an exception and manages to post a 0.1% gain

-

European stock markets traded lower today but the scale of declines was rather small. German DAX dropped 0.12%, French CAC40 trades 0.16% lower while UK FTSE 100 was 0.34% down

-

No breakthrough was made on the US debt ceiling and media reports hint that negotiations may drag

-

US President Biden wants to reach an agreement ahead of G7 meeting later this week but Democrats and Republicans are said to still be far apart on key issues

-

Fed Mester said that Fed remains committed to bringing inflation back to 2% and she does not think that central bank reached a spot to hold rates yet

-

Fed Barkin said that he likes optionality signaled by latest FOMC statement and that a lot may change in the outlook ahead of June meeting as a lot of key data will be released before it

-

Fed Williams said that inflation is gradually moving in the right direction and that economy is beginning to return to more normal patterns

-

ECB Holzmann said he would have preferred a 50 basis point rate hike at May meeting and said that rates need to go beyond 4% to combat inflation

-

US retail sales data for April came in mixed - headline retail sales missed expectations (0.4% MoM vs 0.8% MoM expected) while retail sales ex-autos matched analysts' expectations of 0.4% MoM

-

US industrial production increased 0.5% MoM in April (exp. 0.0% MoM)

-

Canadian CPI inflation accelerated from 4.3 to 4.4% YoY in April (exp. 4.1% YoY)

-

Chinese activity data for April turned out to be a disappointment. Retail sales were 18.4% YoY higher (exp. 21.0% YoY), industrial production increased 5.6% YoY (exp. 10.9% YoY) while urban investments rose 4.7% YoY (exp. 5.5% YoY)

-

UK jobs report for March showed 5.8% YoY increase in wages (exp. 5.8% YoY) as well as the unemployment rate ticking higher from 3.8 to 3.9% (exp. 3.8%)

-

Euro area GDP report for Q1 2023 showed a 0.1% QoQ expansion - in-line with preliminary release

-

German ZEW index dropped from 4.1 to -10.7 in May (exp. -5.3)

-

Polish Q1 GDP report showed a 0.2% YoY contraction (exp. -0.8% YoY). On a quarterly basis growth reached 3.9% QoQ (exp. 0.7% QoQ)

-

IEA boosted global oil demand growth forecast for 2023 to 2.2 million barrels per day, up from 2.0 mbpd previously

-

Atlanta Fed GDPNow model points to a 2.6% growth in Q2 2023, down from 2.7% in previous release

-

USD and CAD are the best performing major currencies while NZD and AUD lag the most

-

USD strengthening pressures precious metals with gold trading over 1% lower and dropping below psychological $2,000 mark

-

Energy commodities traded mixed today - oil dropped 0.7% while US natural gas prices climbed 0.8%

-

Cryptocurrencies traded lower today - Bitcoin dropped 1.1%, Dogecoin traded 0.4% down while Ethereum declined 0.1%

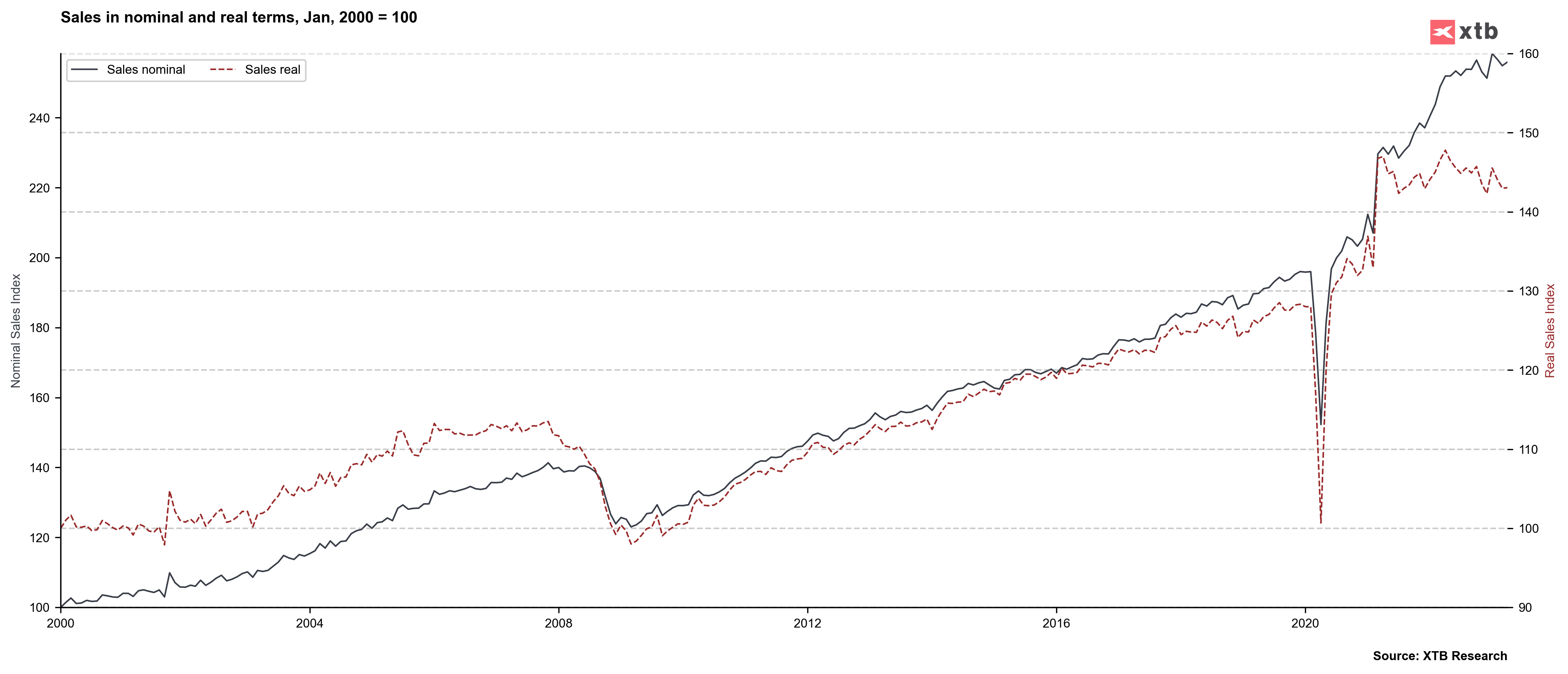

US retail sales climbed in April, following a drop in March. However, the situation looked less upbeat in case of real retail sales as gap between the two continues to grow. Source: Macrobond, XTB

US retail sales climbed in April, following a drop in March. However, the situation looked less upbeat in case of real retail sales as gap between the two continues to grow. Source: Macrobond, XTB

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report