-

Wall Street indices traded higher today following US CPI data for May. S&P 500 trades 0.8% higher, Nasdaq adds 0.9% and Dow Jones advances 0.6%. Small-cap Russell 2000 is the best performing Wall Street index with an around-2% gain at press time

-

US CPI inflation report for May turned out to be mixed. Headline CPI slowed more than expected, from 4.9 to 4.0% YoY (exp. 4.1% YoY), while core gauge slowed from 5.5 to 5.3% YoY and matched expectations

-

Markets took the US CPI report as dovish with USD dropping while equity indices and gold gained. Market odds for a Fed June rate hike dropped following the release

-

Money markets currently price in a less-than-10% chance of 25 bp rate hike tomorrow and around 60% chance of a 25 bp rate hike at July meeting

-

European stock markets traded higher today - German DAX gained 0.8%, UK FTSE 100 moved 0.3% higher and French CAC40 added 0.5%. Polish WIG20 was an outlier among EUropean blue chips indices with a 0.9% drop

-

Russian President Putin said that Russia is considering withdrawing from Black Sea grain deal as Russian conditions for the extension have not been met

-

The People's Bank of China cut the 7-day repo rate by 10 basis points, to 1.90%. This was the first repo rate cut since August 2022 and serves as a strong hint that PBoC will also cut medium-term lending facility rate on June 15, 2023

-

UK jobs data for April turned out to be a positive surprise. Unemployment rate dropped from 3.9% to 3.8% (exp. 4.0%) while headline wage growth accelerated from 6.1% YoY to 6.5% YoY (exp. 6.1% YoY)

-

GBP gained after data releases as it was clearly hawkish and may encourage Bank of England to tighten more

-

German ZEW Expectations index improved from -10.7 to -8.5 in June (exp. -12.5). Meanwhile, the Current Situation index dropped from -34.8 to -56.5 (exp. -40.2)

-

Final German CPI inflation for May came in at 6.1% YoY, matching preliminary release

-

Final Spanish CPI inflation for May came in a 3.2% YoY, matching preliminary release

-

Energy commodities trade higher with oil jumping over 3% and natural gas trading 2.6% higher

-

Precious metals moved higher following US CPI data release but has since given back those gains. Gold trades 0.7% lower, silver drops 1.5% and platinum declines 1.3%

-

GBP and CAD are the best performing major currencies while JPY and USD lag the most

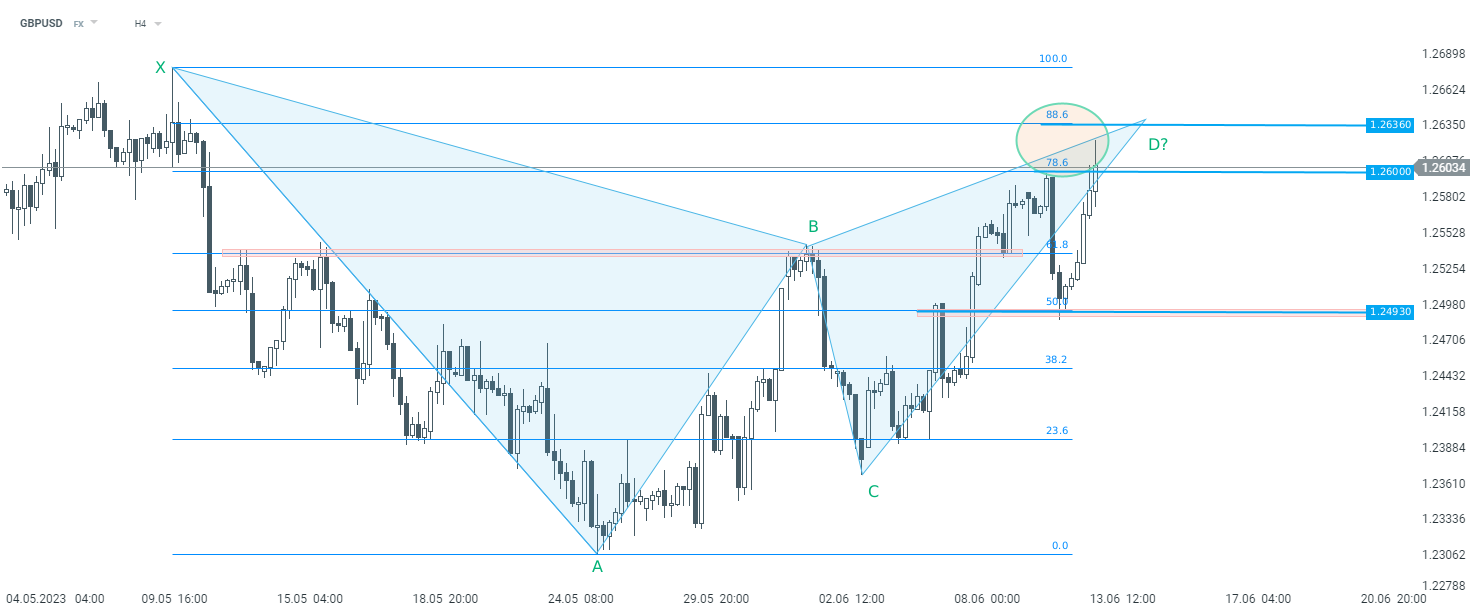

A potential harmonic XABCD pattern can be seen building up on GBPUSD. Taking a look at the chart at H4 interval, we can see that the pair is testing a resistance zone marked with 78.6% and 88.6% retracements. Should a supply side reaction occur here, one cannot rule out a bearish trend reversal. On the other hand, a break above 1.2636 may pave the way for more gains and a new local high. Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

Morning Wrap - Oil price is still elevated (07.03.2026)