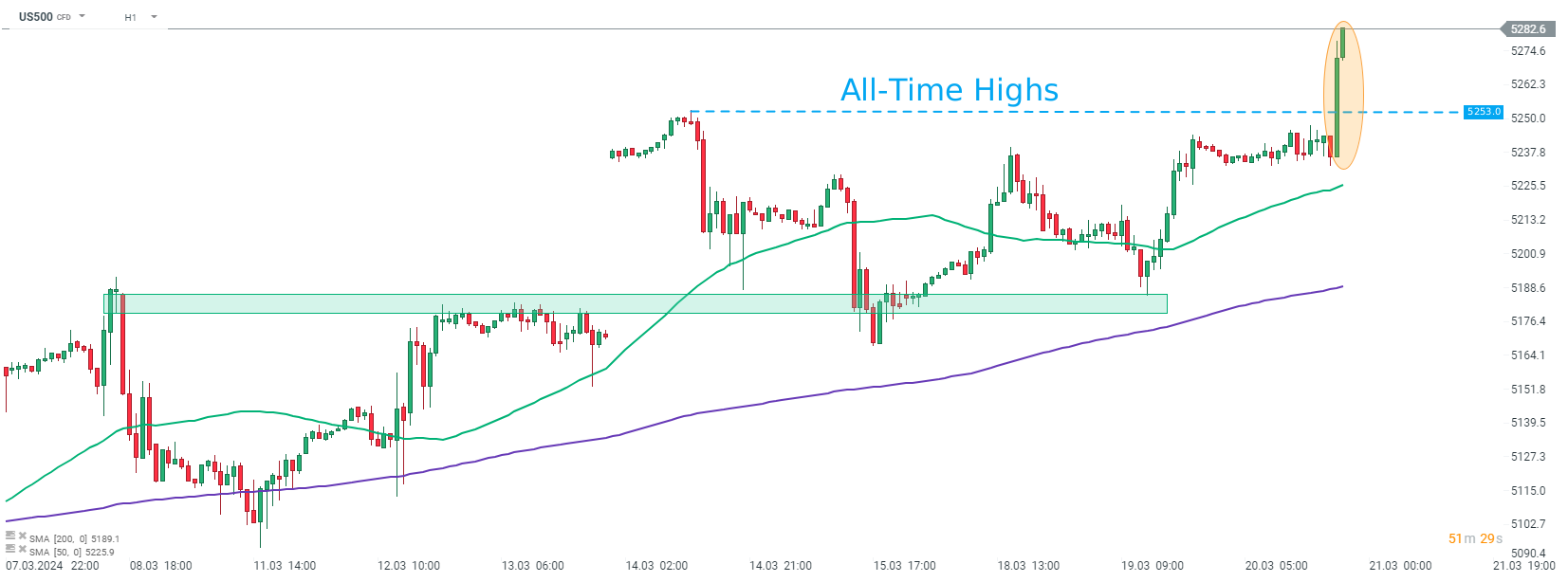

- Wall Street indices climbed to fresh record highs after FOMC decision and Powell's presser. S&P 500 trades 0.8% higher, Dow Jones gains 0.9%, Nasdaq jumps 1.1% and small-cap Russell 2000 rallies 1.4%

- FOMC left interest rates unchanged in the 5.25-5.50% range, in-line with market expectations. Policy statement contained no major changes compared to January

- New FOMC projections showed higher GDP growth in the coming years as well as high core inflation this year

- Median 2024 dot-plot remained unchanged at 4.60% (3 cuts), but only 1 FOMC member now expects 4 or more cuts this year, while 5 members expected it back in December

- In spite of new forecasts being rather hawkish, USD dropped following the decision while indices and gold gained

- Powell has been rather neutral during the press conference, sounding neither hawkish, nor dovish.

- European stock markets traded mixed today. German DAX gained 0.1%, UK FTSE 100 and Dutch AEX traded flat, French CAC 40, dropped 0.5% and Spanish IBEX jumped 0.5%

- Cryptocurrencies are trading higher, with Bitcoin climbing over 4% and breaking above $65,000 mark

- Energy commodities pull back - oil drops 1.5%, while US natural gas prices are down over 3%

- Precious metals rally amid USD weakening - gold trades 1% higher, silver surges 2.4%, platinum adds 1% and palladium jumps 1.9%

- AUD and CAD are the best performing major currencies, while USD and JPY lag the most

- People's Bank of China left 1- and 5-year loan prime rates unchanged at 3.45% and 3.95%, respectively, in-line with market expectations

- UK CPI inflation decelerated from 4.0 to 3.4% YoY in February (exp .3.5% YoY), while core measure dropped 5.1 to 4.5% YoY (exp. 4.6% YoY)

- German PPI inflation came in at -4.1% YoY in February (exp. -3.8% YoY), up from -4.4% YoY in January

- Czech National Bank cut the main interest rate by 50 basis points from 6.25% to 5.75%, in-line with expectations

- DOE report showed a 1.95 million barrel draw in oil inventories (exp. -2.5 mb), a 3.31 million barrel plunge in gasoline inventories (exp. -0.1 mb) and a 0.62 million barrel build in distillate inventories (exp. +0.1 mb)

S&P 500 futures (US500) rallied to fresh all-time highs above 5,250 pts after Fed decision. Source: xStation5

Market wrap: European stocks attempt to stabilize despite the surge in oil prices 🔍

Morning Wrap: Conflict Escalation Pushes Oil to $100 (12.03.2025)

Daily summary: Oil still pressures Wall Street despite favorable CPI data 🗽

Mixed sentiments on Wall Street amid Iran war🗽Oracle shares surge 10%