- Wall Street indices launched today's cash session little changed but have turned lower later on

- S&P 500 and Nasdaq trade 0.1% lower each while Dow Jones drops 0.2%. Small-cap Russell 2000 index trades over 1% lower

- European stock market indices finished today's trading higher but off the daily highs. German DAX gained 0.5%, French CAC40 moved 0.7% higher, FTSE MIB added 0.1% while UK FTSE 100 traded 0.1% lower

- Lack of Middle East escalation as well as downbeat reports on US oil and oil derivatives demand are pushing crude prices lower

- Brent dropped below $80 per barrel for the first time since late-July

- Lack of Middle East escalation is also causing outflows from safe haven assets. Gold drops for the third day in a row and tests $1,950 per ounce area

- Cryptocurrencies traded higher today - Bitcoin gained 0.5%, Ethereum traded 0.8% higher while Dogecoin surged 3%

- EUR and CHF are the best performing major currencies while JPY and AUD lag the most

- ECB Lane said that the Bank has not made enough progress on underlying inflation

- ECB Makhlouf said that while core inflation remains a challenge, it is in a much, much better place now

- ECB Vujcic said he expects inflation to decline towards ECB target in 2025

- ECB Nagel said that discussion on rate cuts are not helpful and it is too early for them given still-high inflation

- ECB Kazaks said that he cannot exclude possibility that further rate hikes may be needed

- Fed Chair Powell delivered opening remarks at Fed Research Conference today but his speech included no mentions on the outlook for the monetary policy

- European Union supports opening talks on Ukraine membership with conditions

- CAD gained slightly after BoC minutes showed that some member felt rates would more likely than not need to increase further

- Canadian building permits plunged 6.5% MoM in September (exp. -1.5% MoM)

- US wholesale sales increased 2.2% MoM in September (exp. 0.9% MoM) while wholesale inventories were 0.2% MoM higher (exp. 0.0% MoM)

- Final German CPI inflation for October came in at 3.8% YoY, matching flash release

- AtlantaFed GDPNow model estimates annualized real US GDP growth in Q4 2023 at 2.1%

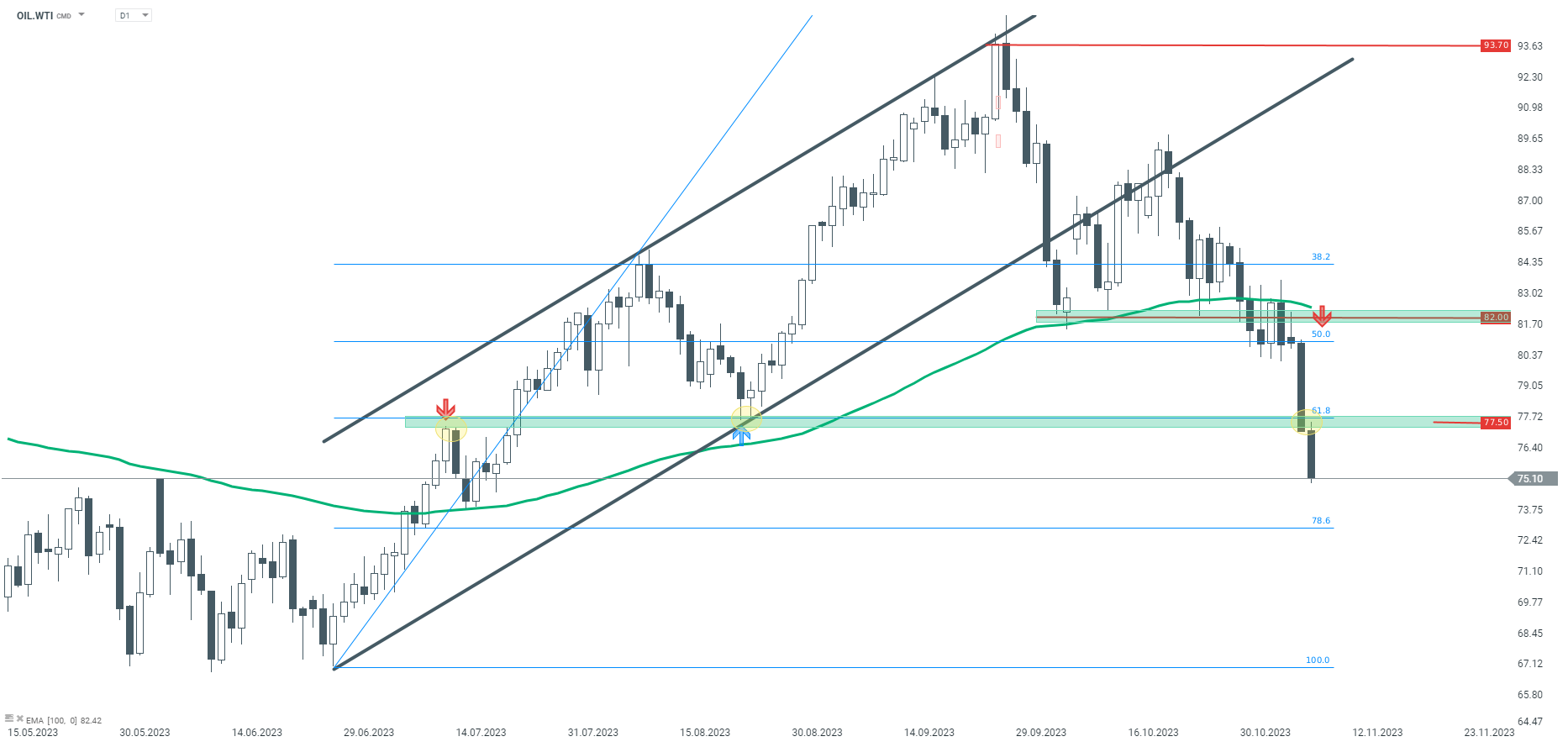

Wednesday is another day marked with oil weakness. WTI (OIL.WTI) broke below the $77.50 support zone, paving the way for an even deeper decline. Source: xStation5

Wednesday is another day marked with oil weakness. WTI (OIL.WTI) broke below the $77.50 support zone, paving the way for an even deeper decline. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

NATGAS muted amid EIA inventories change report