- Weak data from Germany

- Wall Street falls after yesterday’s big rally

- Gold tries to recover from 8-month low

European indices finished today's session mixed, amid disappointing economic data from Germany which showed retail sales plunged 4.5% in January, following a record 9.1% decline month earlier while analysts' expected 0.3% fall. The number of unemployed rose by 9 thousand, following a revised 37 thousand decrease in the previous month and compared with market expectations of a 13 thousand decrease. Also German government plans to extend its lockdown until March 28 while easing some restrictions from next week, according to media reports. Elsewhere, Guo Shuqing, chair of the China Banking and Insurance Regulatory Commission, said that financial markets in Europe, the US and other developed countries were trading at high levels, and that they had “seriously diverged” from the real economy.

US indices are trading mixed as the market gave back some of the strong gains from the previous session. Tech and real estate are the two worst-performing sectors. Apple, Tesla and Microsoft stocks fell about 1% each. Meanwhile, Treasury yields were around the flatline and remained well below 1-year high levels seen in the previous week. Later in the week, investors will focus on ISM's service sector survey as well as the monthly U.S. jobs report to ascertain economic recovery.

WTI crude is trading flat around $60.700 a barrel, while Brent is trading 0.13% lower around $63.61 a barrel as investors remain cautious ahead of an OPEC+ meeting later this week that is expected to result in more supply returning to the market after prices recovered to pre-pandemic levels in February. Investors now anticipate the weekly inventory reports from the API later in the day and from the EIA on Wednesday. Elsewhere gold fell to $1,707 earlier in the session, however buyers managed to erase early losses and precious metal is trading 0.7% higher around $ 1,735.00 / oz. Meanwhile silver rose 1.0 % and is trading near $ 26.80 / oz.

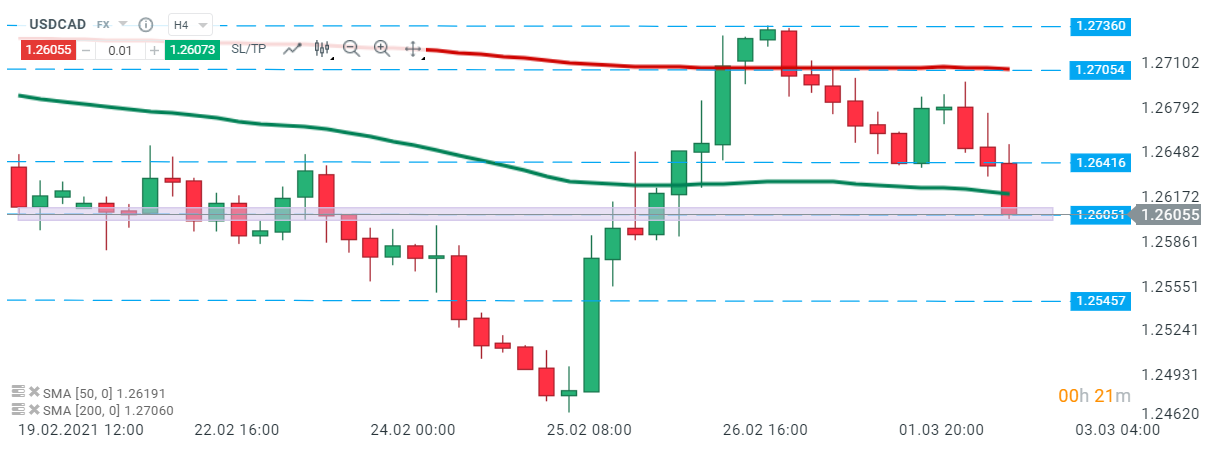

USDCAD pair fell to 1.26 level after today's data showed the Canadian economy expanded an annualized 9.6% in Q4, well above analysts’ expectations of 7.5%. Also factory activity expanded at a faster pace in February, amid higher new orders, output, employment, and purchasing activity, while optimism reached a 5-month high. If sellers will manage to uphold momentum then downward move may accelerate towards next support at 1.2545. On the other hand if buyers will manage to halt declines here, then another upward impulse towards resistance at 1.2641 could be launched. Source: xStation5

USDCAD pair fell to 1.26 level after today's data showed the Canadian economy expanded an annualized 9.6% in Q4, well above analysts’ expectations of 7.5%. Also factory activity expanded at a faster pace in February, amid higher new orders, output, employment, and purchasing activity, while optimism reached a 5-month high. If sellers will manage to uphold momentum then downward move may accelerate towards next support at 1.2545. On the other hand if buyers will manage to halt declines here, then another upward impulse towards resistance at 1.2641 could be launched. Source: xStation5

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz

Morning wrap (05.03.2026)