- European indices finished today’s session in upbeat moods, with DAX closing 2.17% higher while CAC40 and FTSE100 rose 2.50% and 1.44% respectively, led by energy, luxury, and auto sectors;

- US indices erased early losses and moved lower as investors were digesting recent inflation data which may force Fed to act more aggressively. Dow Jones trades 0.80% lower while S&P500 and Nasdaq fell 1.3% and 2.7% respectively,

- The annual inflation rate in the US slowed to 8.3% in April, less than market forecasts of 8.1%, while core CPI gained 6.2% compared to expectations of 6.0%.

- Gold jumped to $1,856/oz, after bouncing of the support at $1,830 region, while silver unsuccessfully tried to break above $22.00 level

- Brent crude futures surged more than 5.50% to around $107,40 per barrel, while WTI price rose 5.80% to $105.40 per barrel amid prospects of strong oil demand after coronavirus cases in China declined while the EU continues to work to move ahead with an embargo on Russian oil.

- US crude inventories unexpectedly increased by 8.487 million barrels, the most in four weeks, and compared to forecasts of a 0.457 million barrels decrease, EIA data showed.

- The 10-year US Treasury note fell to 2.92%, USD weakened;

- JPY and CHF are the best performing major currencies while EUR and GBP lag the most;

- Cryptocurrencies are trading lower. Bitcoin returned below $30,000, Ethereum is testing $2170, while Terra fell below $1.00;

- Coinbase stock plunged over 25% after the US largest cryptocurrency exchange reported a quarterly loss and a 19% drop in monthly users.

Today's session has brought tremendous volatility across all asset classes. Stocks in Europe managed to end today's trading at higher levels, while Wall Street resumed downward move pressured by inflation figures, which showed that price pressure may remain strong in coming months even despite rate hikes. The cryptocurrency market continues to bleed. Bitcoin broke through the psychological barrier of 30.000 USD, which caused panic among other projects. Terra (LUNA) fell by more than 90% today.

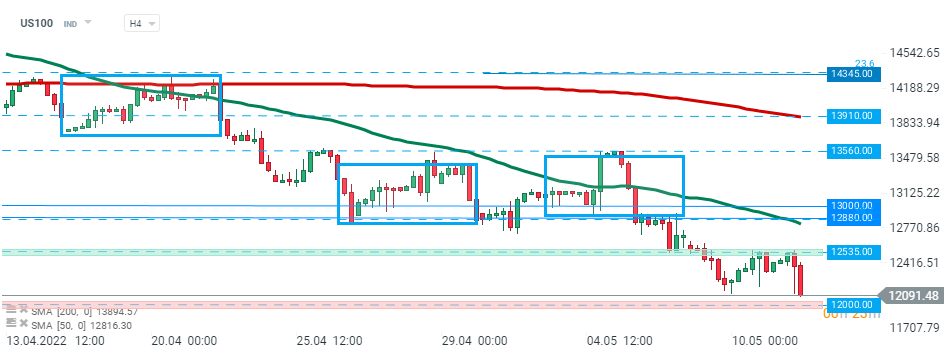

US100 entered the positive territory at the beginning of US session, however buyers failed to uphold momentum and index resumed downward move in the evening and made new low for the year. Nearest major support is located at 12000 pts. Source: xStation5

US100 entered the positive territory at the beginning of US session, however buyers failed to uphold momentum and index resumed downward move in the evening and made new low for the year. Nearest major support is located at 12000 pts. Source: xStation5

🚨US100 erases all daily gains

BREAKING: NATGAS muted after almost in-line EIA data release 💡

BREAKING: US100 ticks higher after NFP upbeat data release 💡

Chart of the day: US100 (20.11.2025)