Nvidia delivered another outstanding report, beating expectations with USD 57 billion in Q3 revenue (+62% y/y) and issuing an exceptionally strong USD 65 billion forecast for Q4. Management addressed all major bearish arguments — from supply constraints to demand durability — emphasizing the feasibility of USD 500 billion in combined Blackwell + Rubin revenue by 2026. The optimistic tone and record data-center sales triggered a strong positive reaction across global equity markets linked to AI.

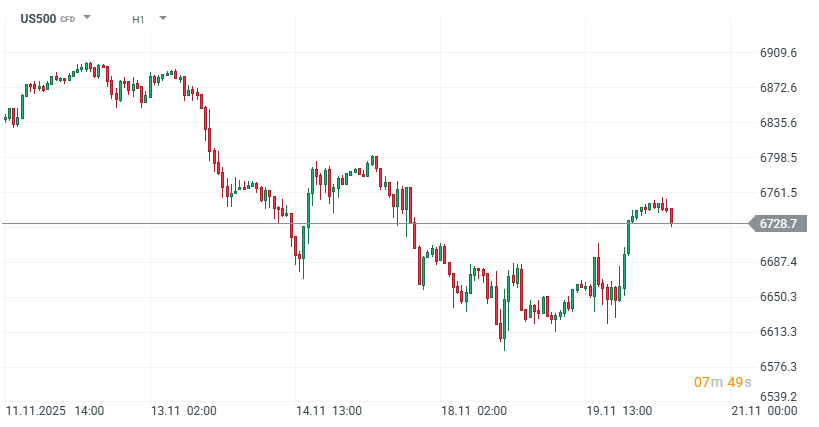

The results immediately improved market sentiment. US100 (Nasdaq 100) rebounded by around 2.00%, reversing some of the recent declines as AI and semiconductor stocks rallied in tandem. Nvidia shares themselves jumped 5–5.5% in pre-market trading to USD 196 per share. AMD, Broadcom and Intel also gained; Asian chipmakers such as Samsung and Foxconn recorded strong increases earlier in the day. The improved risk appetite spilled over into a short-term rebound in the cryptocurrency market as well.

Nvidia was the primary catalyst for markets, but short-term investor focus is now shifting toward upcoming macro data. The market expects the NFP report to be released later today, which could influence the Fed’s December rate decision. For now, however, Nvidia’s results have clearly lifted sentiment, easing concerns about an “AI bubble” and driving a broad-based recovery.

Daily summary: Markets capitulate under the influence of the Persian Gulf

Paramount Skydance shares under pressure after S&P warning

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

Nvidia Faces New H200 Limits in China