- DAX hits new record

- Upbeat economic data from Europe

- US 10-year Treasury yield hit fresh 14-month highs

European indices finished today's session higher amid optimistic economic data. Eurozone economic sentiment indicators rose more than expected in March to an over year high. Germany's consumer price inflation rate rose to 1.7 % YoY in March, the highest since February 2020. Spain's inflation rate reached its highest level in almost two years, while consumer morale in France jumped to a three-month high. Car makers, travel and hospitality stocks performed best during today's session, while bank stocks rebounded in the hope that the Archegos Capital crash would not have as much impact on the European markets as previously predicted. DAX 30 rose 1.3% and hit a new all-time high of 15,009 pts, CAC 40 gained 1.2% and FTSE 100 finished 0.5% higher.

US indices are trading lower, with Nasdaq being the worst performer amid rising bond yields. The 10 year Treasury yield hit a fresh 14-month high which again put pressure on growth stocks. President Joe Biden is expected to provide details about the first phase of his $3 trillion infrastructure plan when he travels to Pittsburgh on Wednesday. Meanwhile, investors are closely monitoring Archegos Capital Management situation development after Japan’s largest bank, the Mitsubishi UFJ Financial Group, warned of a potential $300 million loss. On the data front, Conference Board’s Consumer Confidence Index jumped to 109.7, its highest reading in a year, well above analysts’ expectations of 97.0.

WTI crude fell more than 1.75% and is trading around $60.60 a barrel, while Brent is trading 1.50% lower, around $64.00 a barrel as investors await an OPEC + meeting on Thursday where the extension of supply curbs may be on the table. Weekly inventory reports from the API will be published later in the day. Elsewhere gold fell more than 1.6% to $ 1,684.00 / oz, while silver is trading 2.5 % lower near $ 24.00 / oz as the dollar index extended gains and reached a 4-month high of 93.3 during today's session.

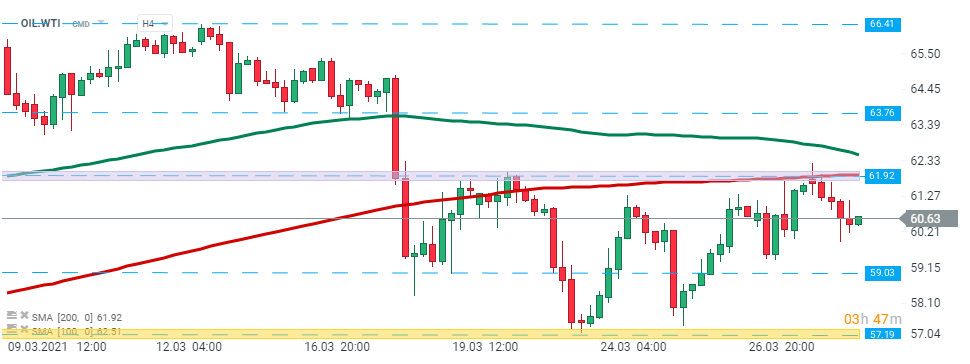

OIL.WTI has been trading in a local sideways move recently. Commodity failed to break above the resistance at $61.92 and price pulled back. Should declines continue, investors should focus on the $59.03 handle, where the previous price reactions can be found. However, in case we finally see a break above aforementioned $61.92, the upward move may accelerate towards $63.76. Source: xStation5

OIL.WTI has been trading in a local sideways move recently. Commodity failed to break above the resistance at $61.92 and price pulled back. Should declines continue, investors should focus on the $59.03 handle, where the previous price reactions can be found. However, in case we finally see a break above aforementioned $61.92, the upward move may accelerate towards $63.76. Source: xStation5

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS