-

Coronavirus continues to pressure stocks

-

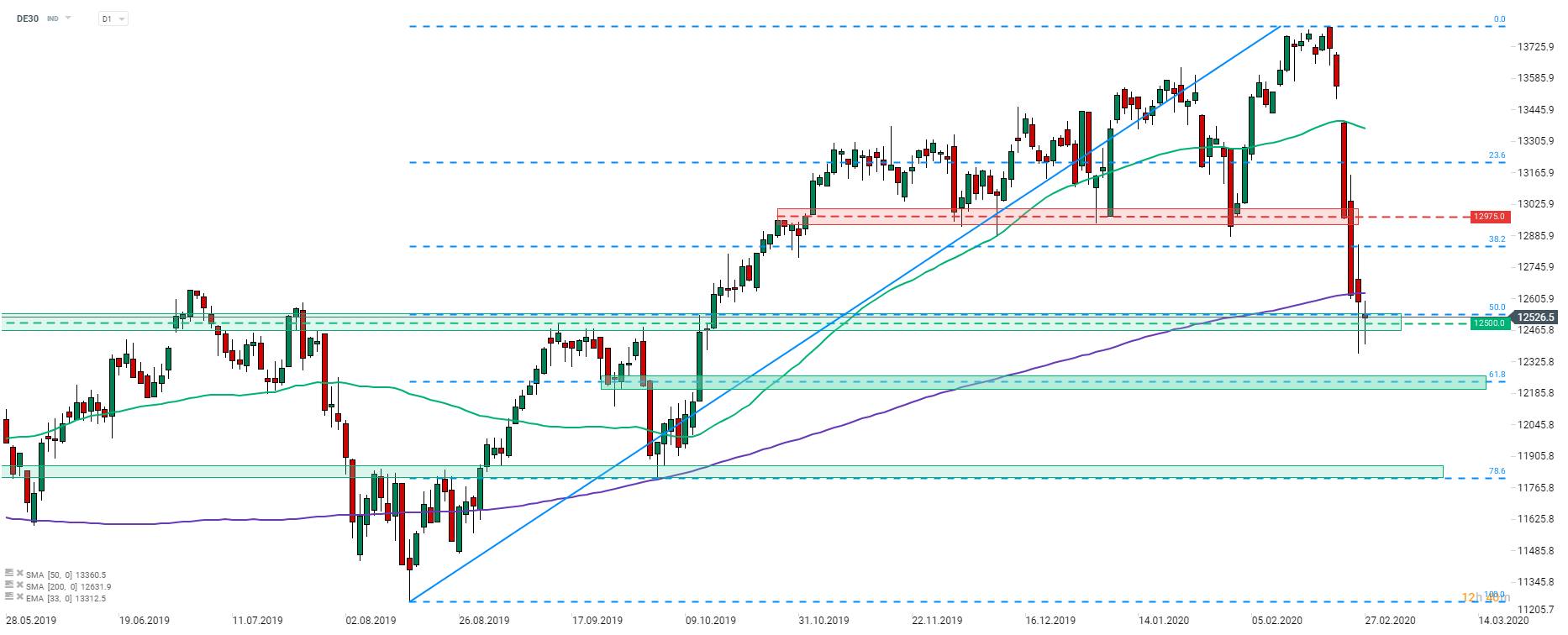

DE30 retests key support at 12500 pts

-

Munich Re (MUV2.DE) announced share buyback programme

European stock market remains under pressure as coronavirus continues to spread worldwide. Overnight news of the first US case of unknown origin raised fears that another major outbreak may take place in the World’s biggest economy. DAX launched today’s cash session around 2% lower but managed to recover slightly since.

Will Germany find a way to increase borrowing?

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appAccording to a Bloomberg report, German Finance Ministry is considering measures that would allow the country to increase borrowing. Olaf Scholz, German Finance Minister, is seeking a way to temporarily suspend the constitutional mechanism that limits German ability to increase debt. In order to do this, borrowings from municipalities could be shifted to the federal budget. However, the move is likely to face strong political opposition.

Source: xStation5

Source: xStation5

DE30 continues to trade near the 50% Fibonacci retracement of the upward impulse started in mid-August 2019. Long lower wicks of today’s and yesterday’s candlestick hint that bulls are looming near the zone at 12500 pts. Having said that, a break lower may require significant deterioration in moods. A major coronavirus outbreak in another big European economy could be a trigger. In such a scenario, the index may head towards the next support in-line - 61.8% retracement (12235 pts). With no major European data scheduled for release, trading on the index is likely to be dominated by coronavirus. The nearest resistance can be found at 200-session moving average (purple line, 12630 pts area).

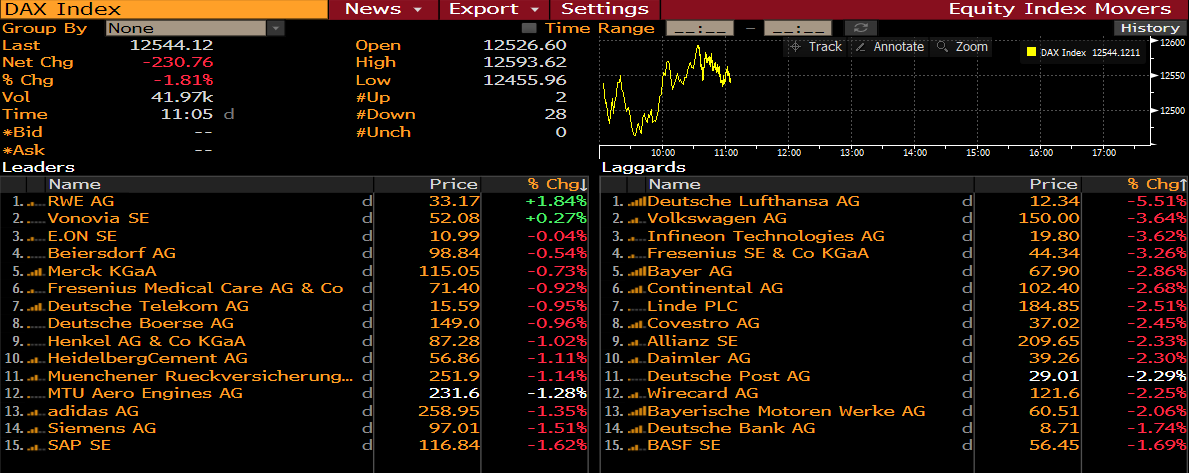

DAX members at 10:05 am GMT. Source: Bloomberg

DAX members at 10:05 am GMT. Source: Bloomberg

Zalando (ZAL.DE) reported earnings for the Q4 2019. The German e-commerce company generated quarterly EBIT of €110.4 million against expected €104.6 million. The company generated revenue of €1.99 million, 1% higher than expected. Full-year EBIT stood at €224.9 million (exp. €220.8 million) while sales reached €6.48 billion (exp. €6.47 billion). The company said it expects 2020 EBIT to fall in the €225-275 million range.

Bayer (BAYN.DE) said that the number of Roundup plaintiff in the US is beginning to level off. The German company does not expect a significant increase in the number of cases that currently stands at around 48,600. However, the company also acknowledged that settlement of the case may require it to sell assets or borrow funds.

In spite of announcing cost-cutting measures to combat demand squeeze resulting from coronavirus outbreak, Lufthansa (LHA.DE) share price can’t find bottom. The stock is taking another massive dive today. Share price dropped almost 20% over the course of the previous two weeks.

Munich Re (MUV2.DE) said it will buy back shares amounting to €1 billion. Buybacks will start from May 2020.

Bayer (BAYN.DE) dropped below the lower limit of the upward channel earlier this week. The stock is experiencing the biggest pullback of the current upward impulse. Bulls attempt to halt decline at the €67 support level. The nearest resistance can be found at €71.85 - the lower limit of the upward channel. Source: xStation5

Bayer (BAYN.DE) dropped below the lower limit of the upward channel earlier this week. The stock is experiencing the biggest pullback of the current upward impulse. Bulls attempt to halt decline at the €67 support level. The nearest resistance can be found at €71.85 - the lower limit of the upward channel. Source: xStation5