- European indices trade higher

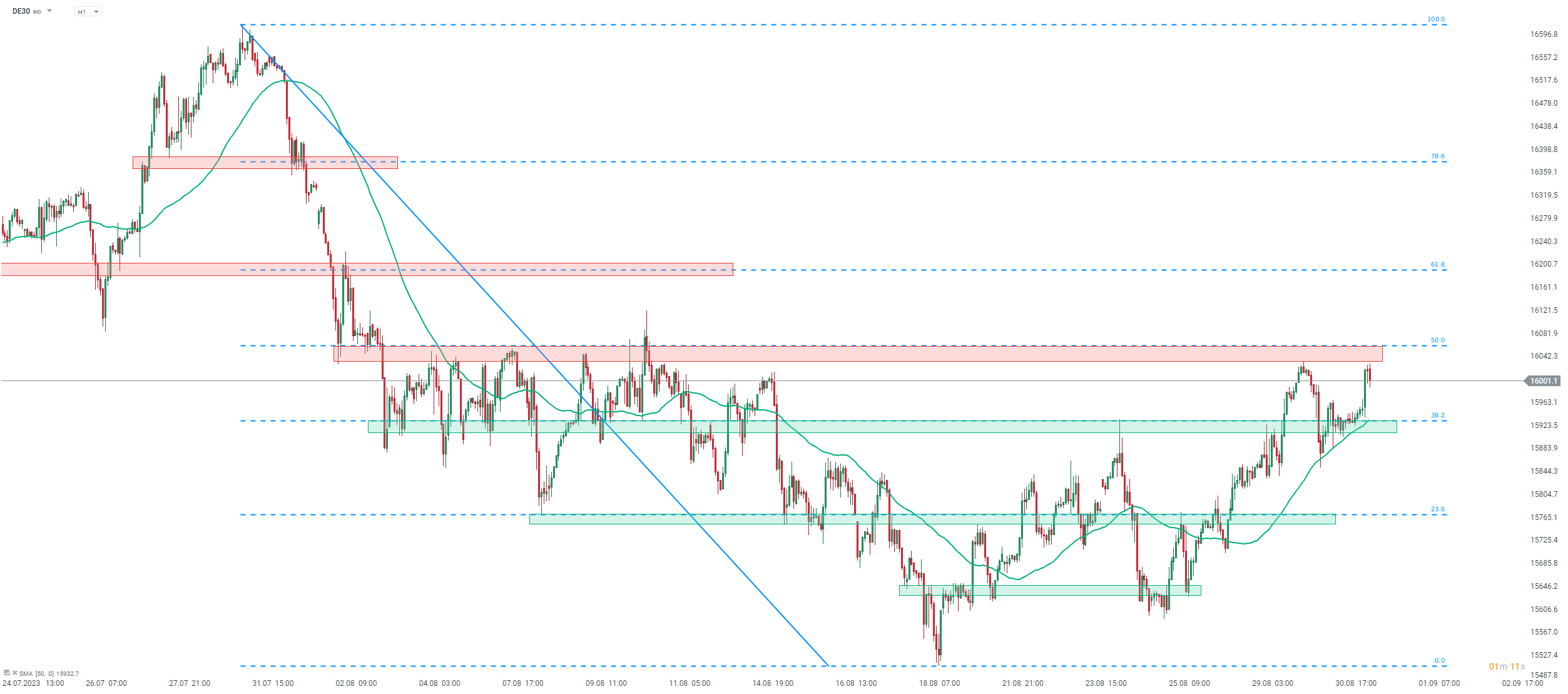

- DE30 bulls once again fail near 16,000 pts

- Siemens Mobility wins tender for electric trains in Austria

European stock market indices are trading higher today, following an upbeat trading on Wall Street yesterday as well as a mixed trading during the Asia-Pacific session earlier today. Economic calendar for the day ahead includes some interesting reports, including:

- US Challenger report on job lay-offs (12:30 pm BST)

- ECB minutes (12:30 pm BST)

- US core PCE inflation (12:30 pm BST)

ECB minutes could potentially trigger the biggest move on the European indices. However, a surprise would be needed and ECB rarely surprises in minutes. The Challenger report is often considered second-tier data and overlooked by the markets while US PCE data comes with a significant lag - today's reading will be for July.

Source: xStation5

Source: xStation5

DE30 continues to struggle with breaking back above the 16,000 pts mark. Index made a failed attempt at breaking above the 16,000-16,050 pts area earlier this week and another attempt - also a failed one - was made this morning. A small pullback can be observed at press time. Should we see declines deepen further, a test of the support zone ranging below 15,930 pts area cannot be ruled out. This is a key near-term zone to watch as it is marked with 38.2% retracement of a recent downward impulse as well as 50-hour moving average (green line). Keep in mind that the aforementioned average acted as a moving support level recently and has limited downward moves. Having said that, a break below this hurdle could hint that a trend reversal is underway.

Company News

According to a Figaro report, Airbus (AIR.DE) is planning to create a joint venture with Air France for maintenance of A350 aircraft. Airbus and Air France will each hold 50% stake in the JV, which is expected to become operational by 2024.

Siemens Mobility, a division of Siemens (SIE.DE), won a tender for a framework agreement to deliver electric trains to Austrian Federal Railways. As part of the agreement, Siemens will deliver up to 540 single-deck electric trains. Deal is said to be worth over €5 billion with trains expected to be deployed in 2028.

Analysts' actions

- Aixtron (AIXA.DE) rated 'overweight' at Barclays. Price target set at €42.00

Aixtron (AIXA.DE) launched today's trading higher following an 'overweight' recommendation from Barclays. However, bulls failed to break above the upper limit of a recent €34.50-35.60 trading range and a pullback was launched. Stock erased all of daily gains and is now trading not far above the €34.50 support. Source: xStation5

US OPEN: Quarterly Earnings Support U.S. Stock Gains

DE40: DAX near 1-week high 📈Deutsche Borse lags, SUSS MicroTec slides 23%

BREAKING: US housing market data stronger than expected 🗽US100 gains

Daily summary: Equities rally as markets await Trump-Xi talks; precious metals decline on risk-on (27.10.2025)