-

Stock exchanges from the Old Continent slightly lower at the start of the new week

-

Moody's downgrades Adidas lender rating

The first trading session on European markets this week brings a moderate deterioration in sentiment in the face of reduced investor activity due to banking holidays in the US and Canada. On the macro calendar today there is a lack of events and readings that could cause increased volatility in the market. Investors' attention is shifting to individual listed companies.

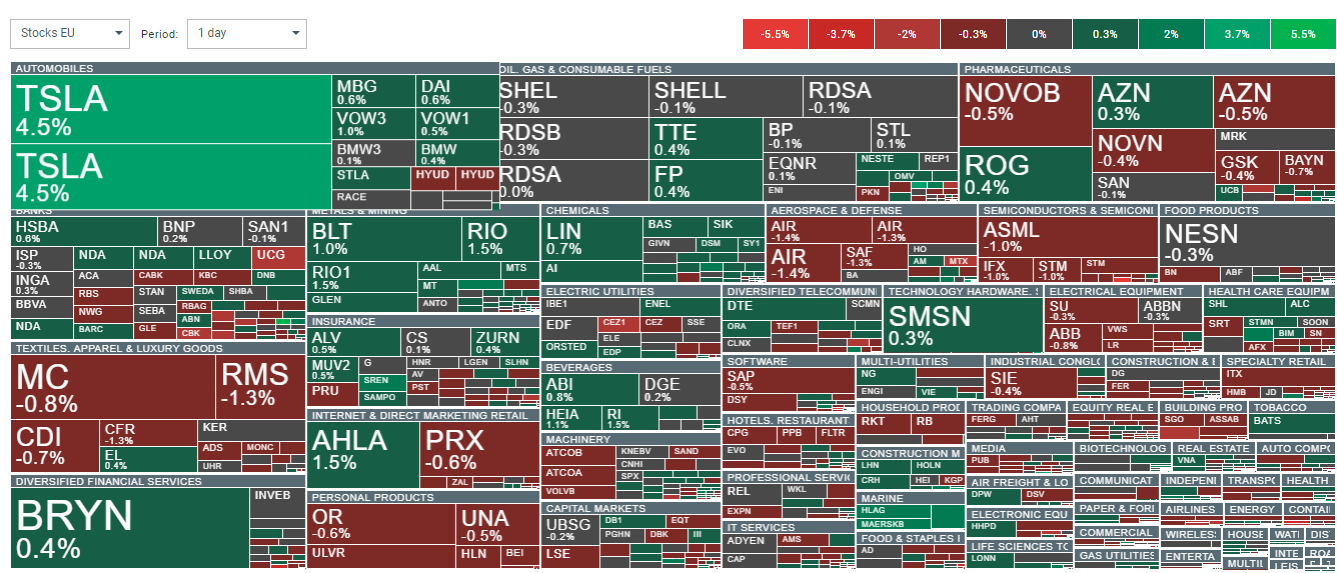

Investor sentiment on the Old Continent deteriorated slightly at the beginning of the new week. Most European companies are currently experiencing moderate declines. Source: xStation 5

Investor sentiment on the Old Continent deteriorated slightly at the beginning of the new week. Most European companies are currently experiencing moderate declines. Source: xStation 5

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appCompany news and bank recommendations:

-

Shares of Airbus (AIR.DE) are trading down nearly 1.5% today following comments by the CEO of its defense division on Eurofighter orders. Despite a plan to increase production of fighter jets and other defense systems, the government is failing to fulfill contracts and new orders, preventing full occupancy of production lines.

-

Moody's downgrades Adidas' (ADS.DE) credit rating due to weak outlooks for next year and problems in the company's management. The long-term rating drops to A3 from A2. The stock is losing nearly 1.2% today.

Changes in the institution's holdings in individual companies of the DAX index (data from the last session). Source: Bloomberg

DE30 chart:

DE30 futures are trading down moderately on Monday. Source: xStation 5